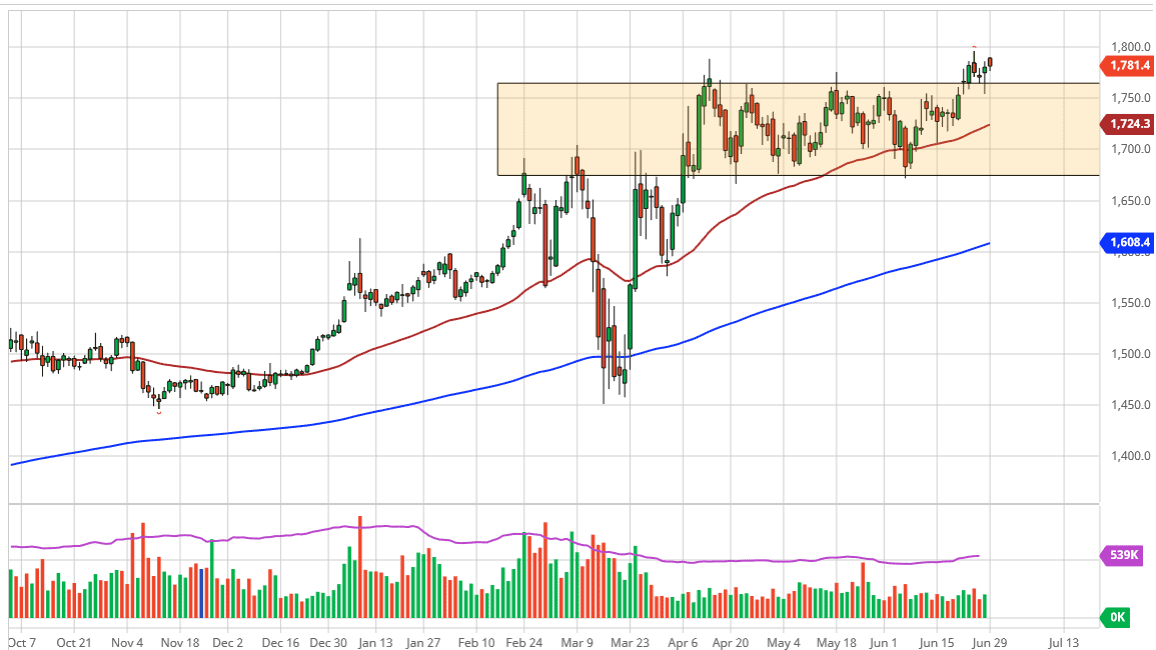

Gold markets have gapped higher to kick off the week, but then turned around to show signs of strength again as we filled the gap and essentially bounce right back. That being said, the market is likely to see plenty of support underneath, extending down to at least the $1750 level. At this point in time, the market would see a lot of interest based upon the fact that it was a previous break out. Beyond that, we have the 50 day EMA underneath at the $1725 level, and then of course you have the psychological support level in the form of $1700. I think ultimately, this is a market that will have plenty of buyers looking to find a bit of value underneath and therefore the “buy on the dips mentality” is still there.

Looking at the chart, you can see that the $1800 level still looms large as far as resistance is concerned, and therefore if we break above there it is likely that the market will take off to the upside for a significant move. At this point, the market is likely to go towards the $2000 level, a large, round, psychologically significant figure. All things being equal, I do think that happens, but it is going to take some time to get there.

Pullbacks at this point will continue to find plenty of value hunters and I think that with the massive amounts of concerns around the world when it comes to the growth scenario, the gold markets could benefit from that. Furthermore, if there are a lot of concerns when it comes to the coronavirus, then it is highly likely that we will continue to see a lot of fear out there, and fear of course is a driver of the gold markets quite a bit as well. With central banks around the world looking to liquefy markets it should not surprise people at all that gold would rise due to liquidity measures. At this point in time, it is only a matter of time before buyers step in and try to pick up value. Furthermore, I think there will be a huge rush into this market if we break above the $1800 level as it will be such a massive breakout. When you see major areas like that crushed, it is not a huge surprise that we would see a flush of new money.