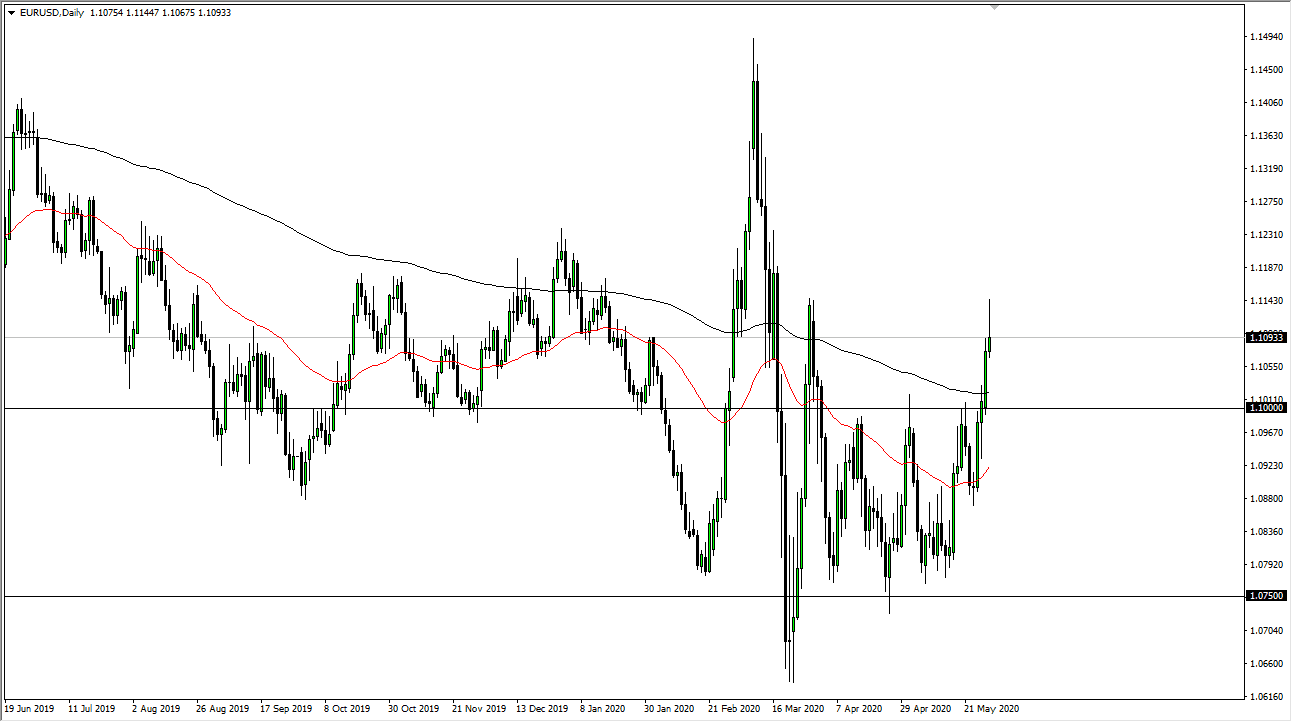

The Euro has extended gains during the day on Friday, reaching well above the 1.11 handle before pulling back. The resulting daily candlestick is a shooting star and it is showing resistance right where you would expect to see it, the 1.1150 handle. After all, that was an area that had seen a lot of selling pressure, so the question now is whether or not we will continue to see this resistance?

It is an interesting time to be trading the Euro, because they had agreed on a “federalized bond” in the European Union, for the first time this past week. That means that Germany is effectively backing Greek debt, as far as the practicality of cashing out a bond is concerned. This is a scenario that is something that a lot of Euro skeptics have been pounding the table on. That being said, the economic figures do not favor the European Union and I feel that it is only a matter of time before we get back to reality. The shooting star does suggest that we are at the very least going to get a pull back so if we break down below the bottom of the candlestick for the Friday session, I will anticipate a move towards the 200 day EMA, which is just above the 1.10 level. If we were to break back down below there, then it is going to be more of that messy nonsense that we had seen several months ago.

On the other hand, if we turn around a break above the top of the candlestick for the trading session on Friday, that would be an extraordinarily bullish sign. That would show a lot of resistance giving way to buyers, and we would more than likely go looking towards the 1.1250 handle. All things being equal, the next few session should be crucial, but I would anticipate a little bit of a pullback more than anything else if I had to put serious money to work. As I have been telling you though, I use is more or less is an indicator on how to trade other EUR related pairs. If this one is rising, a lot of times I will buy the EUR/CAD or something similar. I hate trading this pair, because most of the time it is very choppy. However, it does have its use as an indicator.