For the third consecutive day, the GBP/USD pair stabilized around and above the 1.2700 resistance. It reached its highest level in three months, and its gains reached the 1.2735 level, and is stable around it at the time of writing and at the beginning of Tuesday's trading. The gains in the British pound continued amid the continuous improvement in global financial markets sentiment, as well as the evaporation of Brexit trade negotiations fears, as both the European Union and the United Kingdom recognized that there are no difficult deadlines looming for the negotiations and are likely to continue until the end of the year.

In spite of the Brexit trade negotiations, which ended in a stalemate last week, the pound wasn’t affected and continued to reap gains. The pound had lost a lot of its value during the month of May, and dropped against most other major currencies, with investors becoming increasingly concerned about the failure of the talks in June, as the UK faces a month-end deadline to request an extension for the negotiating period. The foreign exchange options markets showed that investors became increasingly concerned that June would provide negative results for the British pound as the cost of insurance against the significant depreciation of the currency rose sharply, especially around the middle of the month.

The fourth round of negotiations with the European Union ended and no major progress was shown, but the British pound seemed unaffected, because the prevailing theme during the past few days remained a widespread improvement in sentiments associated with the global economies ending closure policies, and because at least officially it hinted a great Negotiators from both sides have the possibility of making progress in the next few months.

After the round of talks that had just concluded, Chief British negotiator David Frost said in a statement that "progress is still limited but our talks have been positive in their tone". The negotiations will continue and we remain committed to achieving successful results. ” Frost said the UK was talking to the European Commission about holding direct talks to find a breakthrough."We are ready to work hard to see if at least the broad outlines of a balanced agreement covering all issues can be reached soon," Frost added.

Meanwhile, UK Prime Minister Boris Johnson is expected to meet European Commission President Ursula von der Leyen sometime in June in an attempt to inject some political momentum into the talks, stressing that efforts are not made by both sides to reach an agreement but flexibility in the schedules is required to succeed.

It appears that the markets were very pessimistic about the direction of the British pound towards the month of June, when a German official said that the leaders of the European Union will interfere in Brexit trade negotiations in the Fall, with the aim of concluding a settlement agreement at a summit on October 15. In this context, Michael Kloss, the German ambassador to Brussels, said that "no real progress" has been made in the talks so far, but that he expected to become the main political focus of the European Union in September and October. Germany will assume the rotating presidency of the European Union in the second half of the year and will be essential in generating the momentum required by the European Union to successfully end the negotiations.

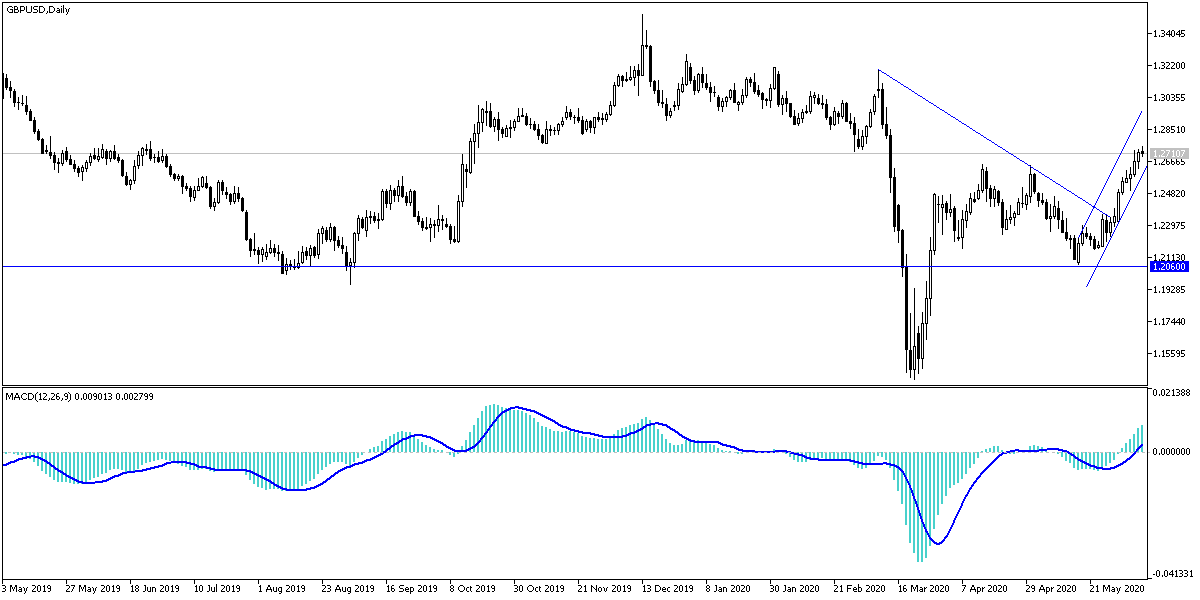

According to the technical analysis of the pair: On the GBP/USD daily chart, the general trend is still bullish and the continued optimism about the Brexit file may push it towards higher resistance levels, and the closest ones are currently 1.2765, 1.2830 and 1.2900, respectively. And there will be no chance of changing the current trend without moving below the 1.2585 support. Despite the recent optimism, I still prefer to sell the pair from every upper level. The pair does not expect any important economic issues today, whether from Britain or the United States of America. It may get some support if investors continued to take risks.