For the third consecutive day, gold prices are subjected to a downward correction due profit taking sales, amid increasing investor’s risk appetite and the abandonment of safe havens. Recent losses pushed gold prices towards the $1689 support, the lowest level in a month, before settling around the $1700 level in the beginning of Thursday’s trading. Continued gains in global stock markets despite the violent unrest in the US states, along with the announcement of a less-than-expected loss of jobs in the American private sector, contributed to the abandonment of the yellow metal as a safe haven.

US stock indices rose to their highest levels since March, amid optimism about efforts to reopen the economy, and gains in the stock market came after ADP data which showed that the private sector lost 2.76 million jobs in May. This was much lower than economists’ expectations of a 8.66 million loss. In April, the private sector lost 19.56 million jobs. Small employers lost 435,000 jobs in May, medium-sized companies have cut 722,000 jobs, and large companies, with 500 or more employees, excluded 1.6 million employees. The services production sector lost 1.97 million jobs, while the manufacturing sector shed 719,000 jobs.

The US dollar faced more pressure as risk sentiment improved following the reopening of business in several countries around the world, which raised hopes for a gradual economic recovery. Positive services sector data from China and Europe, and a lower-than-expected drop in private sector employment in the United States, helped ease concerns slightly.

ISM said its non-manufacturing index - for services - rebounded to a reading of 45.4 in May after falling to an eleven-year low of 41.8 in April. A report by the Ministry of Commerce showed another decline in factory orders in April. Where the report stated that the new orders fell by - 13% in the month after falling by - 11% revised in March. Economists had expected factory orders to drop by -14%, compared to the -10.3% decrease announced in the previous month. The decline in factory orders due to the sharp decline in durable goods orders by - 17.7%.

Accordingly, the US dollar index DXY fell to its lowest level in 3 months to 97.29 earlier in the session, and subsequently rose to the level of 97.29, but it is still significantly lower than its previous closing at 97.67.

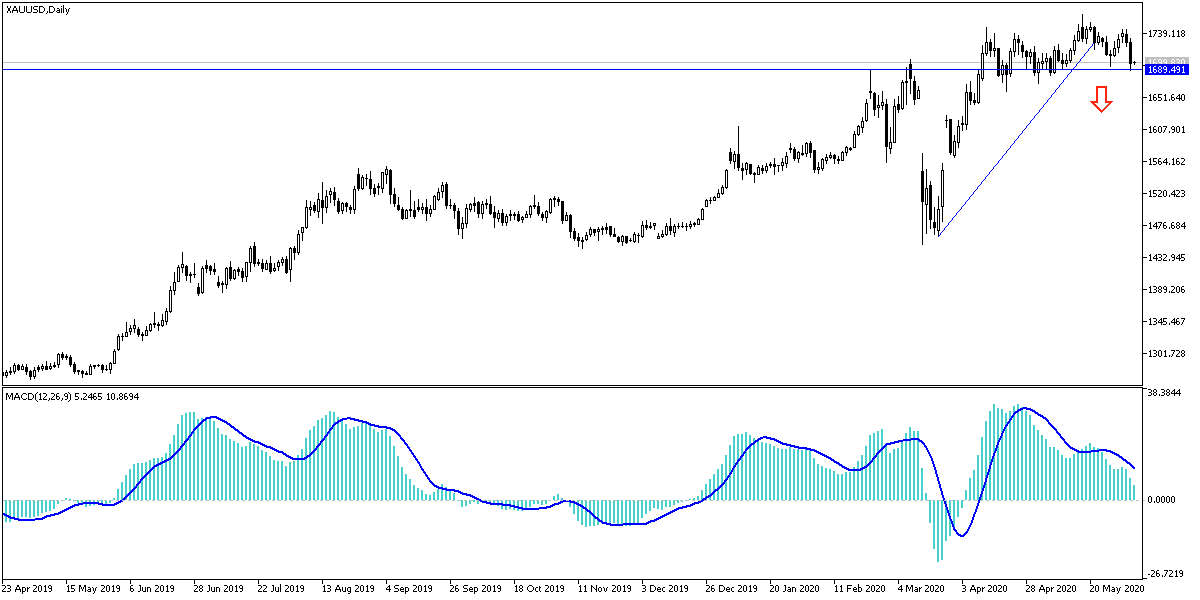

According to gold technical analysis: the last chance for the bulls to control gold performance is the $1700 resistance, as I mentioned in the recent technical analyzes. In terms of the recent downward movement, bears may gain more control if the price of gold moves towards support levels 1685 and 1660 dollars an ounce, and at the same time, these may be good buying levels, as the deadly Corona epidemic will remain a catalyst for markets not to continue to accept the risk. The gold price will react today with the European Central Bank's announcement of its monetary policy, Lagarde statements and the results of the US economic data.