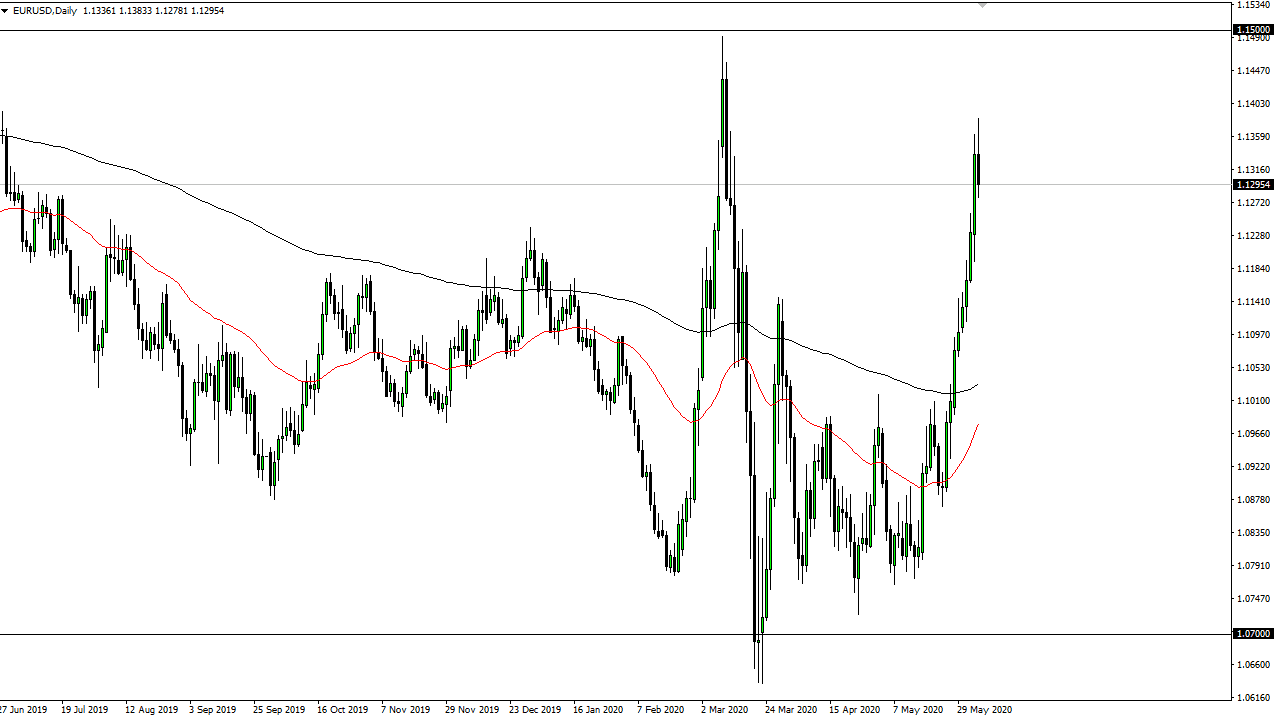

The Euro initially rallied during trading on Friday, waiting for the jobs numbers to come out the United States. The jobs number was anticipated to be a loss of 7 million jobs, but the United States ended up adding 2 million jobs, which is an extraordinarily huge disruption to what people had been pricing into the market. It makes sense that the market has rolled over a bit at this point, because the market has been a bit too parabolic as of late. The 1.13 level is obvious resistance, but we could continue towards 1.15 level which is even more resistive as it is the scene of the most recent break down.

That being said, it is difficult for the market to continue going higher the way it has, because we are so overstretched. At this point, the Euro has taken off due to the fact that the European Central Bank had a little bit rosier picture for the economy than a lot of people had anticipated. However, the Federal Reserve suddenly will have to rethink things now that the jobs numbers have come out so much more positive than originally thought. This is a market is starting to show signs of being overbought, and as a result it is likely that the market will continue to pull back. This is a market that has gotten too far off on one side, and most certainly towards the top of the total risk range that we would be looking at.

Underneath, the 200 day EMA sits right around the 1.10 level, and we could very well see this market try to go down towards that level. Even if we did that, you could still make an argument for the Euro to be bullish but this is a market that I think needs to find more buyers in order to continue to push the market to the upside. However, if we did turn around and break out above the 1.15 handle, it is likely that the market should then go to the 1.1750 level. I would feel much better about that movie if it took a while to get here though, because this is a market that could very well break out but then at the very least needs to come back to reality before ripping to the upside.