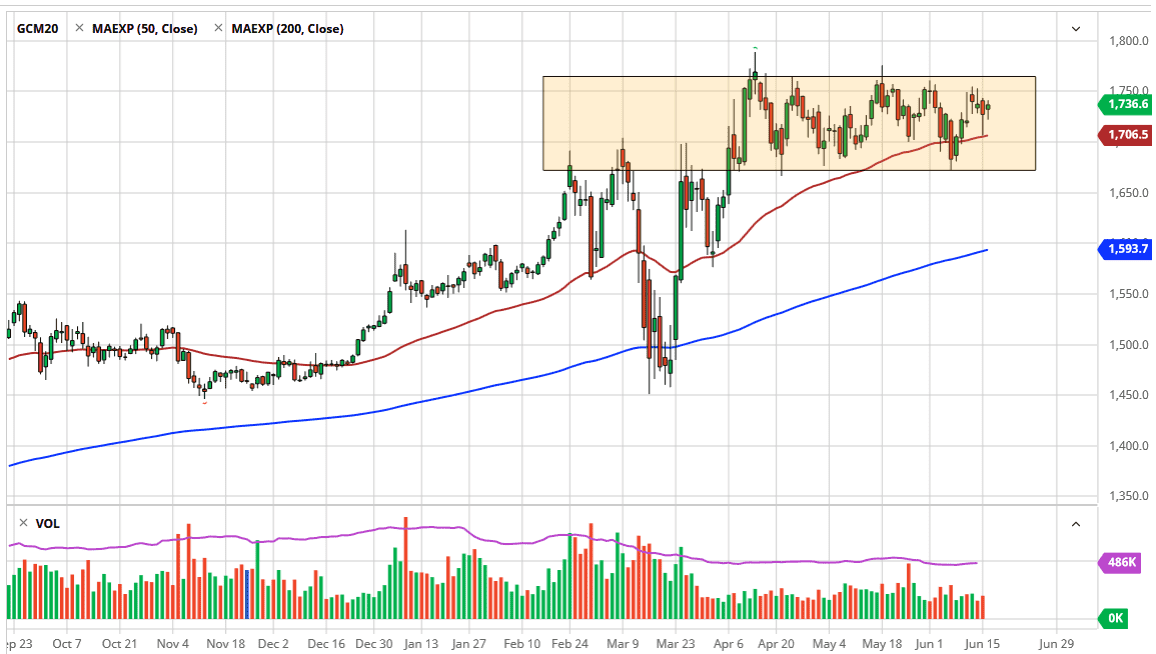

Gold markets have been choppy during the trading session on Tuesday as Jerome Powell spoke in front of Congress. This, of course, causes a lot of volatility in the US dollar which was transferred over into the gold market. At this point, it looks likely that traders will continue to look to dips as buying opportunities in gold because we have been consolidating for several months. This is a continuation pattern from what I can see, as the market has been in an uptrend before. Quite frankly, most of the time we see these rectangles they do break out to continue the overall trend, in this case, higher.

There are a lot of moving pieces right now that could come into play and it makes sense that the market would find buyers down near the $1700 level, which of course features the 50 day EMA. Down to the $1675 level, I see a lot of support so somewhere between there and $1700 might be a good value play as well. Even if we do break down below there, I think there is plenty of support for gold, and therefore I would simply be looking at the $1600 level is the next major target. That is an area where there should be plenty of support based upon the 200 day EMA and the historical action around that level.

On the other hand, if we were to break above the $1775 level on a daily close, then I think the gold market goes looking towards the $1800 level. Breaking above that level opens up a move towards the $2000 level which is a large, round, psychologically significant figure. I think if we break above the $1800 level this will be the beginning of a surge higher in the gold markets overall.

When I look at this chart, I see nothing on it that tells me I should be shorting gold, and even though I fully anticipate that the market will pull back towards the $1700 level, I feel no need to get “cute” with the trade in trying to short the market on the way back down. I am simply buying dips and selling towards the top of the range multiple times in order to pad my account. Once we do break out, then it becomes more of a “buy-and-hold” situation yet again. The US dollar strengthened during the day, but gold sat still, showing signs of real strength.