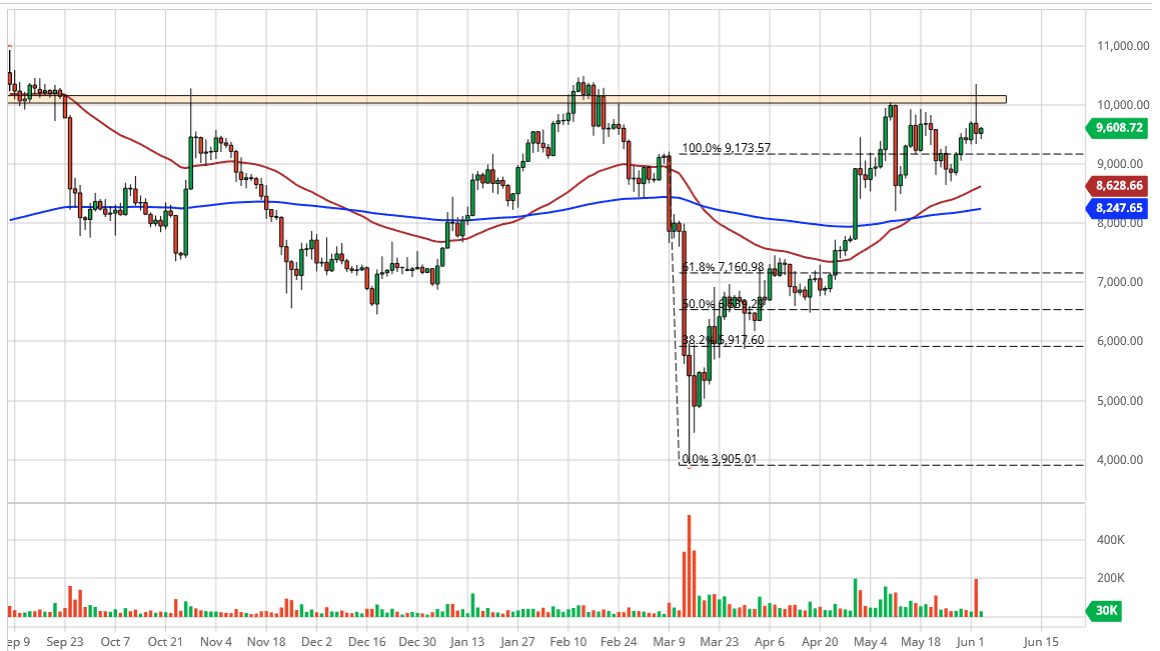

The Bitcoin market has gone back and forth during the trading session on Wednesday, after initially trying to poke above the $10,000 level on Tuesday. You can see that the top of the candlestick from the Tuesday session reached towards the highs from the last time the market try to break above $10,000, and it suggests that we are going to have a lot of work to do to finally go higher. That being said, so far, we continue to struggle in that area. The market of course will pay attention to the $10,000 level as it is a large, round, psychologically significant figure as well, and of course the algorithms will be paying attention to this level also.

Having said that, if we can break above the top of the candlestick from the Tuesday session, then the market is likely to go looking towards $11,000 on its way to the $12,000 level. I do think that we are likely to see a lot of support underneath near the $8500 level, so I feel much more comfortable buying at the lower level like that. Bitcoin does tend to be rather noisy at times, but this market is one that suffers from a lack of liquidity at times are yet to be overly cautious. I think it is only a matter of time before the market find buyers on dips, unless of course we managed to break down below the 200 day EMA which would be a terribly negative turn of events. If that happens, then we probably go looking towards the $7000 level.

There is a lot of noise out there when it comes to currencies in general, and of course Bitcoin will not be any different. The Federal Reserve is printing US dollars as quickly as they can, and as a result that should in theory drive up the idea of Bitcoin going higher. However, there are other games at play as well, including the gold market, and other currencies. In other words, Bitcoin has a lot of volatility built in, and that is probably only going to be more of the same just waiting to happen. Longer-term, we probably go higher but obviously we have some work to do before we can make that happen. To the downside, it is likely that we will see plenty of buyers given enough time, but we have seen multiple meltdowns in this market to be cautious about your position sizing.