GBP/USD: British Pound relatively weak

Yesterday’s signals were not triggered, as none of the key support or resistance levels were reached.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

Short Trade Ideas

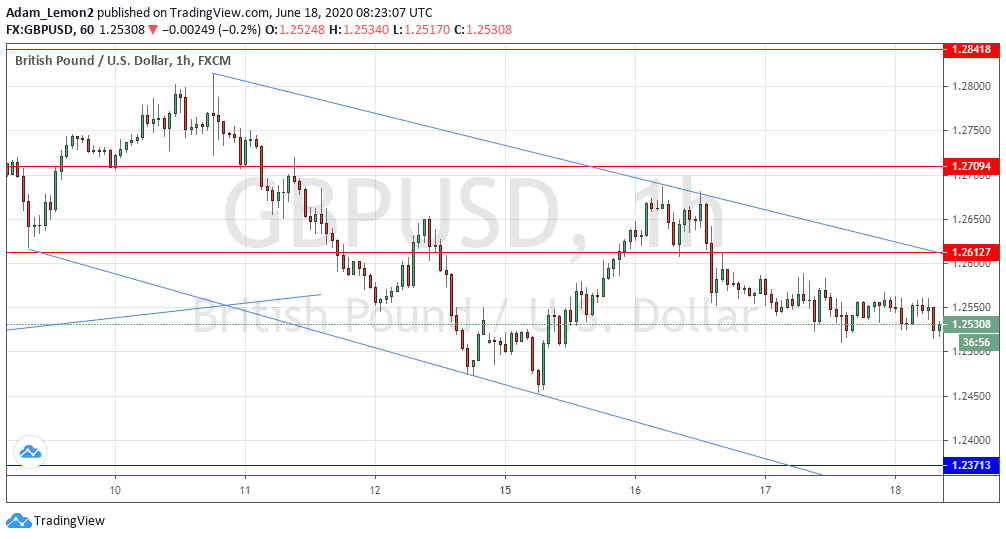

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2613 or 1.2709.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.2371 or 1.2285.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote yesterday that as the British Pound was certainly one of the weaker major currencies, so I saw the potentially good trade in this pair as most likely to be on the short side.

This was a good call as the price has continued to trade within the bearish price channel shown in the chart below and has moved down further over the past 24 hours, although not by much.

The price action over the short term is also bearish, suggesting a further downwards move is likely.

However, the monthly policy release from the Bank of England is due shortly, which is likely to cause volatility and moves that do not respect the technical situation, which can make trading in this pair very risk until after the release is made.

The best that can be said is that a release that hits the Pound should have more potential to push the price down than a bullish release would push it up, due to the medium-term bearish trend here.

Regarding the GBP, the Bank of England will release its Monetary Policy Summary and Official Bank Rate plus Asset Purchase Facility and Votes at Noon London time. There is nothing of high importance scheduled today concerning the USD.