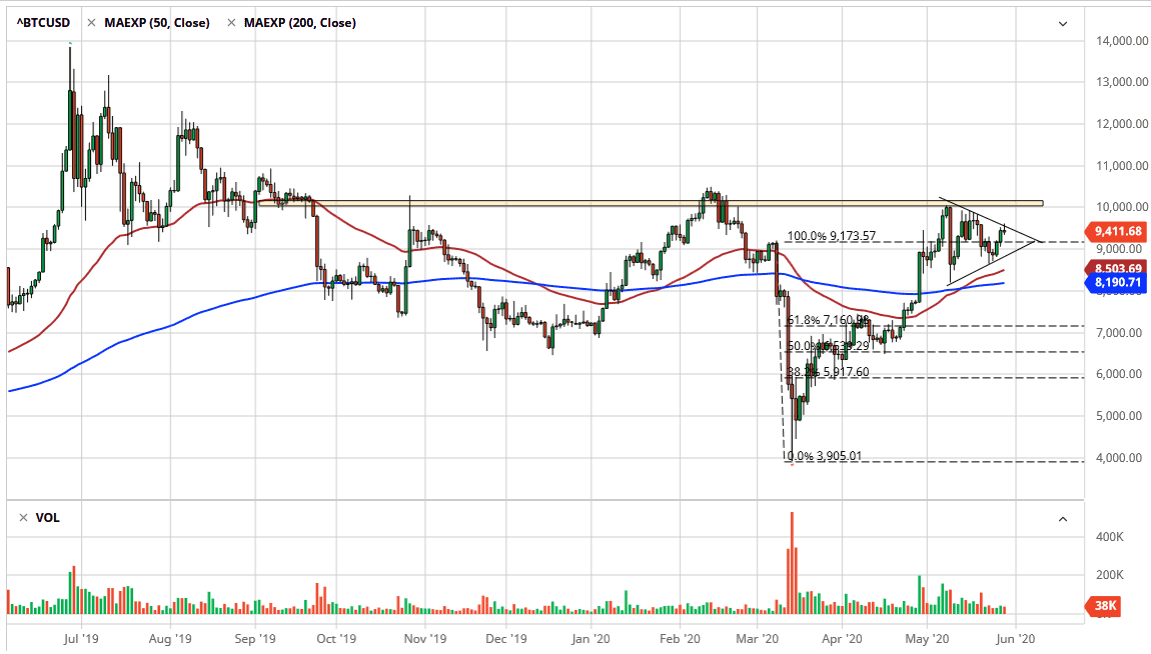

The bitcoin markets initially rally during the trading session on Friday but gave back the gains as we are starting to form a symmetrical triangle. This of course is a compression of price, and therefore could set up an explosion in one direction or the other. After all, markets cannot go in the same direction forever and that applies to bitcoin as well as anything else.

Looking at the chart, you can also make an argument for resistance near the $10,000 level and I think that would be your target if you can get a breakout above the downtrend line. At this point, we would then have a lot of resistance built back into the marketplace, and therefore I would not be surprised at all to see a little bit of a pullback from that area. To the downside, the uptrend line should continue to offer support and therefore I thickets only a matter of time before the buyers come back in that general vicinity. Below there, we also have the 50 day EMA which of course is crucial so I think it is only a matter of time that buyers would be involved again.

Bitcoin has a lot of things working for and against it, but quite frankly it has not been as explosive as people had thought it was going to be due to the halving in May. It seems as if the reaction in price was much less stringent than in the past, which has to be noted as a potentially bearish thing. Beyond that, we also have to look at the fact that the US dollar has been absolutely pummeled over the last couple of days against several currencies, but bitcoin did not seem to take advantage of that. Yes, I do think we are more likely to try to break to the upside than the down, but it certainly is not in a rush. I think going back and forth in this triangle probably continues to be the case for the next several days, but ultimately we are more than likely going to see choppy volatility more than anything else, so keep your position size relatively small, unless of course we get a break out above that $10,000 level. To the downside, the 50 day EMA and of course the $8000 level should offer plenty of support.