The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. The current market environment has changed from one of crisis to a questionable rebound, despite the growth in the global coronavirus pandemic which continues.

Big Picture 28th June 2020

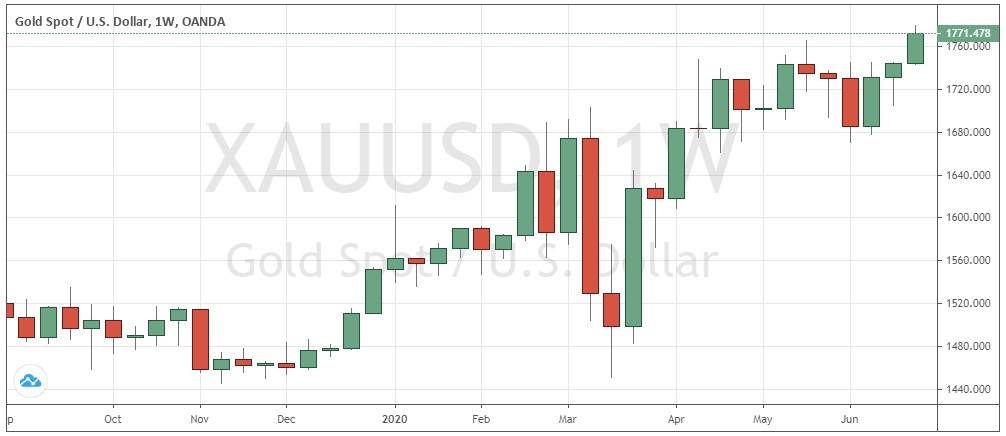

In my previous piece last week, I saw the most attractive trade set-up for as likely to belong to Gold in U.S. Dollar terms following a daily (New York) close above $1750. This was a good call, as Gold closed at $1754.77 last Monday and ended the week up by 0.95% at $1771.48.

Last week’s Forex market saw the strongest rise in the relative value of the Australian Dollar and the strongest fall in the relative value of the Japanese Yen.

Fundamental Analysis & Market Sentiment

The world is not coming to an end, but we are living in an extraordinary time of global health crisis, the type of which has not been seen in one hundred years. There is both fear and optimism, but it is important to remember that the evidence shows that the vast majority of people are going to survive and be healthy.

Friday saw daily new confirmed coronavirus cases hit a new all-time high of 194,190 cases. This is a sign that globally, the wave of disease is still advancing to a peak.

We have seen the epicenter of the global coronavirus pandemic move into Latin America, with Brazil now seeing more new deaths from the virus than any other country in the world, and a higher total death toll than any country except the U.S. The rolling averages of deaths have decreased significantly in Europe. However, the U.S. has seen a sharp increase in new cases over recent days to new all-time highs of over 40,000 cases per day. Cases are also rising in Asia and Africa.

Latin America and the Caribbean are now responsible for approximately 52% of confirmed new daily deaths, with the U.S.A. at about 12% and Europe at about 10%. The strongest growth in new confirmed cases is happening in Brazil, the U.S.A., India, South Africa, Colombia, Iraq, the Philippines, Israel, Algeria, Romania, and Serbia.

The U.S. stock market fell firmly last week, as there is evidence that the coronavirus pandemic is peaking to a new crest throughout many states in the south and west. There is concern about the persistence of unemployment from earlier closures and restrictions and the economic impact of the reversals of easing which are now being imposed in several states.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows last week printed another bullish pin candlestick which followed a bullish lower inflection point candlestick formation rejecting the area around 12200 which has provided some support over recent months. This short-term price action is unquestionably bullish. There is no long-term trend, as the price is lower than it was 3 months ago but higher than it was 6 months ago. Overall, next week’s price movement in the U.S. Dollar looks slightly more likely to be upwards than downwards based upon the recent price action.

S&P 500 Index

Last week the price fell on fears of the economic impact of the coronavirus pandemic as the rate of new infections in the U.S. increased to hit an all-time high. Friday saw this major global stock index close below its 200-day moving average for the first time in almost three weeks. This is a bearish sign; however, the price remains above the key psychological round number of 3000.

Gold

Last week printed a bullish candlestick which closed very near its high at a new 8-year high price. The price action of recent weeks is showing a strong long-term bullish trend with a breakout above the former key psychological level of resistance at $1750. The price is most likely to rise over the coming week.

Bottom Line

I see the most attractive trade set-up for this week as likely to belong to Gold in U.S. Dollar terms following a daily (New York) close above $1771.