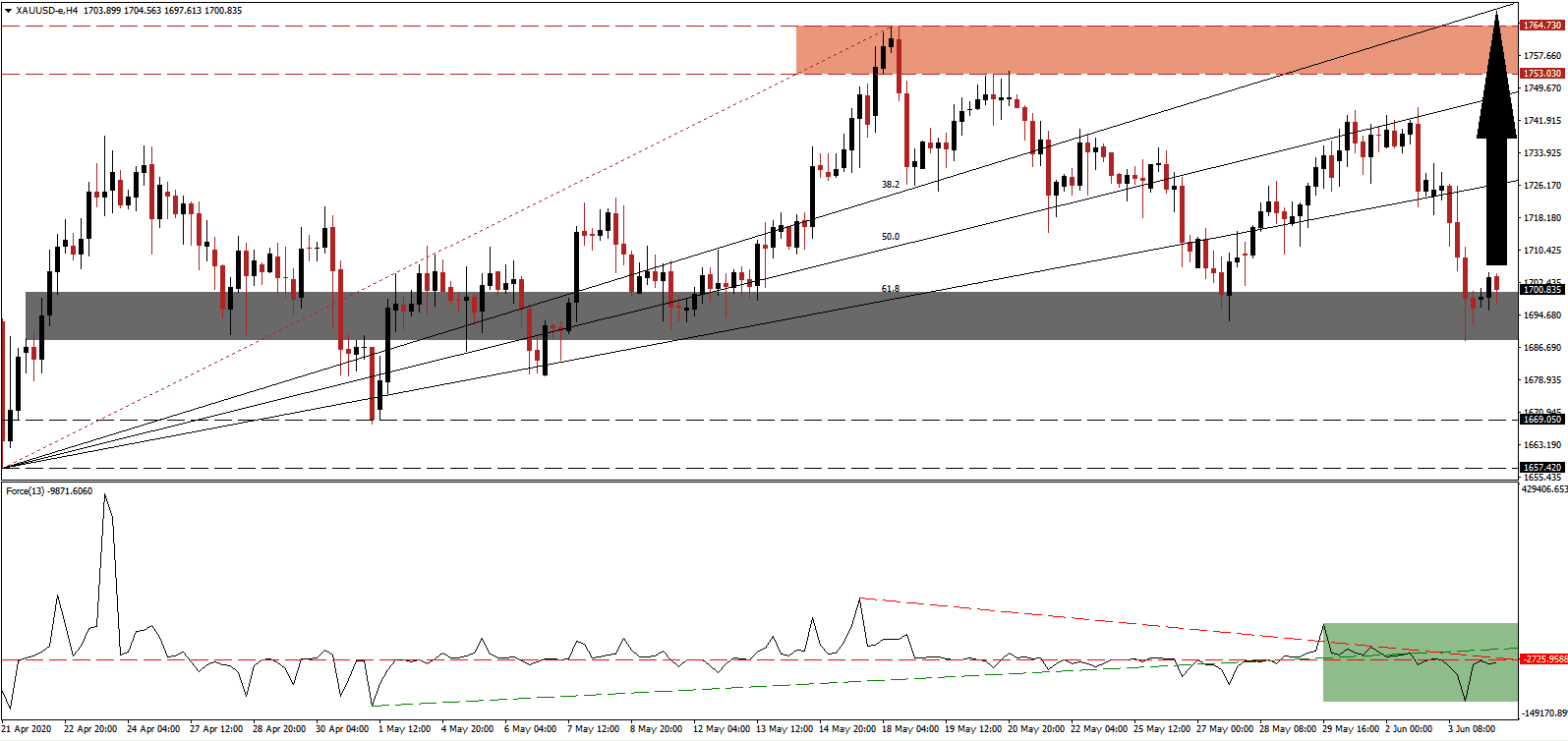

Financial markets extended their disconnect from fundamental reality, primarily driven by retail demand. Misplaced optimism about the reopening of economies aided the rush of risk appetite. Traders are ignoring warnings from health officials and companies in regards to earnings, with a distinct focus on more central bank market manipulation to the upside. While governments are easing lockdown restrictions, new Covid-19 infections have accelerated. Economic data confirms a deep recession, but the attention shifted to view better than forecast data as a sign for a V-shaped recovery, despite a multitude of warnings and data points suggesting the opposite. Gold faced heavy selling and was rejected by its ascending 50.0 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next-generation technical indicator, dropped to a multi-week low before stabilizing and retracing to the upside. It is now challenging its horizontal resistance level, as marked by the green rectangle, with the descending resistance level adding bearish pressures. A breakout is expected to catapult the Force Index higher. Given the proximity of its ascending support level, a triple breakout cannot be excluded, which will take this technical indicator above the 0 center-line and grant bulls complete control of gold.

Sweden, which implemented a controversial relaxed rule to the pandemic, has acknowledged its mistake. The realization of errors is led by the state epidemiologist and architect of the strategy, Anders Tegnell. Most countries decided to relax rules without a proper test, trace, and isolate (TTI) infrastructure in place. The risk of a secondary wave of infections increased amid the careless disregard and an inappropriate initial response to the virus. Selling pressure in gold deteriorated after price action reached its short-term support zone located between 1,688.37 and 1,700.06, as marked by the grey rectangle.

With economies and epidemiology intertwined, a hybrid approach to tackle both issues is paramount. A recent study identified optimized results by alternating 50 days of extreme quarantine with 30 days of relaxed rules. Governments fail to embrace this and are focused solely on the resumption of economic activity, ignoring the fact that a functioning economy requires a healthy workforce and consumer. Gold is well-positioned to resume its rally and accelerate into its resistance zone located between 1,753.03 and 1,764.73, as identified by the red rectangle. A breakout is probably, with the 38.2 Fibonacci Retracement Fan Resistance Level guiding price action higher.

Gold Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1,701.00

Take Profit @ 1,765.00

Stop Loss @ 1,681.00

Upside Potential: 6,400 pips

Downside Risk: 2,000 pips

Risk/Reward Ratio: 3.20

In the event the Force Index is pressured into a reversal by its descending resistance level, gold is likely to attempt an extension of its corrective phase. Given the disconnect between financial markets and fundamentals, in conjunction with an increase in risk for a secondary Covid-19 infection wave, any breakdown from current levels will offer traders an excellent buying opportunity. The downside potential is limited to its support zone located between 1,657.42 and 1,669.05.

Gold Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1,674.00

Take Profit @ 1,659.00

Stop Loss @ 1,681.00

Downside Potential: 1,500 pips

Upside Risk: 700 pips

Risk/Reward Ratio: 2.14