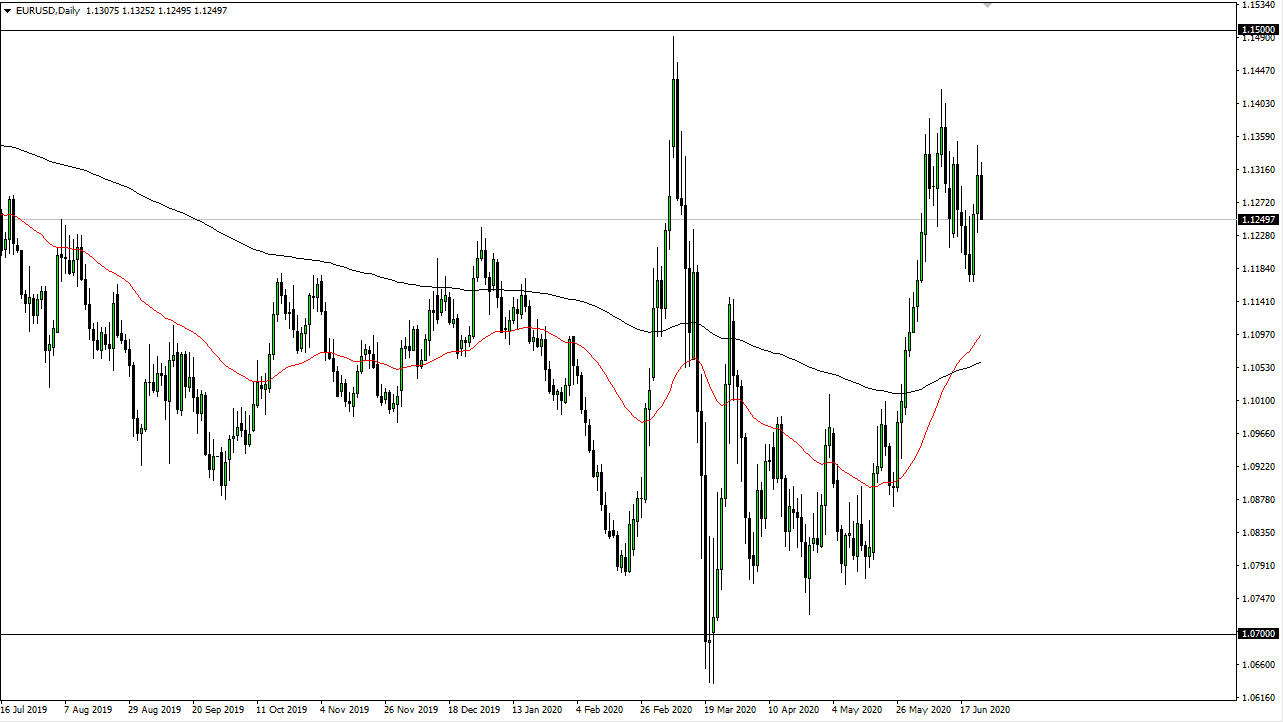

The Euro tried to rally during the trading session on Wednesday but failed at the 1.1350 level yet again. With that being the case, we make a series a “lower lows”, which of course is a negative look. I think the 1.1150 level underneath is a target initially, followed by the 1.1050 level. We also have the 200 day EMA in that area so therefore it makes sense that we would see that targeted. I think it is going to be choppy and nasty, but I do expect to see the market reaching down towards that area.

In the meantime, I like fading the Euro every time it rallies, perhaps starting to sell near the 1.13 level if we bounce towards there. If we do, I am uncomfortable shorting as well at the open, because I think longer term this pair is going to do the same thing regardless. This does not mean that we cannot rally in the short term, it is just that it seems to be very unlikely this point.

To the upside, I see the 1.15 level as the absolute top of the range, with the 1.14 handle above offering the beginning of that massive resistance. With this, I think there is a bit of negativity in that area that should continue to cause major issues. If we were to break above the 1.15 level, that changes everything for the Euro. However, I do not believe that we will not see that happening, at least not anytime soon. To the downside, if we were to break down below the 1.10 level, then we enter into an area that could be very noisy all the way down to the 1.08 handle.

One thing I think you can count on in the Forex markets is a lot of volatility but is starting to look more likely to me that we are going to see US dollar strength against several currencies around the world, not just the Euro. The Forex markets do tend to base most trading on the US dollar in general, so you will get synchronicity between several different pairs at the same time. All things look highly likely pointing towards greenback strength, so I am not interested in buying the Euro, at least not until we rake above the 1.15 handle which of course is not going to happen during the trading session on Thursday.