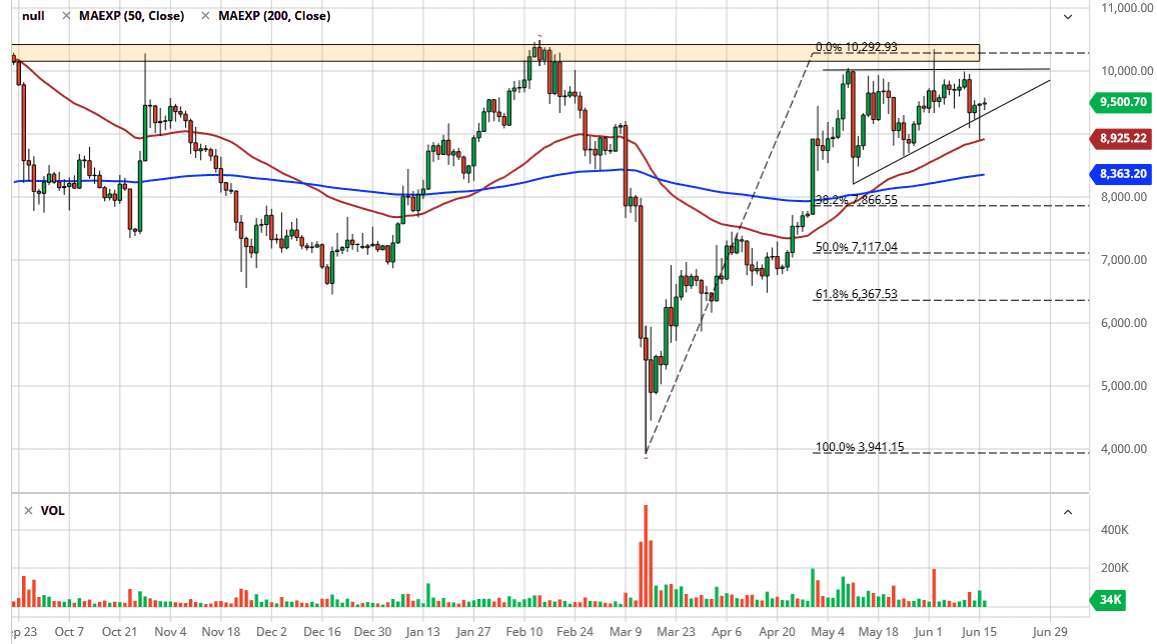

The bitcoin market did extraordinarily little during the trading session on Tuesday, as the markets were all over the place outside of the crypto world. This market has rallied quite nicely over the last several months and I think at this point we are simply trying to digest all of the gains, as we are forming a bit of an ascending triangle. The ascending triangle has a ceiling just above between the $10,000 level and the $10,500 level. It is getting through there that is going to be exceedingly difficult, but if we do, then the market is highly likely to continue racing to the upside.

With the Federal Reserve loosening monetary policy, it makes quite a bit of sense that the bitcoin market would continue to climb, so at this point, I do not have any interest in shorting the market. This is not to say that we cannot break down a bit from here, but quite frankly I think between the uptrend line, the 50 day EMA, the 200 day EMA, and the $8000 level, one of those should support the market. This is not to say that you can just jump in and start buying hand over fist, but clearly, we have several levels that could come into play and offer buying pressure.

The hammer from the trading session on Monday really drove home the point that we see a lot of support, especially if the 50 day EMA and the uptrend line. The fact that the next candlestick, meaning the Tuesday session, ended up being very neutral shows yet still more resiliency in the market. Remember, the US dollar rallied significantly during the trading session, yet Bitcoin remains still during the same session. That is a sign of strength or at least a sign that the strength of the US dollar is not wearing away from the attraction of this market.

With the Federal Reserve and multiple other central banks around the world continuing to do soft yield control buying bonds, it drives down the idea of the strength of fiat currencies. If that is going to continue to be the case, then it is likely that traders will be looking for other places to earn returns, and alternate investments such as Bitcoin certainly fall within that realm. I believe in buying on dips, and now we simply are trying to build up the necessary momentum to go higher.