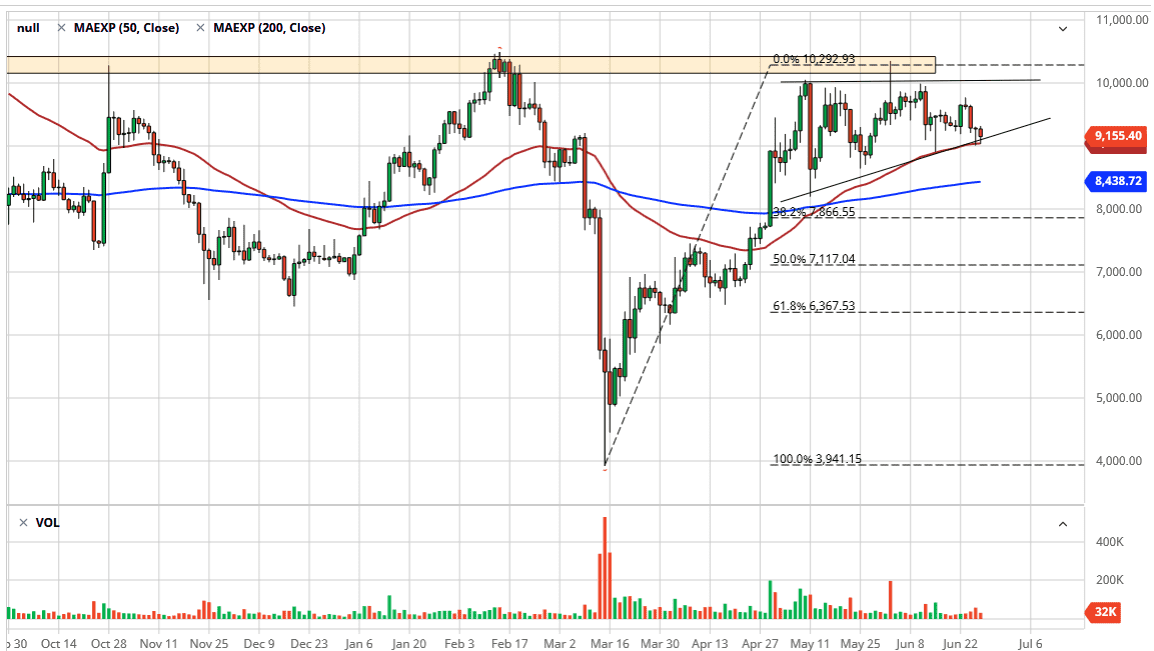

Bitcoin markets fell slightly during the trading session on Friday, reaching down towards the 50 day EMA. This is an area that has offered support more than once, and it certainly looks as if traders are paying quite a bit of attention to this indicator. After all, the Bitcoin market is mainly a retail market, and therefore a lot of traders will follow the same basic indicators. The 50 day EMA is without a doubt one of the more basic indicators and that tends to attract newer traders.

When you look at the chart, you can see that we are still forming a bit of an ascending triangle, although it is very sloppy in general. That being said, it is also worth noting that the 50 day EMA is sitting just above the $9000 level, which of course is a large, round, psychologically significant figure. That is an obvious area that will attract a lot of people, so I think that is another reason why people will be looking at as potential value. All things being equal, this is a market that is in an uptrend and trying to build up the necessary momentum to continue going higher.

The $10,000 level is a major psychological barrier above, and it should be noted that the resistance level extends all the way to the $10,500 level. If we can break above there, then the market could go much higher and that could bring in fresh money as it would be such an explosive break out just waiting to happen. That being said, we have a lot of work to do to get there, and although I am bullish of Bitcoin right now, I recognize it will break down could open up a move down to the 200 day EMA.

Bitcoin will come and go as far as value is concerned right along with the actions of the US dollar as it is considered to be a way to get away from fiat currencies. As a general, if the US dollar starts to fall apart, the Bitcoin market will be a beneficiary. At this point, it is likely that we will continue to see a lot of volatility, but I do think that people are building up the necessary momentum to finally make that move higher. It is not until we break down below the 200 day EMA that I would be concerned.