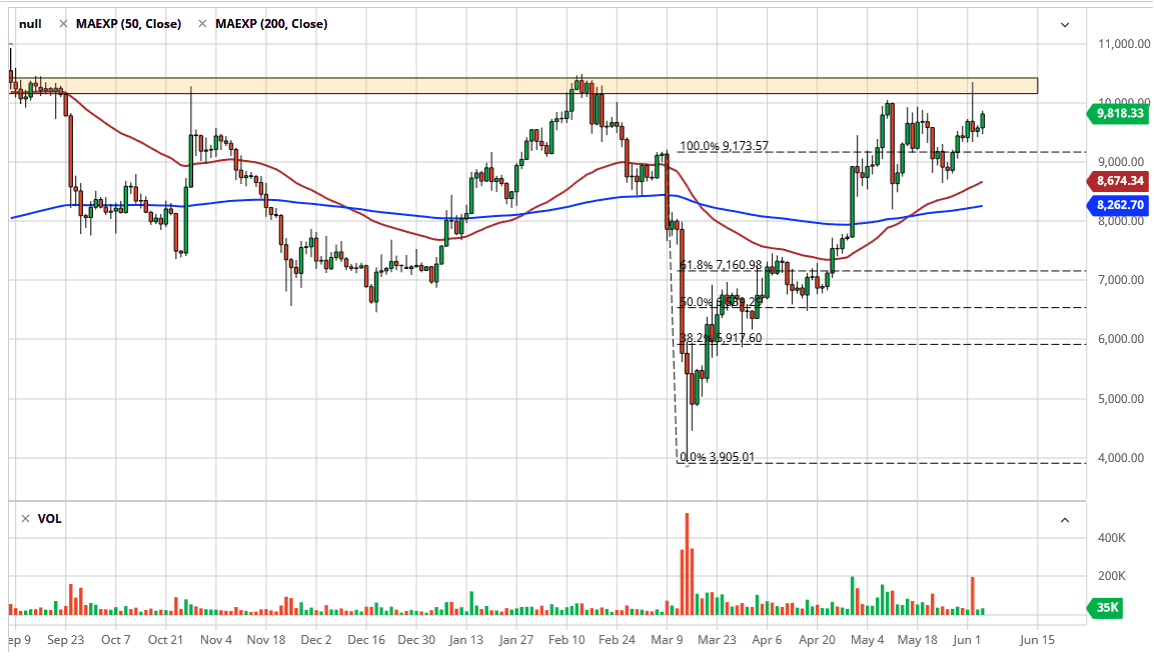

Bitcoin markets have rallied a bit during the trading session on Thursday, reaching towards the $10,000 level above. That is an area where we have seen a lot of selling pressure in the past, and as a result it is likely that we will continue to see a lot of back and forth in that general vicinity. The market breaking above the shooting star from the Tuesday session could then open up the door towards even more gains. The $11,000 level would more than likely be the next target. After that, then the market probably goes looking towards the $12,000 level above there as well.

That being said, I think that we will probably see the occasional pullback in order to offer a bit of value on a dip. What is interesting is that the US dollar got absolutely crushed during the trading session, while Bitcoin rallied, but not quite as much as you would think. It is because of this that I believe that the $10,000 level will continue to be an area that it is difficult to break through. However, we do break above that shooting star, there could be a bit of a reaction like a “beach ball held underwater”, which means that we could shoot straight up in the air.

Having said that, if the market does pull back from here, I think there should be plenty of support near the $9000 level, and then of course the 50 day EMA underneath that is a technical factor as well. At this point, the market is likely to see plenty of choppy volatility, but in the end, it is obvious to me that the market at least wants to try to break out. If we pull back below the 200 day EMA, then were probably going to see the Bitcoin market make a race towards the $8000 level, and then possibly even the $7200 level. One thing is for sure, volatility is going to be much worse around the world, so having said that I do not suspect that we are going to see that be any different here in the Bitcoin market which of course is much smaller than many other financial markets. Ultimately, I believe that we are looking at a scenario where we will simply go back and forth and eventually have a massive move in one direction or the other.