Global equity markets rallied over the past two months, driven by misplaced economic optimism of retail traders. Gold remained elevated, suggesting institutional demand for the world’s primary safe-haven assets remained stable. It also confirmed a disconnect between consumer consensus and economic reality. Earlier this week, US Federal Reserve Chairman Powell deflated optimism after confirming the central bank’s outlook of a long recovery. He pledged no interest rate increase until 2023 at the earliest, sending equity markets in the US to their worst daily loss since March. Gold was able to complete a breakout above its short-term resistance zone, converting it into support.

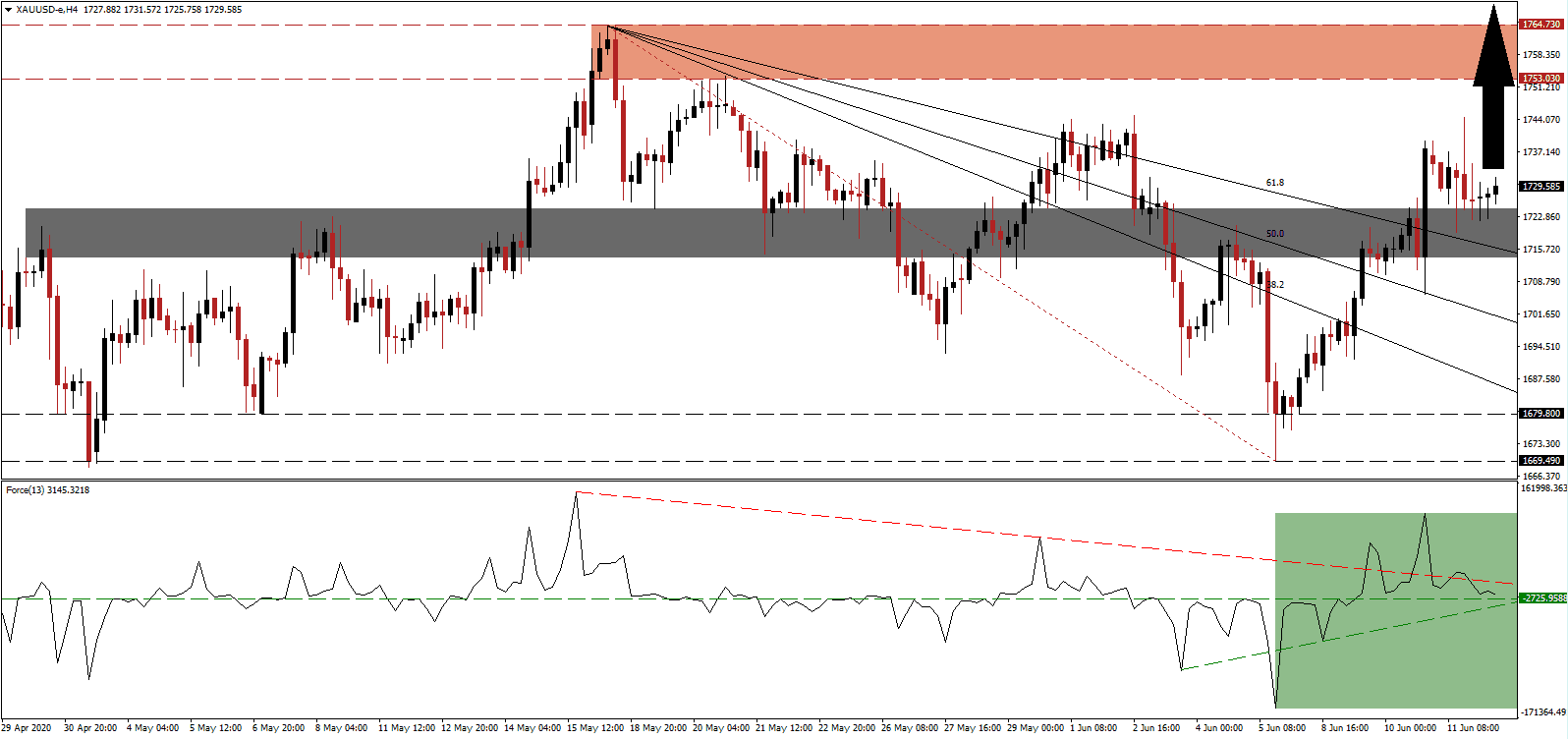

The Force Index, a next-generation technical indicator, initially spiked to a multi-week low before collapsing below its descending resistance level. It maintains its position above the horizontal support level, as marked by the green rectangle, but failure to extend higher confirms a rise in expected volatility. The ascending support level is favored to supply sufficient upside pressure for gold to resume its advance. Bulls are in complete control of price action with this technical indicator in positive territory.

According to the latest World Bank assessment, the global economy will not return to levels preceding the Covid-19 pandemic until 2022, and only if certain developments materialize. The current trend points in the opposite direction, with new infections on the rise globally after many governments eased or lifted lockdown restrictions. It adds a long-term bullish catalyst for this precious metal. Increasing upside pressures in gold was the push above the descending 61.8 Fibonacci Retracement Fan Resistance Level. It accompanied the conversion of its short-term resistance zone, located between 1,713.98 and 1,724.70, as marked by the grey rectangle, into support.

Fears over a second infection wave are intensifying with governments ruling out a complete economic lockdown. Global debt levels spiked, as stimulus and bailout packages were rapidly announced, anchored in the false hope of a swift recovery. While mitigating short-term issues, it created more massive problems down the road. Gold is well-positioned to accelerate into its resistance zone located between 1,753.03 and 1,764.73, as identified by the red rectangle. A breakout is anticipated to elevate price action into its next resistance zone between 1,795.85 and 1,814.45, resembling a new 2020 high.

Gold Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1,729.00

Take Profit @ 1,814.00

Stop Loss @ 1,704.00

Upside Potential: 8,500 pips

Downside Risk: 2,500 pips

Risk/Reward Ratio: 3.40

Should the descending resistance level pressure the Force Index farther to the downside, gold is likely to embark on a brief correction. Due to the intensifying bearish economic outlook, traders are advised to consider any sell-off as an excellent buying opportunity. The downside potential is confined to its support zone located between 1,669.49 and 1,679.80, which is pending an upward revision to reflect the rise in bullish conditions.

Gold Technical Trading Set-Up - Confined Breakdown Scenario

Short Entry @ 1,694.00

Take Profit @ 1,674.00

Stop Loss @ 1,704.00

Downside Potential: 2,000 pips

Upside Risk 1,000 pips

Risk/Reward Ratio: 2.00