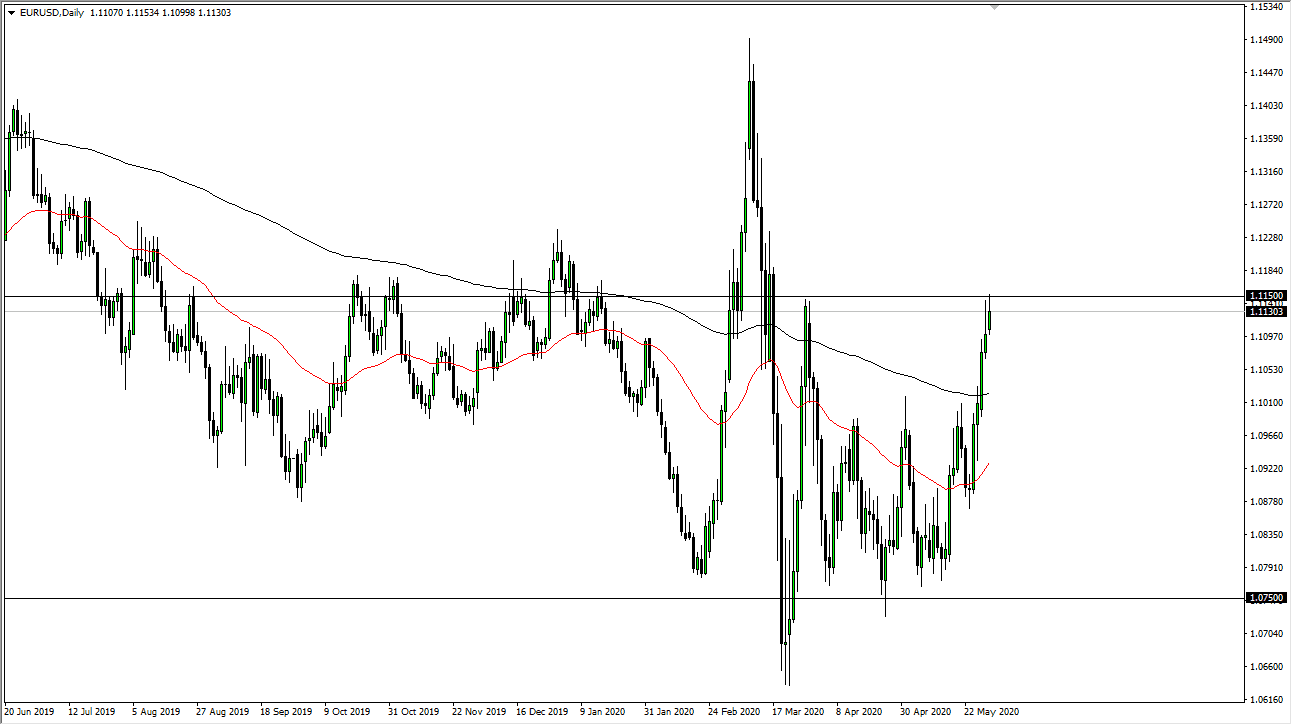

The Euro continues to grind higher against the greenback, as the Forex market seems to be focusing more on the idea of European bonds being federalized than anything else. That being said, it does look as if the 1.1150 level is the beginning of further resistance, but this market has underperformed some other currencies against the US dollar. If you want an example, simply look at the British pound or the Australian dollar, both of which have done so much better than the Euro. So, what does this tell me?

What this tells me is that if there is a turnaround towards the US dollar for any reason whatsoever, it is the Euro that is going to get absolutely crushed. Even the Canadian dollar did better against the US dollar during the day on Monday, so therefore I do not trust the Euro rallied all.

Ultimately, this is a pair that I think will continue to be very noisy but at least it has stopped shopping around in little tiny increments like it tends to do. I am looking to fade this pair, but I need to see the market drop down below the 1.11 level in order to do so, or I would be more than willing to sell near the 1.1250 level. With this, you also have to keep in mind that the Federal Reserve liquidity continues to be a major driver of markets to other currencies away from the US dollar, which is going to start drying up over the course of that next couple of months.

To the downside I would anticipate that the 1.10 level underneath is a target, as it was previous resistance. If we break down below that level, then we could see something rather negative. Ultimately, this is a market that I think continues to see a lot of headwinds above, but if we do break out to the upside then the next longer-term target will be the 1.15 handle. To the downside, it will be interesting to see how this plays out because I know a lot of analysts believe that the Euro should continue to get pounded, although I did see a couple of them turn around and suggest that the Euro should be bought. As we start to see analysts flip over, it is almost always a sign that we are getting towards the top.