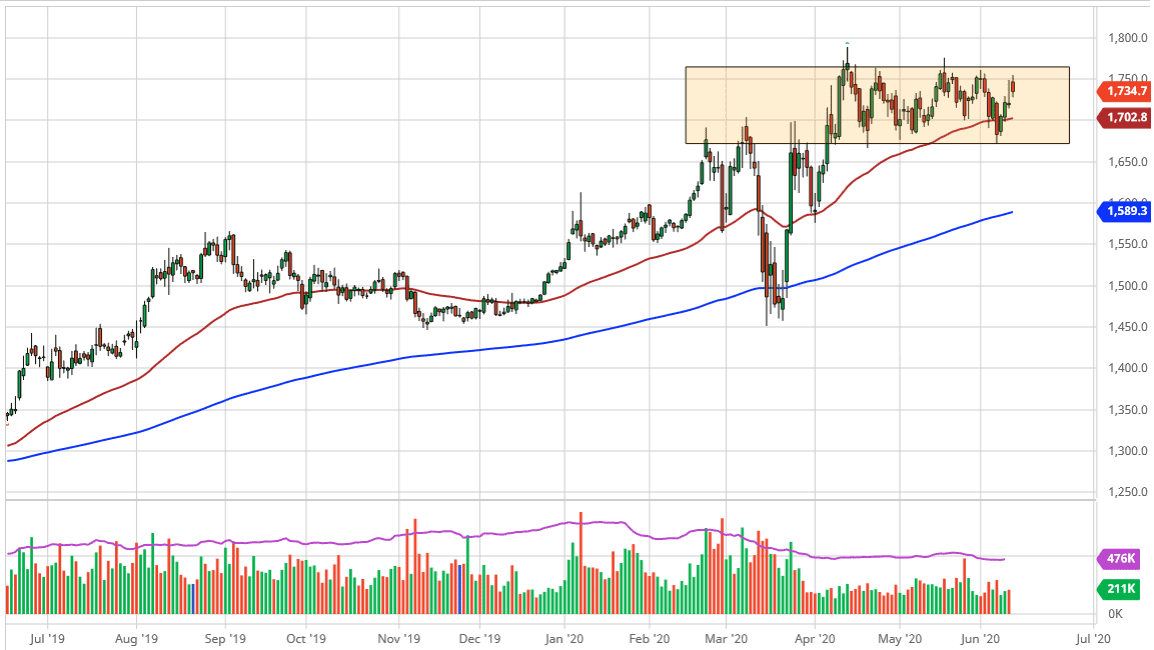

The gold markets have rallied significantly during the trading session after gapping higher, but then pulled back quite a bit. We are at the top of a larger consolidation area, with the $1750 level offering resistance yet again. Furthermore, the market has shown itself to be in consolidation for some time, so I think it makes sense that we pulled back from the level where we did, so having said that it is likely that the market will continue to respect this. That being said, I think that if we pull back towards the $1700 level, then you start looking for buying opportunities.

At this point, the market is simply carving out this range trying to figure out where were going next, and quite often this is a sign at the top of the market where we are simply trying to digest gains. The consolidation will typically lead to continuation, so at least that is what we are thinking. Ultimately, I think that the market will break out to the upside, but we need to get a daily close above the $1775 level. At that point, the market is likely to go looking towards the $1800 level, possibly even the $2000 level. Ultimately, I like buying dips and I have no interest in trying to sell gold because it is hard to imagine a scenario where we suddenly have the “risk on” trade again. Most of the downward pressure that we have seen was more or less done to the US dollar gaining overall. After all, keep in mind that the commodity is priced in those US dollars, at least in this futures market, so that obviously has an influence.

To the downside, even if we were to break down below there it is likely that the $1600 level would be an area where you would see a lot of interest, because it is a large, round, psychologically significant figure, and it is an area where the 200 day EMA is sitting so at this point I suspect that the buyers are certainly waiting at that area as well. All things being equal, I remain very bullish of gold because there are a whole fistful of reasons why we should continue to go higher, not the least of which will be the fear trade and the trade against the central banks and their liquidity measures, as people try to find hard assets that hold their value when currency falls.