Despite the stronger than expected reading of the German ZEW index, the EUR/USD pair continued to decline, and accordingly, it took off towards the 1.1227 support before settling around the 1.1260 level at the time of writing.

Yesterday's trading session started at around 1.1355. The European single currency retreated after the strong start of the new week after the ZEW survey in June surprised the markets by achieving stronger levels than expected. As the German ZEW confidence index rose from a reading of 51.0 to 63.4, markets were expecting an increase to only 60.

The Eurozone ZEW rose from 46.0 to 58.6, where markets were expecting a reading of 53.4. "There is increasing confidence that the economy will recover by the end of the summer of 2020. This is reflected in the renewed rise in the ZEW economic confidence index as well as the more optimistic assessment of the current situation," says Professor Achim Wambash, President of the ZEW Institute. The expected gains for the separate sectors in Germany are still very different.

The ZEW is a German survey that asks 300 financial experts for their opinions on various questions related to the market and the economy. The June recovery reflects optimism between analysts and investors that has risen in recent weeks as more major economies have taken other steps to reopen. European politicians have signaled a willingness to make concessions in negotiations over proposals for the European Commission's recovery fund.

The Euro dropped against the dollar after the ZEW survey yesterday, despite the fact that the announcement closely coincided with reports of increased geopolitical tensions in some parts of the world, especially between India and China after a border dispute between the two parties led to clashes that resulted in the loss of lives of both Sides. Tensions between North and South Korea also increased.

Commenting on the performance of the pair, said Kim Mondy, strategist at the Commonwealth Bank of Australia: "The EUR/USD rose to 1.1340 due to the weakening dollar." He added that the “European Council meeting next Friday is essential for the Euro, and any indications that the four opposition countries are softening their stance against the European Union’s large-scale recovery fund, financed in large part by grants instead of loans, would push the EUR/USD up. ”

Global stock markets got further boost after the Federal Reserve’s recent decision to expand the corporate asset purchase program and speculation about plans that the White House may have sufficient support to spend on infrastructure.

The geopolitical tensions and political measures were the most influential on the markets, and this week the Euro will monitor the results of the European Union Council meeting on Friday, in which the leaders are expected to discuss the European Commission’s proposal to create a 750 billion Euro recovery fund financed by the budget and consisting of grants and loans to heavily indebted member states struggling to cover the cost of the coronavirus.

From the United States, and after the announcement of a record decrease in US retail sales in the previous month, the US Department of Commerce issued a report showing that retail sales rebounded more than expected in May as stores began to reopen after closings to counter the pandemic. Accordingly, retail sales increased by 17.7% in May after falling by -14.7% in April. Economists had expected retail sales to rise 8.0 percent, compared to - 16.4 percent that was announced the previous month.

The record increase in retail sales is partly due to a major rebound in car sales and parts dealers, which rose by 44.1 percent in May after falling 12.3 percent in April. Excluding the recovery in car sales, retail sales increased by 12.4% in May after falling 15.2% in April. Previous car sales were expected to jump 5.5 percent.

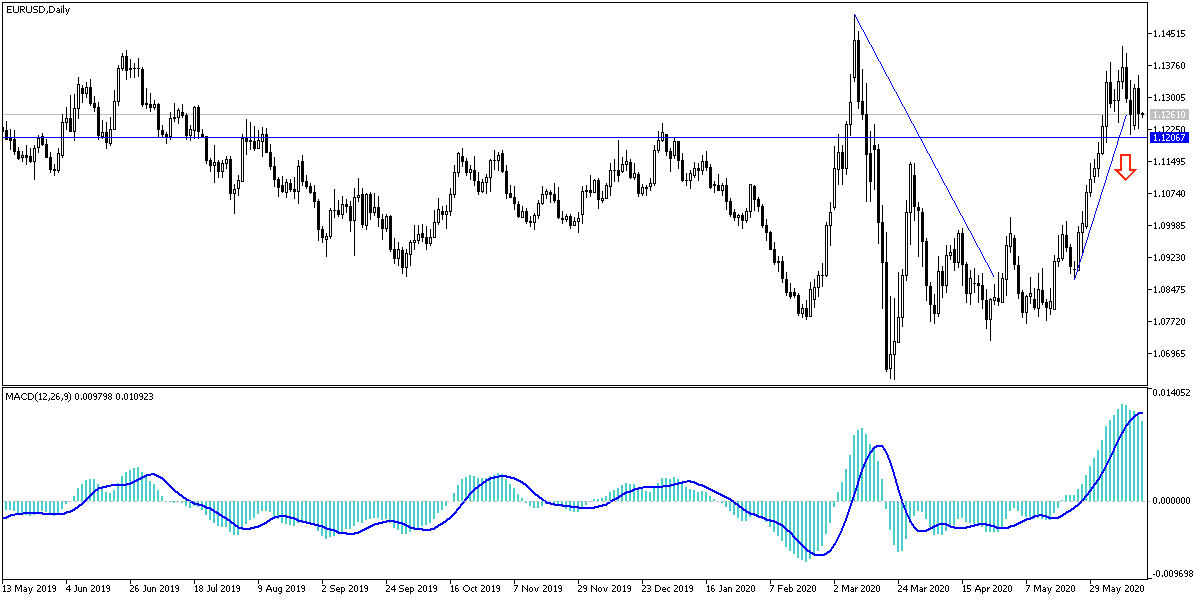

According to the technical analysis of the pair: On the EUR/USD 4 hours chart, a head and shoulders formation started to form, threatening the future of the bullish correction.

Current performance: A push back below the 1.1200 support will increase the bear's control over the performance to move towards stronger support levels. On the other hand, stability above the 1.2400 resistance will remain a catalyst for bulls to complete the upward correction path which started at the end of last month. For the time being, the pair's gains will remain a selling opportunity until the results of this week’s important European summit meeting are known.

As for the economic calendar data today: From the Eurozone, the consumer price index will be announced. From the United States, building permits and housing starts will be announced, as well as the content of Jerome Powell's important testimony.