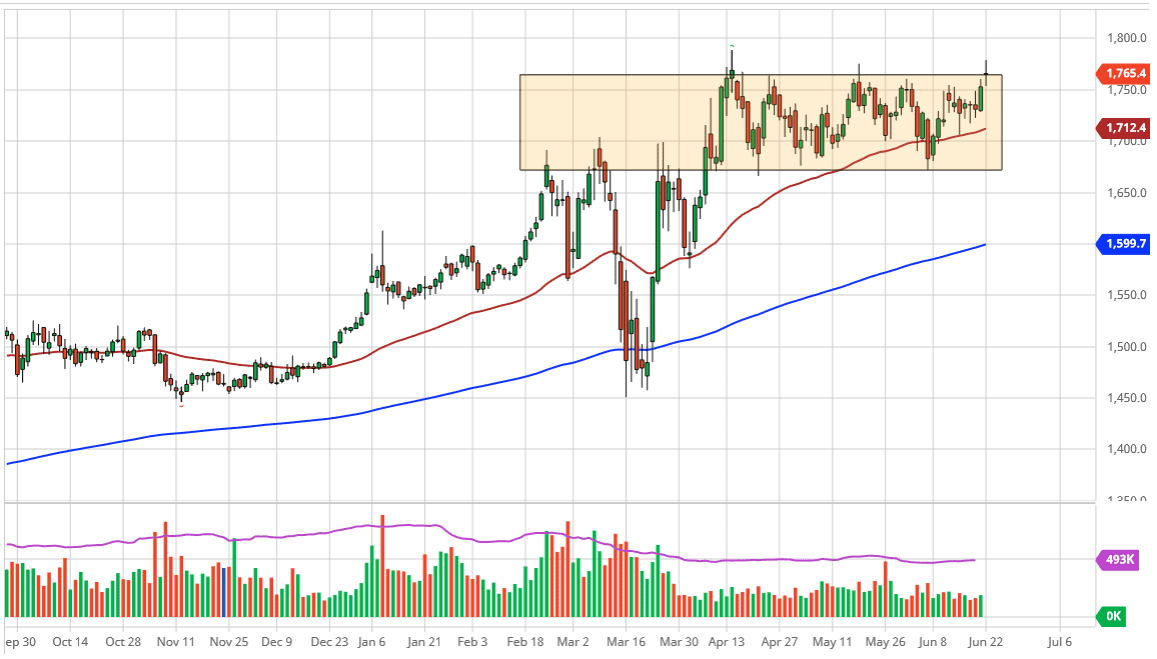

Gold markets gapped higher to kick off the week, then pulled back to fill the gap and then rallied again before pulling back yet again. Ultimately, the gold markets are trying to chew through a major resistance barrier, but I do think it is only a matter of time before we reach to the upside, looking towards the $1800 level. Because of that, the market is likely to see the $1800 level as a gateway to much higher pricing, and you can take a look at the rectangle that we have been trading in as a measuring stick for the potential move further. Based upon the measurement, we are going to go to at least $1850 level.

To the downside, I see a lot of support at the $1750 level as well, as it was an area that had been devious resistance. Furthermore, even if we pull back to their think there is plenty of support done at the 50 day EMA which is currently sitting at the $1712 handle. After that, the $1700 level offers support that extends down to the $1675 level. In other words, I like buying this market on dips due to the fact that the momentum is definitely to the upside. There are plenty of fundamental reasons to consider that gold should go higher.

Gold markets are getting a bit of a boost due to the fact that the central banks around the world are doing a ton of quantitative easing, and there are plenty of reasons out there to think that traders might need to find a little bit of safety, something that gold does provide most of the time. With that in mind, I think that gold will break out over the next several days, pushing towards $2000 over the longer term. I do not have any interest in shorting gold, because between the central banks and their actions, and the global outlook for growth, there is no reason to think that gold will suddenly selloff and a major “risk-on” type of scenario. In fact, I believe that gold will be one of the better trades for the remainder of the year and next year, as we continue to try to work out the scenario going forward.