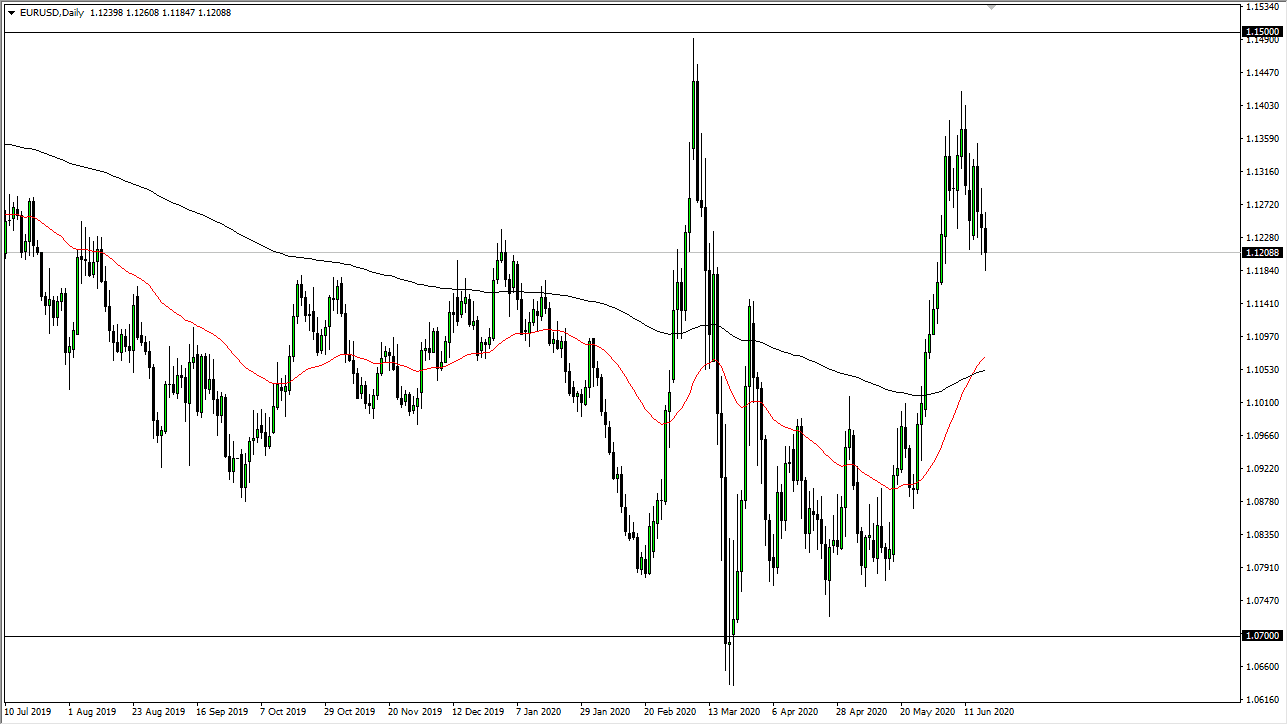

The Euro has initially tried to rally during early trading on Thursday, but it is becoming obvious that the market is getting a bit heavy and that it is ready to break down a bit. The market now comes down to whether or not the US dollar strengthens or weakens overall. At this point, the market looks likely to see a lot of volatility, but that is nothing new in this pair. Having said that, we are starting to drift a bit lower and when you look at the weekly chart, you can see that there is a significant shooting star from the previous week that has just been broken through. Because of this, it should suggest that we are going much lower, but it is probably going to take more of a grind lower than anything else.

Having said all of that, I do believe that the market is probably going to try to go towards the 1.1050 level eventually, as the 200 day EMA is sitting in that general vicinity. The 1.1050 level has been important more than once, so I think that it makes quite a bit of sense that we could see a return to that level. When you look at the longer-term chart, the 1.15 level is a massive resistance barrier that starts at the 1.14 handle. To the downside, I believe that the 1.10 level extends down to the 1.08 handle. In other words, this is a market that does not really know what to do with itself. When you think about it though, it makes quite a bit of sense as the ECB and the Fed both are doing everything, they can stimulate their economies, which is essentially code speak for destroy their own currencies.

When both central banks are going out of their way to outdo each other in this aspect, it makes sense that you get a lot of volatility. Longer-term, we have been in a downtrend and there is a lot of concern out there about dollar shortages, but at the end of the day I think we are simply going to go back and forth and the volatility is a feature that is probably going to continue to be very common. Ultimately, I think that the market is trying to figure out which direction to break for a longer-term trend, but right now we just do not have the clarity to do that.