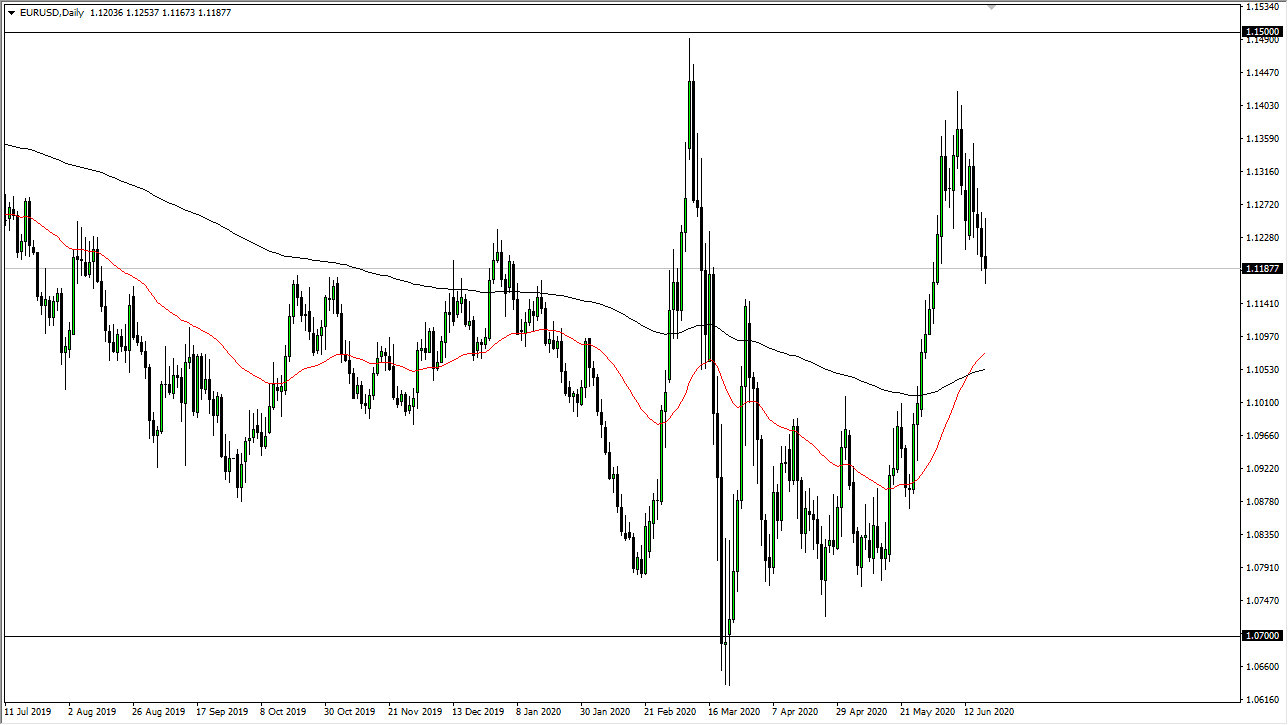

The Euro rallied a bit during the trading session initially on Friday but then turned around to show signs of strength. At this point, the market looks likely to continue seeing sellers every time we rally. The market is going to continue to see exhaustion above and I think it is only a matter of time before rallies are sold into. Quite frankly, that is my play for most of next week, and I think that the 1.14 level has massive resistance that extends towards the 1.15 handle. All things being equal, I think there is so much in the way of noise above, so we will be looking for sellers between here and there.

The candlestick shows itself as a potential “inverted hammer”, which of course, is a negative candlestick. If we break down below the bottom, it should open up a bit of a trapdoor to reach down towards the 200 day EMA which is closer to the 1.1050 level. That is also an area that has been important more than once, so it would make sense to go back there. On the other hand, if we break above the top of the candlestick for the trading session on Friday that would be positive, but I see so much in the way of noise between here and the 1.14 level that I would simply wait for a selling opportunity yet again.

The market has been going back and forth for quite some time, and the EUR/USD pair tends to be very choppy, to say the least. All things being equal, I think that this is a market that made rallies but only down to about the 1.10 level. There are plenty of buyers underneath though, and I do not necessarily think we will break out of the range that we have been in. All things being equal, the market will continue to be one that if you are patient enough, should offer plenty of opportunities. I do not really have a scenario in which I'm willing to buy the Euro right now unless something changes drastically. I do not see that happening, so at this point more than likely what we will see is a “fading the rallies” type of set up occasionally going forward.