AUD/USD: Aussie has great residual strength

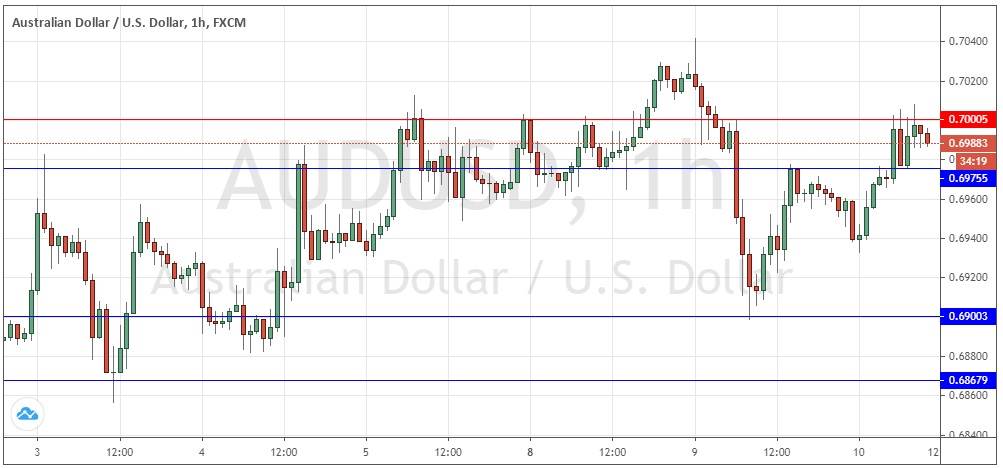

Yesterday’s signals were not triggered, as there was no suitable bearish price action at either 0.6957 or 0.7000 to trigger a short trade signal.

Today’s AUD/USD Signals

Risk 0.75%.

Trades must be entered from 8am New York time Wednesday to 5pm Tokyo time Thursday.

Long Trade Ideas

- Go long following bullish price action on the H1 time frame immediately upon the next touch of 0.6976 or 0.6900.

- Put the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade Ideas

- Go short following bearish price action on the H1 time frame immediately upon the next touch of 0.7000 or 0.7109.

- Put the stop loss 1 pip above the highest price made today.

- Move the stop loss to break even once the trade is 10 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote yesterday that the bearish retracement was likely to reverse, so I was seeking a long trade from a bounce at the support level at 0.6868.

I also saw a short trade from a bearish reversal at 0.7000 as a good medium-term trade entry.

I was correct that the bullish price action was likely to resume, but the low did not reach 0.6868. I was also correct that there was likely to be resistance at 0.7000, although so far this is just holding the price down instead of triggering a real downwards price movement.

The short-term price action suggests that the price is likely to make a bullish breakout above 0.7000. I would usually see this as a bullish sign and look to go long within the breakout pattern if it happens, but as there is a very important FOMC release due later which tends to strongly affect the USD in ways that do not respect technical levels, I would keep any such long trades to short-term scalps.

The outlook is more bullish above the big round number at 0.7000, which is clearly today’s pivotal point.

There is nothing of high importance due today concerning the AUD. Regarding the USD, there will be a release of CPI (inflation) data at 1:30pm London time, followed by the FOMC Projections, Federal Funds Rate, and Statement at 7pm, followed by the usual press conference half an hour later.