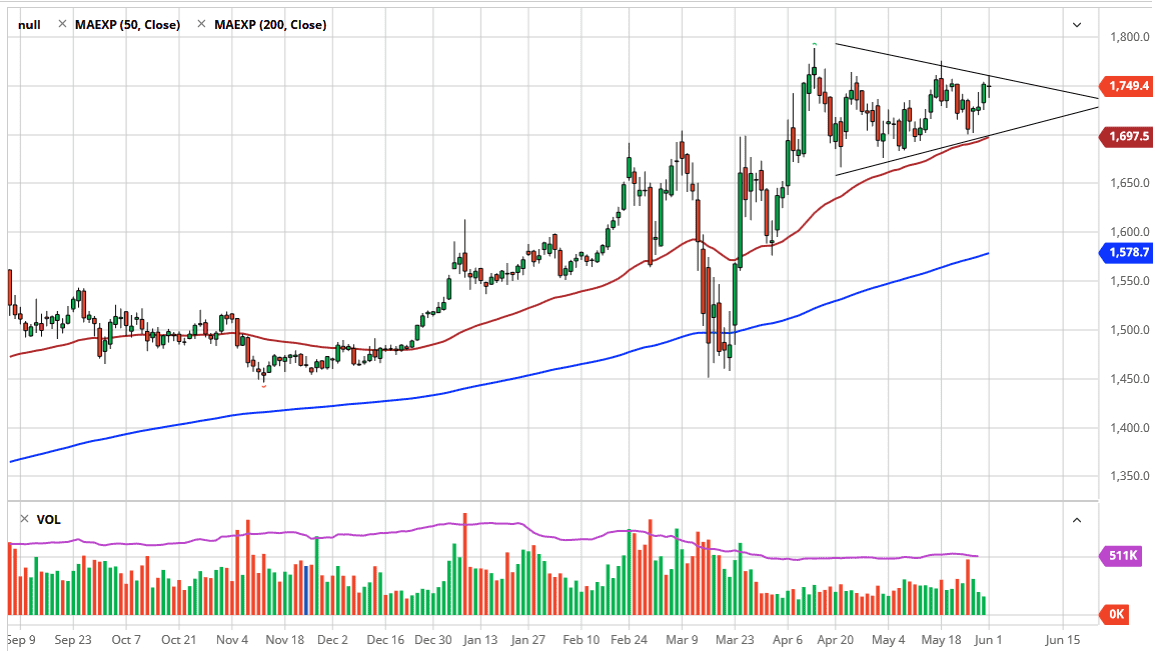

The gold markets had a very choppy trading session on Monday, as we have continued to be very noisy in this market as well as others. The $1750 level has been an area of significant resistance, so having said that it is not a huge surprise that we have stalled here yet again. I think the market will continue to bounce around in this triangle, but I do like the idea of buying and not selling. Quite frankly, I can see plenty of reasons for gold to go higher, with that in mind, I have to go with the longer term trend, which obviously is to the upside.

The uptrend line in the symmetrical triangle continues to look interesting, especially considering it is near the $1700 level, an area that is a large, round, psychologically significant figure that will attract a lot of attention. That being said, the market is likely to continue seeing buyers on dips, and therefore it is likely that the trend will continue going forward. After all, central banks around the world continue to see a lot of printing of currency, and therefore people will be looking to buy hard assets. Furthermore, the headline risks out there are extreme, so that of course could cause major issues. With that being the case, I like the idea of buying on dips and therefore even though I know that the market is likely to pull back from here, I will simply look for buying opportunity below. You can see that we have seen buyers over the last 24 hours, and I think it is only a matter of time before we see that again.

However, if we were to turn around a break above the $1760 level, then the market could continue to go higher, perhaps looking towards the psychologically and structurally important $1800 level. With that, the market is likely to see some headline risk due to the big figure and of course a lot of attention paid to buy news media and the like. If we can break above the $1800 level, then it is likely that the market goes looking towards the $2000 level which is my longer-term target. As far as selling is concerned, I do not even have a scenario in which I am willing to do now, because quite frankly not only are the printing presses running at full speed, but we also have a world of risks out there just waiting to cause issues.