In the beginning of this week’s trading, the EUR/USD pair attempted to correct upwards with gains reaching the 1.1288 resistance before settling around the 1.1240 level at the time of writing. The European single currency tried to avoid a fall below the 1.1200 support in order not to increase losses, and despite these attempts, the stronger US dollar is still stronger amid a mass risk aversion in the financial markets, as increasing numbers of coronavirus might hinder international efforts to reopen the international economy and a return to the same closure policies to contain the outbreak. The pair got the last support from optimism about Merkel's statements that Germany will not stop stimulating the European economy in the face of the pandemic, which is good for the plans that the bloc wants to endorse despite the opposition of some European countries. French President Macron adopts the same position as Merkel, but their desire is missing the collective agreement of European leaders, which creates a continuing threat to any gains for the Euro in the coming days.

On the economic level. Preliminary data released by the German statistics office Destatis revealed that German inflation unexpectedly increased in June from its lowest level in 45 months. Consumer price inflation rose to 0.9 percent in June from 0.6 percent in May. The price was expected to remain unchanged at 0.6 percent, the lowest level since September 2016. On a monthly basis, consumer prices rose 0.6 percent in June, faster than the expected 0.3 percent increase and in contrast to the May drop of 0.1 percent.

From the United States, Pending home sales saw a record rebound to 44.3%, better than expectation of a 18.9% sales, after a record decline of -21.8%. The National Association of Realtors said yesterday that its pending sales index rose to 99.6 in May, the highest monthly increase in the index since its creation in January 2001.

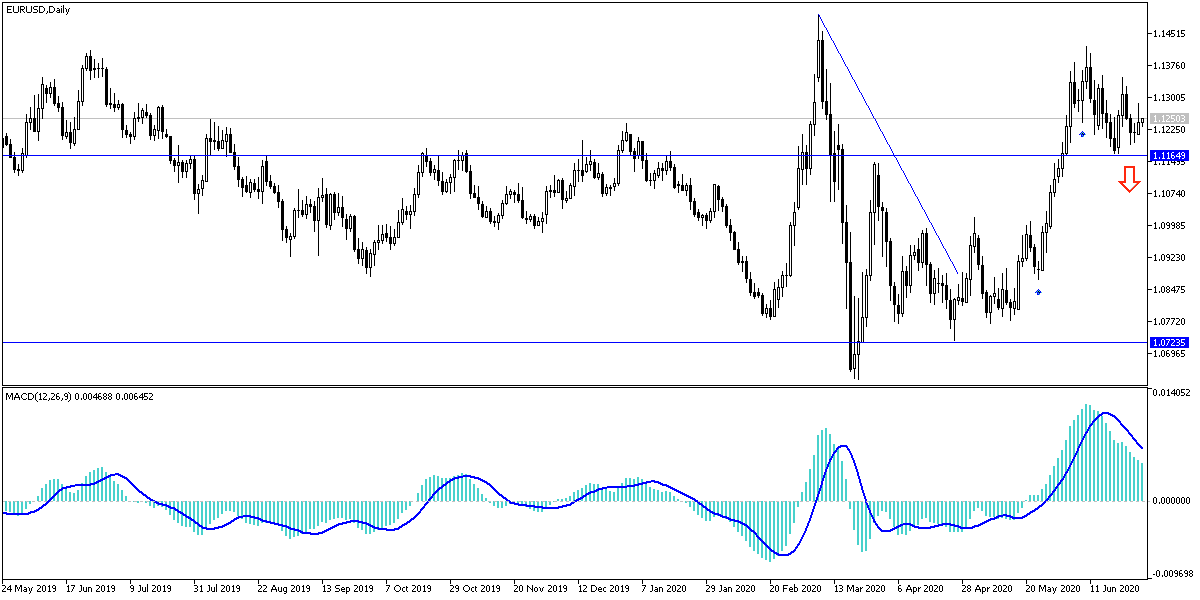

According to the technical analysis of the pair: Recent EUR/USD bounce has not yet reached to a reverse of the downward outlook dominating performance. The bears will be closest to breaching the 1.1200 support, which in turn will increase the bearish momentum to move towards 1.1000 psychological support, respectively. The single European currency will remain under that pressure until the final announcement of a collective agreement of European countries to stimulate the economy of the bloc, as in addition to the coronavirus shocks, the US administration threaten to impose more tariffs. On the upside, the nearest resistance levels for the pair are currently 1.1295, 1.1355 and 1.1455, respectively. I still prefer to sell the pair from every higher level.

As for the economic calendar data today: From the Eurozone, the CPI reading will be announced. During the American session, the PMI reading from Chicago and the US consumer confidence reading will be released, and then the important testimony of Federal Reserve Governor Jerome Powell along with the US Treasury Secretary before the US Parliament.