Gold markets have rallied a bit during the trading session again on Thursday, as we continue to see a lot of concern around the world. With the jobs number coming out on Friday I believe that there will be a lot of interest in gold, not to mention the fact that the US dollar will be crucial as far as how it is moving. I think that the market is more than likely going to see a lot of volatility, but we are most certainly in an uptrend, so I do not want to fight that anyway.

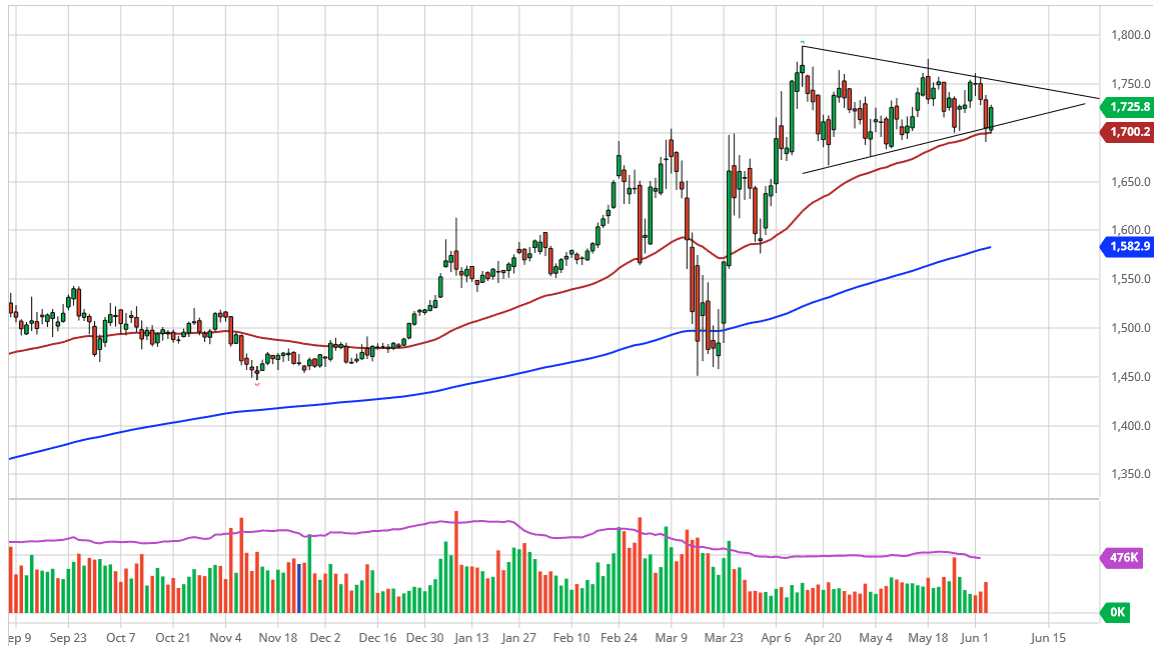

It is worth noting that the bounce occurred right at the 50 day EMA, and of course the $1700 level. This is an area that is worth paying attention to, and as you can see it continues to see the market to the upside. Ultimately, the market breaking above the top of the triangle is what I expect to see but it does not initially mean that has to happen right this moment. After all, there are a lot of headlines going back and forth around the world, so it is highly likely that we are going to see more chopping around.

The jobs number will have a crucial effect on the US dollar, and it is likely that we will see that have a crucial effect on the gold market. Longer-term though, I believe that a lot of things like the coronavirus reinfection rate, riots in the streets of the United States, US/China trade tensions increasing, and of course a concern of the global economy slowing down yet again could send plenty of traders looking for the safety of gold. The world of noise out there is likely going to be a major factor, and I just do not see how that changes.

If we break down below the bottom of the candlestick from the trading session on Wednesday, then we probably go looking towards the $1650 level, an area that I think will be supportive, but most likely than not we will probably continue to drop further from there to reach towards the $1600 level. That is an area where the 200 day EMA is starting to reach towards. The 200 day EMA of course is a trend of finding technical analysis tool, so a lot of people will pay attention to it. Longer-term, I see no reason why this market does break out of the triangle to the upside though, looking for the $1800 level and then eventually the $2000 level after that.