After several attempts in which gold prices tried to bounce upward, it succeeded during last Friday's trading session to move higher to the $1745 resistance an ounce, the highest level in a month, amid renewed fears of financial markets and investors from the start of a second wave of the COVID-19 pandemic, as the global economy did not celebrate the reopening. We expected before that the bullish momentum will continue, if the global cases and deaths increased due to the reopening of the economies without reaching a vaccine that eliminates the disease. The yellow metal started this week’s trading upward to the $1758 resistance.

On Sunday, Spain ended the national emergency after three months of closure, allowing its 47 million people to travel freely throughout the country for the first time since March 14. Spain also removed the 14-day quarantine requirement for visitors from Britain and countries in Europe and the Schengen visa-free travel area, to boost the vital tourism sector.

In contrast, the Brazilian Ministry of Health said that the total number of cases increased by more than 50 thousand cases per day. President Jair Bolsonaro has reduced the risk of the virus infection even though his country has seen nearly 50,000 deaths in three months, the second highest death toll in the world. South Africa hit a one-day high of 4,966 new cases on Saturday and 46 deaths. Despite the increase, President Cyril Ramavusa has announced an additional easing of one of the most stringent closures in the world. Casinos, beauty salons and restaurant service will be reopened.

In the United States, the virus appeared to spread across the west and south. Arizona State reported 3109 new cases, just below Friday's number, and 26 deaths. Nevada also reported a new high of 445 cases. In Europe, there is a meat canning plant in northwestern Germany alone with 1,029 cases, so the regional government issued quarantine to all 6,500 workers, managers, and family members at the meat processing facility in Rieds-Wiedenbroek.

The government of British Prime Minister Boris Johnson will announce this week whether Britain will relax the rules for social distancing of people staying two meters (6 feet) away. Business groups are pushing to reduce this to one meter (3 feet) to facilitate the reopening of bars, restaurants and schools, but this may also lead to more infection cases. Britain has the largest number of deaths in Europe - and the third highest in the world - with more than 42,500 dead.

In Asia, China and South Korea have reported new cases of coronavirus, threatening to diminish their recovery.

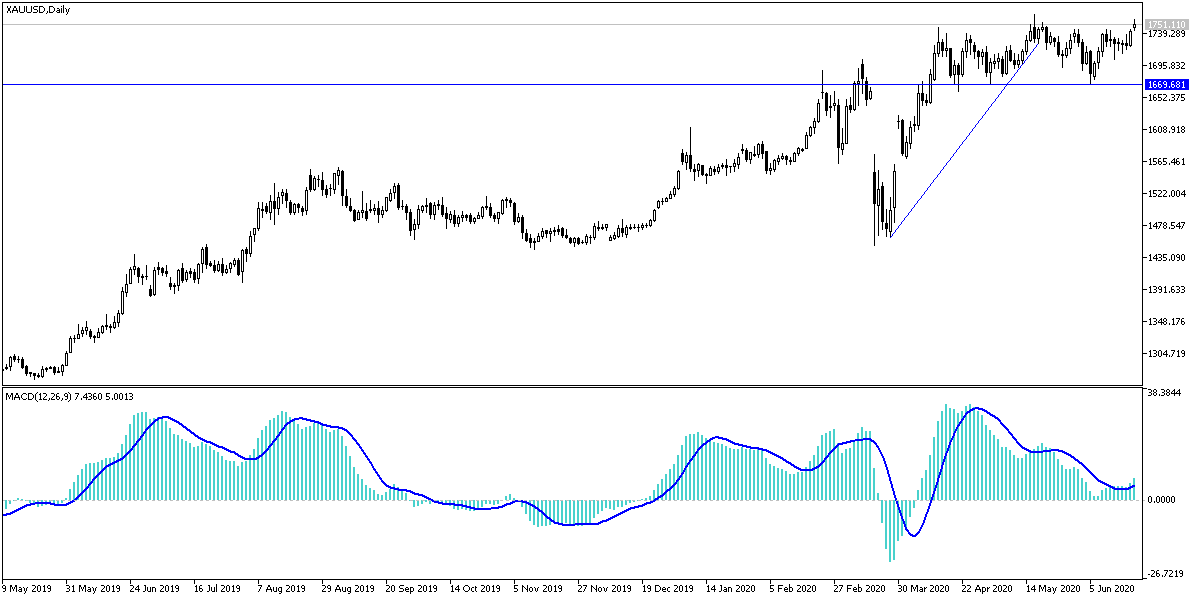

According to gold technical analysis: In the short term, the price of gold appears to be trading within a bullish wedge pattern on the 60-minute time frame chart. This indicates a short-term bullish bias in market sentiment. However, gold bulls seem to be struggling to breach the major $1,750 resistance. They will look to extend existing short-term gains towards $1753 or higher at $1764. On the other hand, bears will look for short-term profits at around $1727 or less at $1713.

On the long-term, and according to the performance on the daily chart, it seems that the price of gold has recently bounced back from the trend line support to rise towards new highs at around $1769. The price of the yellow metal is currently trading around $1742. Multi years Highs can be retested in the coming days. Accordingly, bulls will look to push the price towards $1769 or higher to $1807. On the other hand, bears will target long-term decline profits at around $1700 or less at about $1656.

The economic calendar has no important issues, so the biggest focus of the yellow metal will be on the extent of the investors' risk appetite.