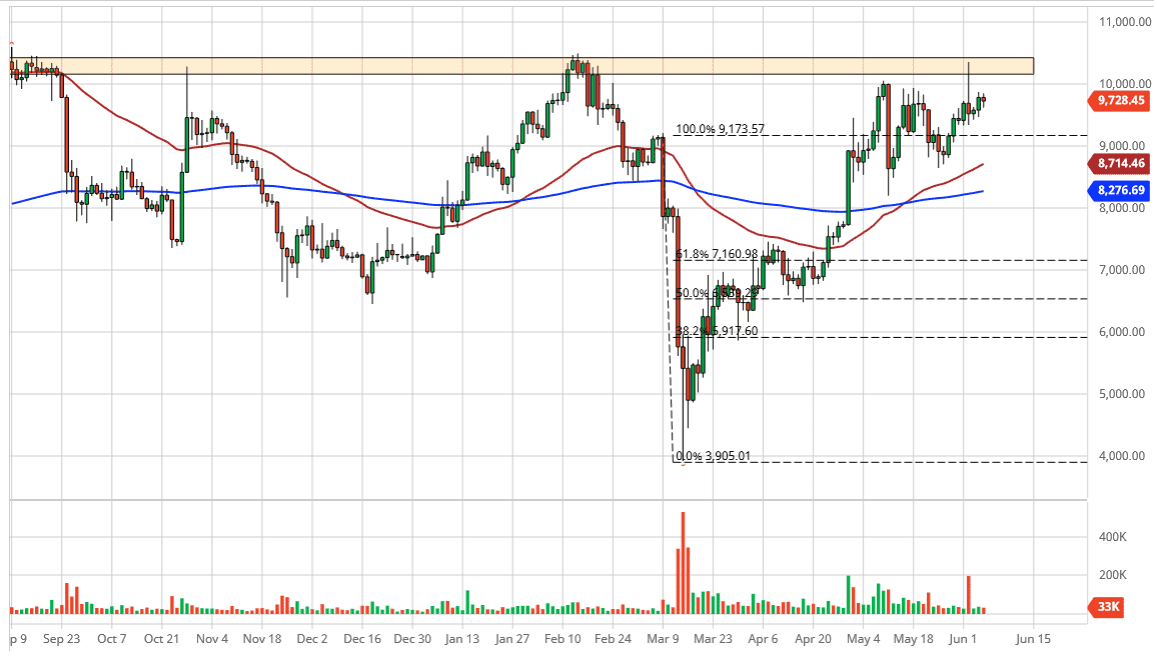

Bitcoin markets pulled back slightly during the trading session on Friday, as the jobs number came out in force a lot of currencies higher against the greenback. It is interesting that Bitcoin is trying to break out against it but seems to be running into a lot of trouble. The $10,000 level is a large, round, psychologically significant figure, so you should of course pay attention to that. If we can break above the $10,500 level, then it is likely that the bitcoin market will continue to grind towards the $11,000 level, possibly even higher than that. Short-term pullbacks in the meantime do make sense as we are trying to build up the necessary momentum to break out.

To the downside I see a lot of support down towards the 50 day EMA. The 50 day EMA is currently sitting at the 8700 level, and I think will continue to attract a lot of attention. Pullbacks are important to build up the necessary momentum to go higher, and that might be what we are seeing here. I think that as long as we stay above the 50 day EMA there should be plenty of buyers looking to get involved. Not only that, there is the 200 day EMA underneath so I think that is also an opportunity for buyers to get involved.

On a break above the $10,500 level, it is likely that the market will race towards the $11,000 level, and then perhaps even break above there. If we can break above there, then it is likely that we are going to go looking towards the $12,000 level eventually. If we break down below the 200 day EMA, it is likely that the market then goes looking towards the $7000 level, which is an area that was previous resistance, which should now be support. Having said that, if we do break down below the 200 day EMA it is likely that the market will break down rather significantly and rapidly. Bitcoin is failing a bit in the sense that it is not gaining at the US dollars expense, so I do find that kind of interesting. However, we have a couple of clear levels that we can pay attention to, giving us an opportunity to start buying or selling depending on which way we break. Expect volatility going forward as markets are trying to price in all of the moving pieces right now.