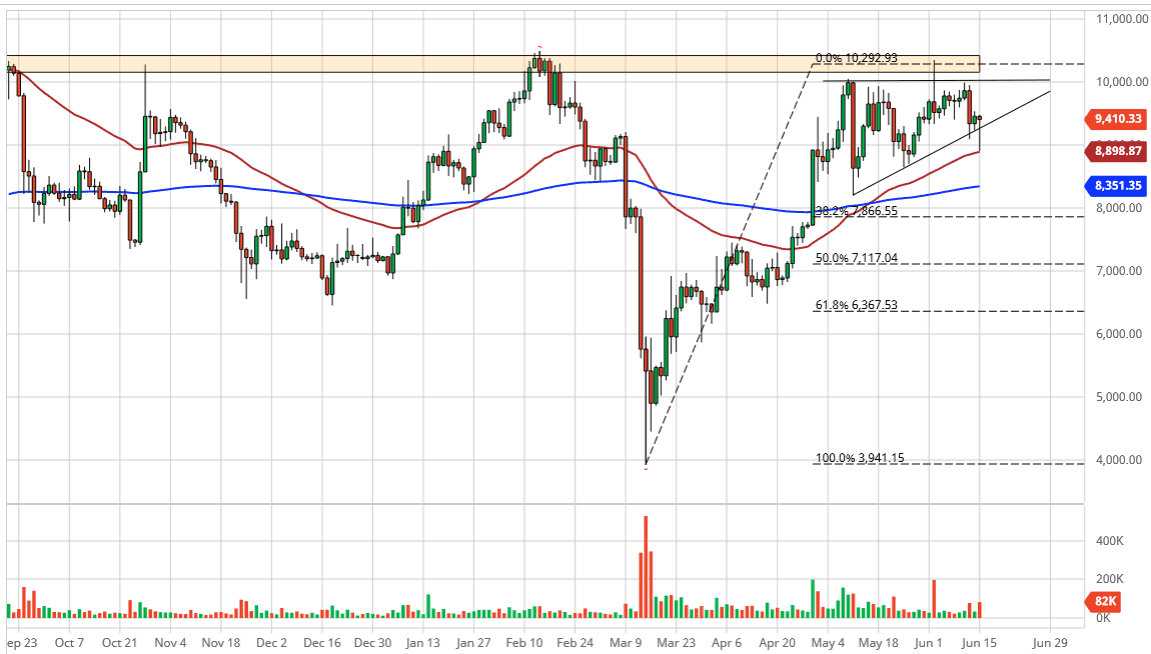

Bitcoin markets initially fell during the trading session on Monday, reaching down towards the 50 day EMA. By finding support there, the market has turned around to form a bit of a hammer. The hammer at this point in time suggests that we are going to continue the uptrend, which we have been in for some time. What I find particularly interesting is the fact that the market is back within the ascending triangle, and therefore it shows that the market is ready to continue what we had seen previously.

One of the biggest reasons for the recovery in my opinion is that the Federal Reserve is now stepping out to buy more corporate bonds, and therefore the US dollar getting hammered. That of course favors the Bitcoin market in general because it shows just how profligate the central banks around the world will continue to be. After all, the Bitcoin market is overly sensitive to what goes on with the US dollar, and therefore I think that we should continue to look at the Bitcoin market as the “anti-dollar”, although it does not always act at the same time.

The $10,000 level above will continue to be crucial, so I think it offers plenty of resistance. Above there, it extends all the way to the $10,500 level, and at this point if we were to break above there then the Bitcoin market will continue to go much higher. On the other hand, if we break down below the 50 day EMA, it is likely that we will move down to the 200 day EMA. This is a larger timeframe type of technical indicator that a lot of people pay attention to, and it does seem to have a particularly interesting effect on the Bitcoin market, more so than many others. Perhaps this is due to the fact that so many retail traders are involved in Bitcoin, but nonetheless it is something that has shown a proclivity to cause reactions.

All things being equal, I do think that Bitcoin eventually will break out to the upside, especially if the Federal Reserve can accomplish its long-term goal of destroying the greenback. Obviously, they have made great strides in doing so during the day, and over the last several weeks. To me, it looks like the only thing that can stop the descent of the US dollar would be other central banks being just as reckless. Either way, even if it is the European Central Bank, that helps Bitcoin as well. Buying on dips should continue to work.