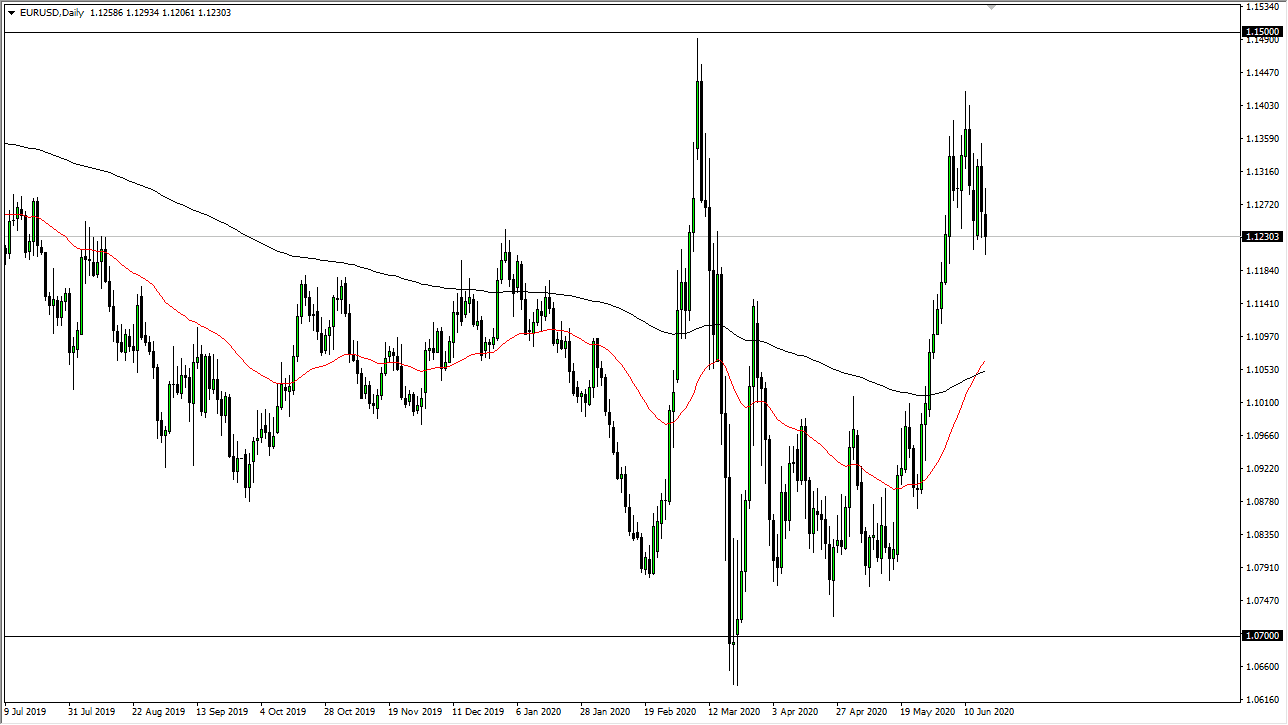

The Euro looks as if it may try to rally a bit from this general vicinity, but as you can see on the last couple of candlesticks, we have had sellers above. The 1.14 level continues to cause major issues, and I believe that the resistance extends all the way to the 1.15 handle. After all, we have been looking at that number more than once over the last year or two, and it always seems to cause issues for the Euro in general.

We initially started the day positively, but then broke down towards the 1.12 handle. That is an area that is starting to offer support yet again, and we get below, and I think the Euro then starts to unwind down towards the 200 day EMA which is closer to the 1.1050 level. In fact, that is the trade at this point in time: to simply fade rallies that show signs of exhaustion so that you can take advantage of what should be a bigger move. When you look at the longer-term chart, it makes quite a bit of sense that we could get there without too many issues, because this has been an extraordinarily negative market for quite some time.

When you look at the longer-term consolidation area, it appears that the 1.07 level is the bottom of the overall range, just as the 1.15 level is the top. We have gotten a bit too close to the top, and it appears that as we could not build up enough steam to break out to the upside it is time to start rolling over. When you look at the weekly candlestick from last week, it was essentially a perfect shooting star so I do believe that this market will find sellers every time it rallies from here. That is the same if we break down, as it simply would be a bit of gravity coming back into the marketplace that had gotten a bit parabolic. The US dollar is a safety currency, and with all of the problems that we have out there, it would make quite a bit of sense that sooner or later people will start buying the greenback again. Beyond that, the European Union still has to deal with the Brexit, which looks like it is going to be a “hard Brexit”, which could cause some unforeseen problems.