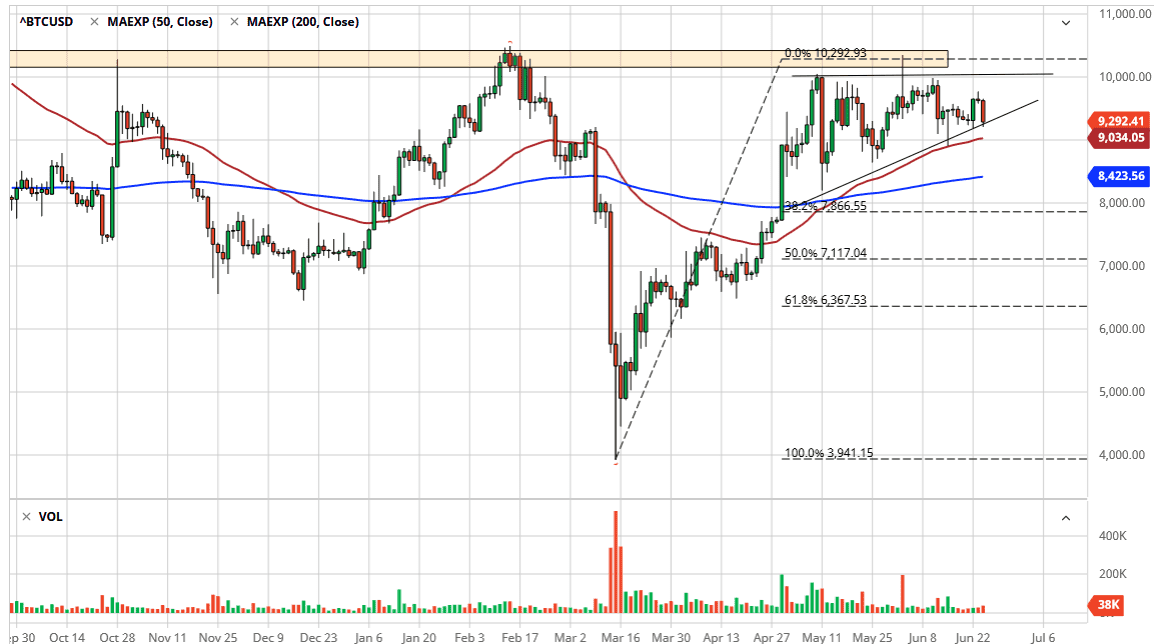

Bitcoin markets broke down significantly during the trading session on Wednesday, reaching down towards the uptrend line that makes the ascending triangle. This is a market that I think will go looking towards the $10,000 level above, with the 50 day EMA underneath offering support right along with that uptrend line. If that is going to be the case, then it makes quite a bit of sense that traders will be looking to pick up a bit of value here, because there are technical arguments made for either direction outperforming.

The US dollar got a bit of a boost during the trading session on Wednesday, so that has an influence on how this asset is priced when measured against the US dollar, so it’s not a huge surprise that we fell. With that being said, I think that we are still going to continue to look back and forth at this area as it is an ascending triangle, thereby seeing a couple of different forces pressing. I think that we will eventually break to the upside and go looking towards that crucial $10,000 handle, and I also recognize that the $10,000 level has significant resistance extending all the way to the $10,500 level, which is something worth paying attention to. The shape of the triangle is rather stark, so I do believe that there is a lot of demand underneath.

When I look at this area, breaking above opens up a potential move all the way to the $12,000 level, something that would be welcomed by the bullish traders out there. I think that $12,000 has always been the target, but there is obvious psychological importance when it comes to the $10,000 level, and I think at that point it is obvious that traders would be looking for some type of direction.

I anticipate that a move above the $10,000 level could be rather explosive because it would suggest that there was a major breakout and that breakout of course would attract a lot of attention. We have been trying everything we can to break above the $10,000 level but what is most important to pay attention to is sellers are having less and less influence on the market, and at the end of the day that is probably what matters more than anything else.