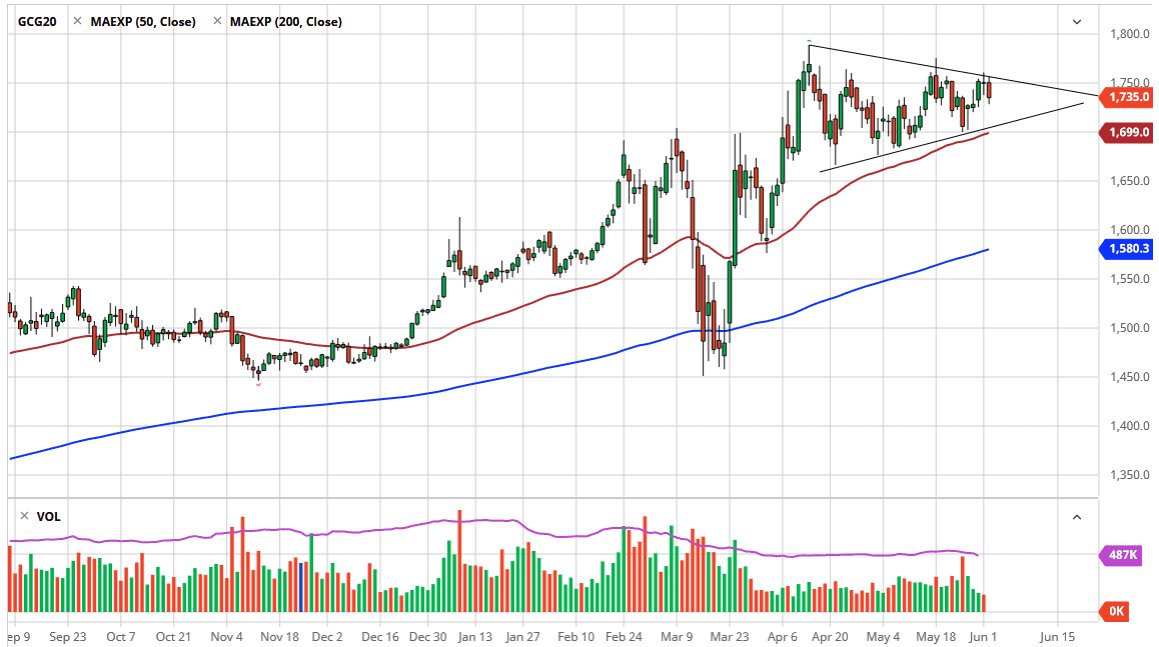

The gold markets have initially tried to break out during the trading session on Tuesday but then pulled back to reach into the middle of the triangle from a longer-term standpoint. A triangle is symmetrical, so that suggests that the market does not know where it wants to go next. However, the reality is that when you get consolidation it is normally continuation. In other words, the market should continue to go higher based upon that and of course it makes sense when you look at the overall attitude of the market, as central banks around the world continue to print money, bringing down the value of fiat currencies.

As a result, people will buy gold and silver, and other “things.” The question now is whether or not we are entering the reflation trade, or are we simply worried about headline risks out there? Both of those could work in golds favor, so I am a buyer of gold and believe that if we can break above the $1760 level, it is likely that the market continues to go towards the $1800 level. To the downside, we have an uptrend line that has helped form the massive triangle, which of course is going to attract the attention of everyone. The 50 day EMA sits at the bottom of this triangle, so I think that is another reason to think that buyers will be in the neighborhood if we get down there. Ultimately, if we break down below the 50 day EMA then it is likely that we will try to look toward support underneath, especially near the $1600 level. I think that the $1600 level should continue to be rather difficult, so breaking down below there would change the entire trend. At that point, we would be below the 200 day EMA by the time we get down there. All things being equal though, I believe that we are going to go towards the $2000 level and that is my longer-term target.

Gold has the tail end of central bank printing, and of course all of the risks out there when it comes to a geopolitical concerns, the coronavirus that has not gone anywhere, Brexit, and a whole list of other things that could come into play and cause issues. Ultimately, I like the idea of buying dips as it gives you value in a market that is obviously bullish.