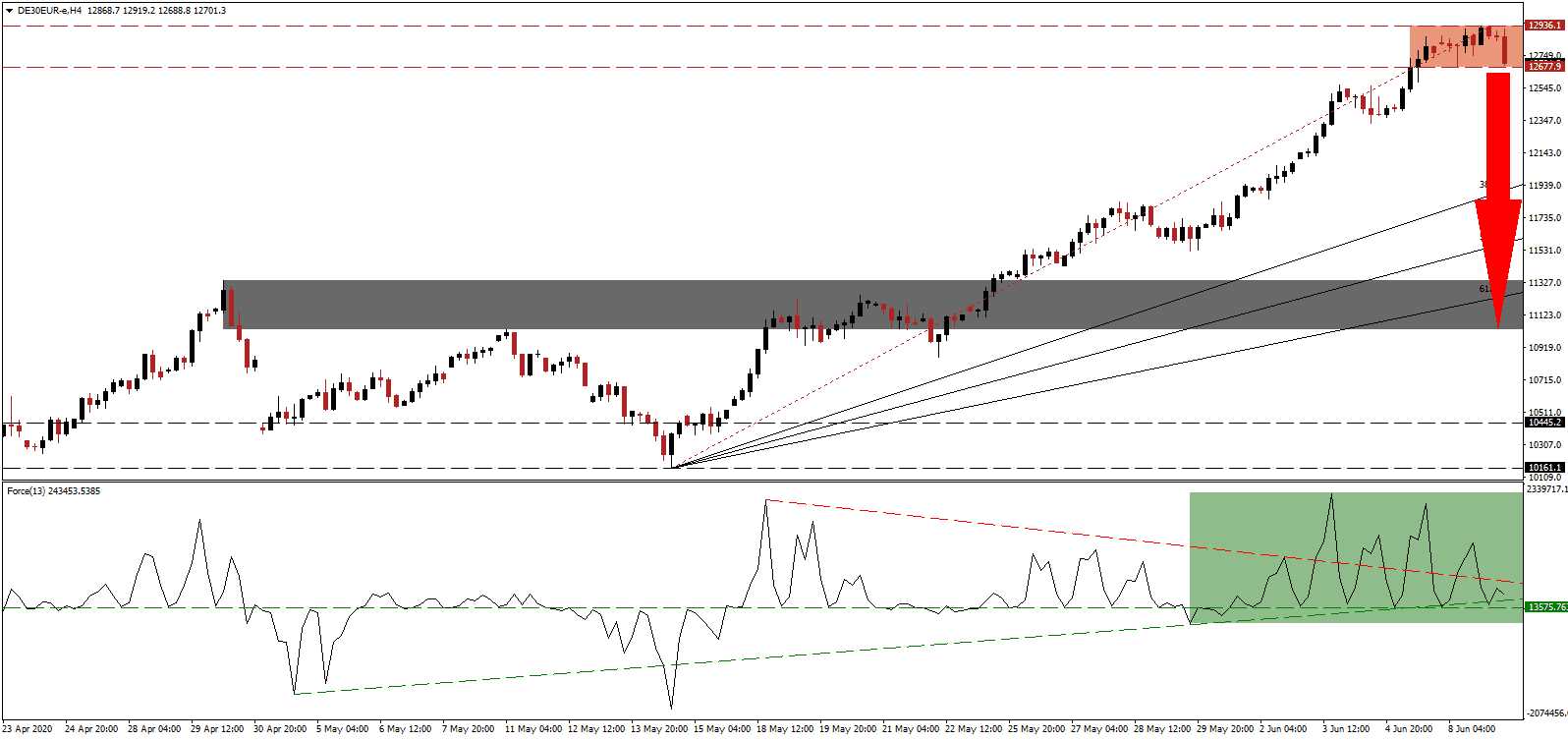

Before the global Covid-19 pandemic wreaked havoc in economies, Germany led a manufacturing recession in Europe, mirrored across the globe. The US-China trade war magnified the slowdown, but was not the cause of it, as it emerged months before US President Trump lashed out at allies and strategic competitors alike. Germany began easing lockdown restrictions, a move duplicated across developed countries, risking a second infection wave. Financial markets ignore warning signs, and misplaced optimism propelled the DAX 30 higher, currently resting inside a resistance zone. It rallied from its intra-day low of 7,953.6 to an intra-day high of 12,936.1, up 62.7% in two-and-a-half months.

The Force Index, a next-generation technical indicator, provided an early warning that a trend reversal is imminent. After posting a new multi-week peak, a series of lower highs allowed for the formation of a negative divergence. The Force Index followed through with a contraction below its descending resistance level. It was able to bounce off of its ascending support level, as marked by the green rectangle, and maintains its position above its horizontal support level. This technical indicator is expected to collapse into negative territory, driven by the accumulation in downside momentum, placing bears in control of the DAX 30.

At the height of the Covid-19 pandemic, currently identified as April, Germany recorded its worst month on record measured by industrial production. The worse than expected 17.9% collapse, led by a 74.6% plunge in the automotive industry, followed an 8.9% drop in March. Exports for April dropped by 24.0%, also exceeding expectations for a decrease of 15.6% after March witnessed a decline of 11.7%. It adds to breakdown pressures in the DAX 30, which is on track to move below its resistance zone located between 12,677.9 and 12,936.1, as marked by the red rectangle.

A breakdown is favored to initiate a profit-taking sell-off, closing the gap between the DAX 30 and its ascending 38.2 Fibonacci Retracement Fan Support Level. While a temporary recovery in economic data is anticipated to follow the easing of lockdown restrictions, the long-term outlook remains bearish. Pending supply-chain adjustments due to the Covid-19 pandemic and a reshuffling of the existing global trade environment will impact equity markets. Price action is well-positioned to accelerate into its short-term support zone located between 11,030.3 and 11,338.0, as identified by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is passing through it, and a breakdown cannot be excluded, followed by an extended corrective phase.

DAX 30 Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 12,700.0

Take Profit @ 11,000.0

Stop Loss @ 13,100.0

Downside Potential: 17,000 pips

Upside Risk: 4,000 pips

Risk/Reward Ratio: 4.25

In the event the Force Index eclipses its descending resistance level, the DAX 30 may attempt a breakout. Due to ongoing long-term bearish progress in the global economy, weighing on the export-oriented German economy and blue-chip index, any advance will provide traders a secondary selling opportunity to consider. The Second-quarter earnings season is additionally expected to apply downside pressure, while the next resistance zone is located between 13,643.8 and 13,827.9, the previous all-time high.

DAX 30 Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 13,325.0

Take Profit @ 13,825.0

Stop Loss @ 13,100.0

Upside Potential: 5,000 pips

Downside Risk: 2,250 pips

Risk/Reward Ratio: 2.22