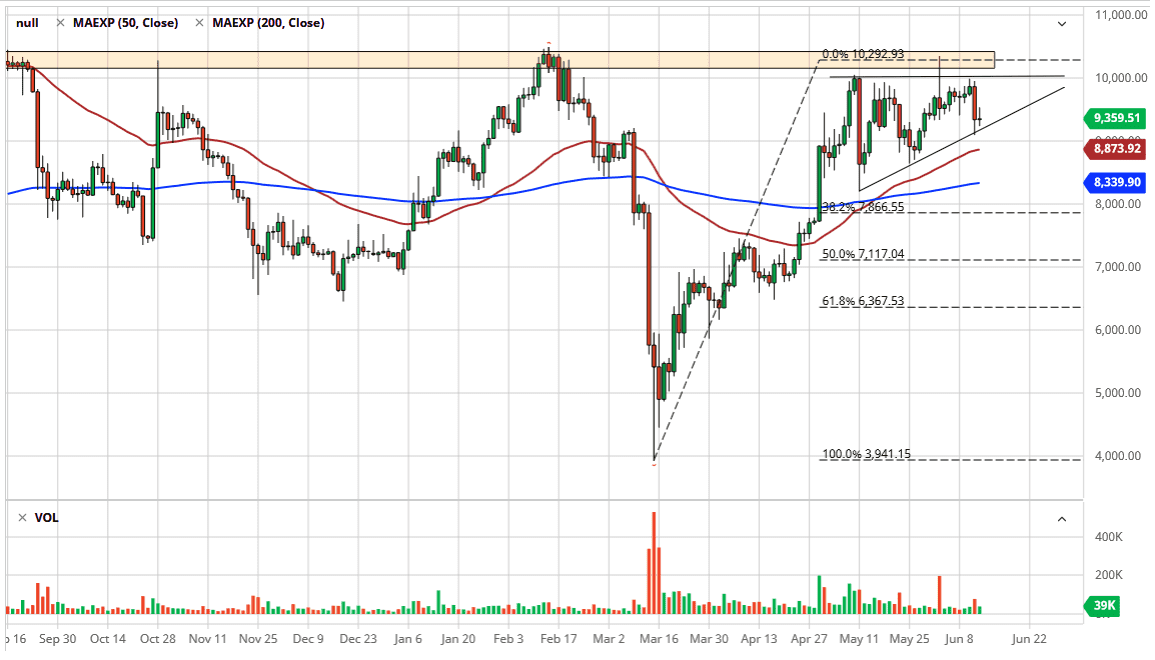

Bitcoin markets continue to show signs of support underneath, although the Friday session was relatively quiet. Ultimately, the market has been in an uptrend since March, and now it looks as if we are finally trying to build up enough momentum to break above the $10,000 level. That, of course, is a large, round, psychologically significant figure, which extends to the $10,500 level.

The ascending triangle is a very bullish sign and is also backed up by the 50 day EMA reaching towards the same uptrend line. Ultimately, this is a market that needs to figure out what it wants to do longer-term, but at this point, one thing that you should pay attention to is that there was a lot of selling on Thursday and the volume did pick up just a bit. This is the one negative sign that I see on the chart right now, other than the obvious resistance above.

I think it is going to take a lot of momentum to finally break above the $10,500 level, but if we do, it opens up the door to the 11,000 level and then eventually the $12,000 level. Ultimately, the Bitcoin market got thrown out with everything else during the trading session on Thursday, as stock markets got absolutely hammered. Anything involving risk was cut hard during the day, but it does look like we are trying to stabilize a bit in this general vicinity. If we break above the top of the range for the trading session on Friday, then I think we are going to go towards the $10,000 level. If we do break down from here, the 50 day EMA then becomes a significant amount of support, and then if you break it down even more, it is likely that the market will go looking towards the 200 day EMA underneath.

Once we break through there, the market probably drops about $1500, looking for some type of support near the $7000 level underneath. That is an area that coincides quite nicely with the 50% Fibonacci retracement level, so it makes quite a bit of sense as well. All things being equal, I think that the Bitcoin market will probably see buyers on dips, so I am not necessarily looking to short this market. If we break to the upside and sliced through the $10,500 level, the market is likely to break higher with a little bit more in the way of momentum.