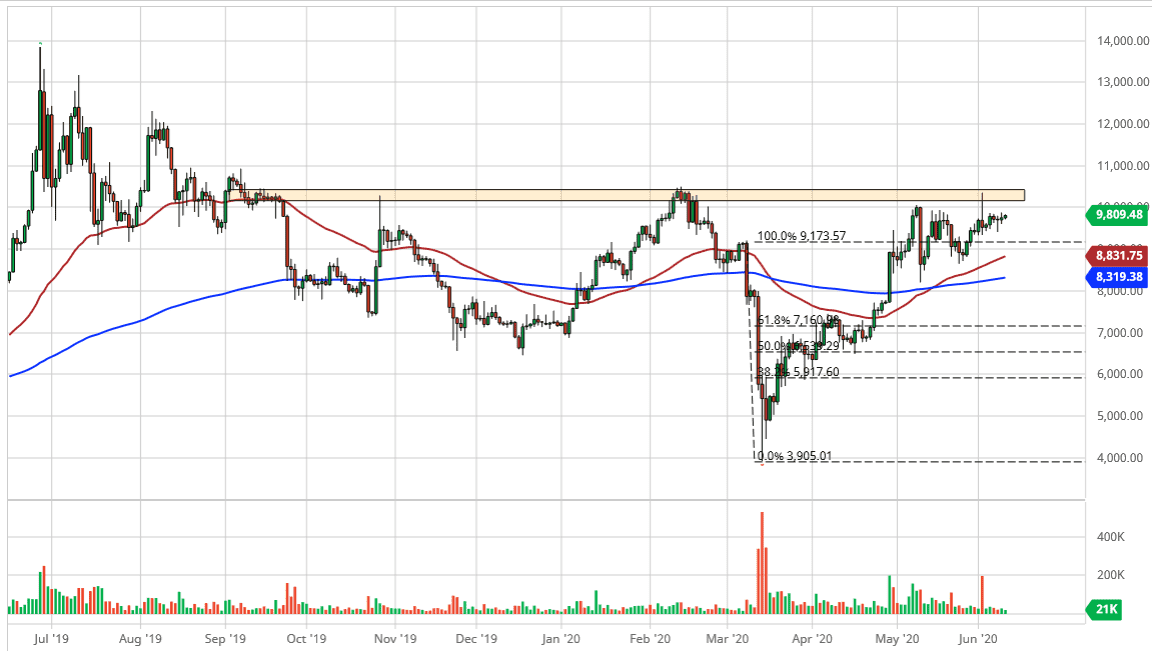

The Bitcoin market continues to rally rather significantly during the trading session on Wednesday to show more strength in a market that quite frankly looks as if it is trying to build up the necessary pressure to break out. When you look at the overall pattern beginning in May, you can see that we are forming a bit of an ascending triangle. This obviously is a bullish sign and it shows that we are trying to take out the $10,000 handle, which I believe shows resistance all the way to the $10,500 level. That being said, if we were to break above that level it could free Bitcoin to go much farther.

It should be noted that the US dollar is getting pounded against various currencies around the world as the Federal Reserve continues to look very dovish after the meeting. If the US dollar gets hit, that should in theory be good for Bitcoin over the longer term. Whether or not we can break out in the next day or two is a completely different question, but from a longer-term fundamental perspective, it should be relatively strong due to this.

To the downside, the 50 day EMA sits at the 8836 handle, and should offer support as we approach it. Also, as I mentioned previously, there is an ascending triangle. This means that there is a short-term trend line underneath, which should also offer bullish pressure as well. With that being the case, I think the market eventually will find buyers even on dips. I do not have any interest in selling it right now and would not suggest it. In fact, it is not until we break down below the 200 day EMA that I think I could be convinced that selling Bitcoin would be a feasible trade.

If we do break out above the resistance, then it is likely that we go looking towards the $12,500 level, possibly even as high as $15,000. This does not mean that it will happen quickly, but that would be the longer-term target. If we were to break down below the 200 day EMA, then we could go looking towards the $7350 level, an area that had previously been a bit resistive. All things being equal, this is a market that looks very bullish but also looks as if it has a lot of work ahead of it.