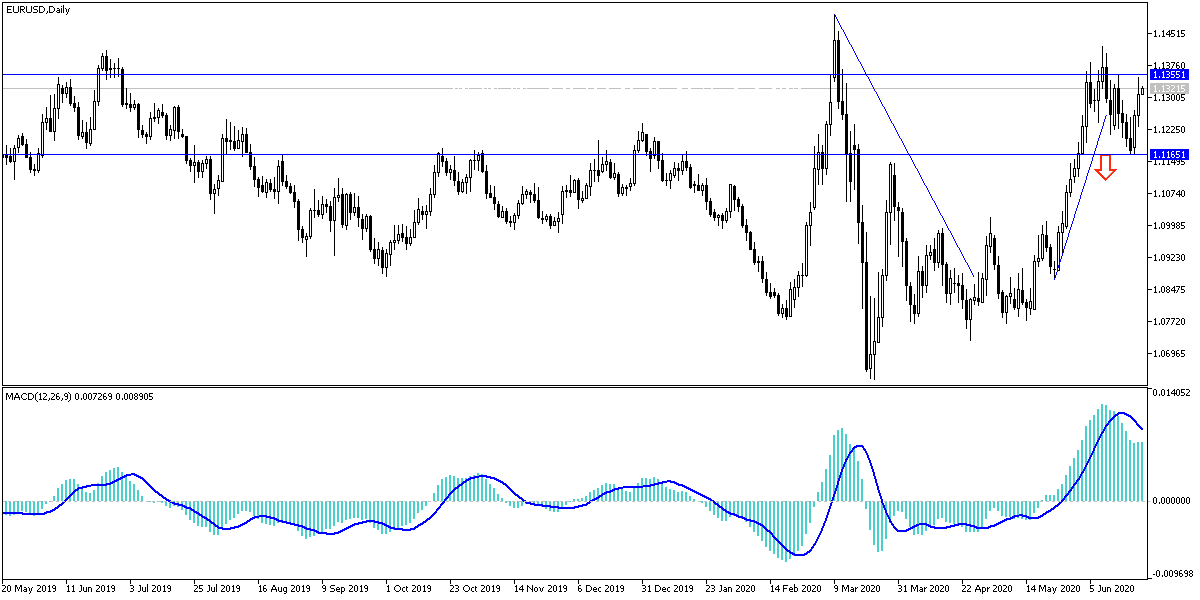

The weakening of the US dollar, along with the positive results of the European economic data, helped the EUR/USD to correct upwards to the 1.1348 resistance before settling around the 1.1310 level at the time of writing. Rebound gains from the 1.1168 support following the announcement of a shocking increase in Coronavirus cases after the reopening of global economies, which was positive for the safe haven US dollar. The single European currency moved positively after IHS Markit surveys indicated a strong pickup in manufacturing and services for the month of June, although economists urged caution, warning that the results give a misleading impression of conditions in the Eurozone economy.

The manufacturing sector along with the services sector in Europe continued to recover in June, as economies reopened and activity levels recovered. The Eurozone manufacturing PMI rose from a reading of 39.4 to 46.9 when expectations were for an increase of only 43.8, while the services index rose from 30.5 to 47.3. It is worth noting that the German Manufacturing PMI increased from 36.6 to 44.6 when expectations were for the increase to 41.5 only. The Services PMI increased from 32.6 to 45.8, compared to expectations for a reading of 41.7.

Meanwhile, in France, the Services PMI rose from 31.1 to 50.3, surpassing the consensus of 44.9. French manufacturing index rose from 40.6 to 52.1 while markets were expecting a reading of 46.1.

Commenting on the results, Klaus Festsen, chief Eurozone economist at Pantheon Macro Economics said: “It is very likely that the lower key influences in France have led to a jump this month in the PMI, while the rate of improvement in Germany is smoother, partly due to the smaller hit in the first place. All we would like to say with certainty on this point is that slow improvement is still in progress, a story confirmed by the details”.

PMI surveys measure changes in industry activity by requiring respondents to evaluate employment and production conditions, new orders, prices, delivery, and inventory. The number above 50.0 indicates growth in the industry while the number below 50 corresponds to deflation.

Markets are interested in PMI data because it is an indicator of the momentum within the economy, which has a direct impact on inflation expectations, which determines interest rate policies. The outlook for prices is an important engine for currencies, although borrowing costs are widely expected to remain at their new lows for several years, everywhere, including the Eurozone.

According to the technical analysis of the pair: It is expected that the bullish momentum of the EUR/USD price will not last much, and therefore currency traders may consider activating profit-taking operations with the pair testing the resistance levels at 1.1375, 1.1440 and 1.1520, respectively. The European failure to agree recently to stimulate the European economy will continue to be a pressure factor on any gains for the Euro in the coming period. On the other hand, by moving below the 1.1240 support, the pair will increase the bearish momentum, and thus return to move in the range of the bearish channel again.

As for the economic calendar data today: The IFO reading of the German business climate will be announced. There are no significant US economic releases today.