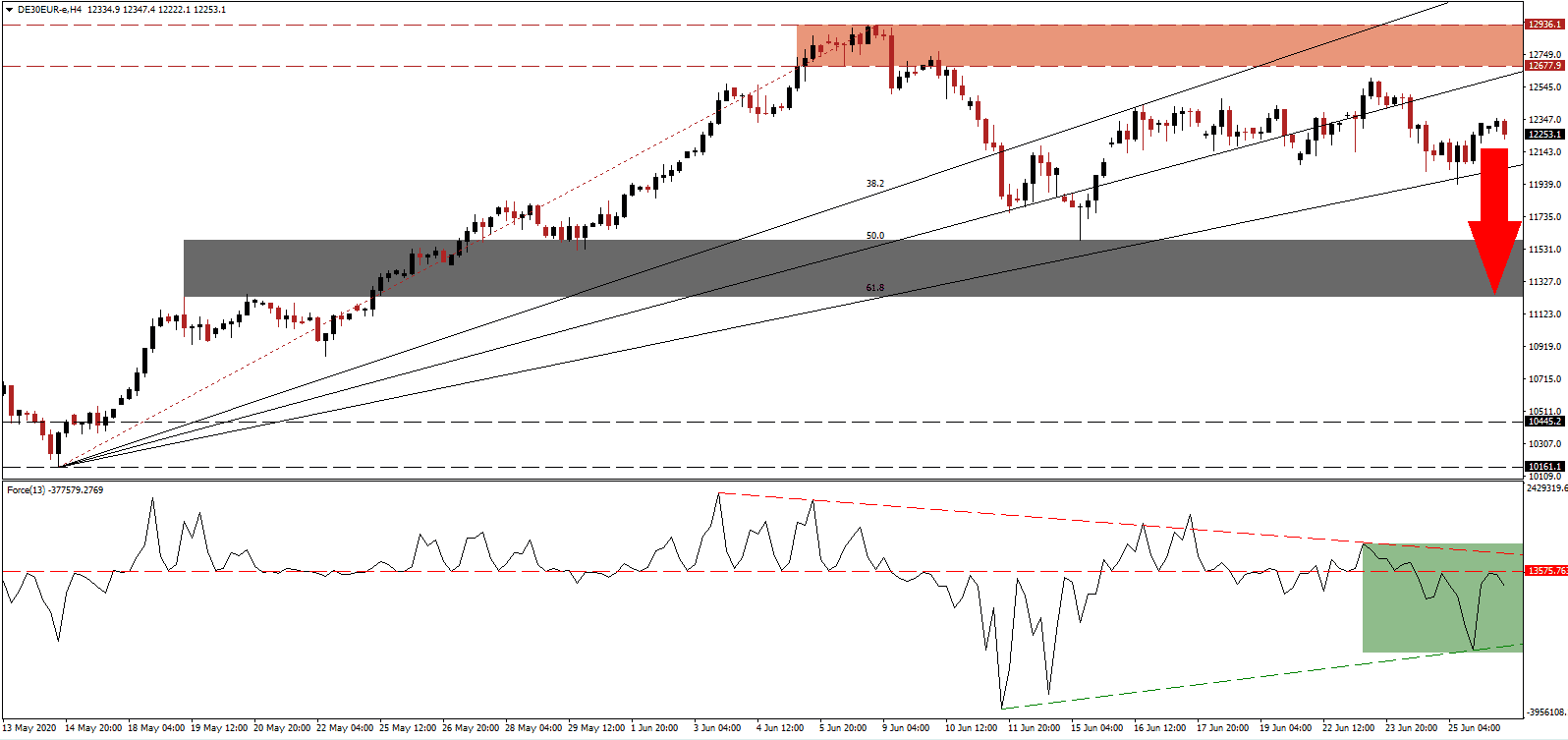

Growth forecasts for the German economy have been revised lower, following a series of global GDP adjustments to the downside. It confirms that governments and their economic advisors, together with central banks, misunderstood and underestimated the negative impact of the Covid-19 pandemic. Despite their inability to assess economic conditions, the five-member German Council of Economic Experts maintains their view of a V-shaped recovery. The DAX 30 remains in a bearish chart pattern following the breakdown below its resistance zone, with downside pressures expanding.

The Force Index, a next-generation technical indicator, confirms the dominance of bearish momentum after being rejected by its horizontal resistance level. Adding to negative progress is the descending resistance level, as marked by the green rectangle. It is favored to pressure the Force Index below its ascending support level. Bears remain in control of the DAX 30 with this technical indicator firmly in negative territory.

Germany is forecast to face a 6.5% GDP drop in 2020, per the government’s advisory board. It is more bullish than the Kiel Institute for the World Economy (IfW), a Top 50 most influential global think tank, which predicts a 6.8% contraction. The International Monetary Fund updated its assessment to reflect a 7.8% decrease. With the overly bullish outlook by the German Council of Economic Experts, further errors are expected. The DAX 30 completed a breakdown below its resistance zone located between 12,677.9 and 12,936.1, as identified by the red rectangle, ending its recovery off of the March lows.

One area of widespread agreement is that the German economy will not recover until 2022 at the earliest, a date which could be pushed farther into the future, depending on developments on the ground. Continental Europe’s largest economy is faced with a surge in new Covid-19 clusters, raising concerns over the depressed recovery potential of the export-dependent German economy. The DAX 30 is positioned for a breakdown below its ascending 61.8 Fibonacci Retracement Fan Support Level, from where it can accelerate into its short-term support zone located between 11,230.1 and 11,589.1, as marked by the grey rectangle. An extension into its support zone between 10,161.1 and 10,445.2 is probable.

DAX 30 Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 12,250.0

Take Profit @ 11,230.0

Stop Loss @ 12,500.0

Downside Potential: 10,200 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 4.08

A breakout in the Force Index above its ascending support level is likely to pressure the DAX 30 back into its resistance zone. Given the rise in global Covid-19 infections, the absence of treatment, and ongoing downward revisions to global GDP and trade, in conjunction with the surge in debt, any advance should be considered a selling opportunity. The upside potential remains reduced to the top range of its resistance zone.

DAX 30 Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 12,650.0

Take Profit @ 12,930.0

Stop Loss @ 12,500.0

Upside Potential: 2,800 pips

Downside Risk: 1,300 pips

Risk/Reward Ratio: 2.15