With the beginning of this week’s trading, gold prices rose to achieve sharp gains that pushed it to the resistance at $1763 an ounce, the highest level since mid-April, with the rise of new COVID-19 cases. The yellow metal settled around the $1754 dollars an ounce in the beginning of Tuesday’s trading. Escaping the risk, with renewed fears of increasing global infection numbers, increased demand for the metal as a safe haven.

The World Health Organization announced the largest one-day increase in cases of COVID-19 on Sunday, with more than 183,000 new cases reported, most of which are from the Americas; On Monday, South Korea announced the re-emergence of the deadly virus through a "second wave." Analysts believe that the weak dollar also contributed to the rise in gold prices. A weaker dollar could make US currency denominated assets more attractive to buyers using other monetary units.

Last week, the Bank of England became the last central bank to expand quantitative easing plans, while the Bank of Japan was uniquely pessimistic, echoing the morale of other major central banks, including the European Central Bank and the Federal Reserve, and as expected, with interest rates likely to remain low for the longer term. Thanks to central bank stimulus, and concerns about a second wave of Covid-19, the outlook for gold as a safe haven appears positive.

Among the most recent economic data, the Chicago Federal National Activity Index showed a rise to a reading of 2.61 in May from a revised rate of 17.89 in April. Existing home sales data for May revealed a 9.7% decrease in May to a seasonally adjusted annual pace of 3.91 million homes, and this was the third consecutive monthly decline in sales, which is a further evidence of damage caused by the pandemic to the housing market.

The National Association of Realtors said on Monday that the monthly decline pushed sales to a seasonally adjusted annual rate of 3.91 million, the slowest pace since the tax credit for homebuyers ended in October 2010. Sales have fallen across all regions of the country, with the largest drop witnessed in the northeast, where the virus infection was especially severe. Existing and new home sales fell sharply during the traditional spring sale season as communities closed to prevent the spread of Coronavirus.

In a research note dated Friday, Goldman Sachs raised its 12-month forecast for gold by 11% to $2,000 an ounce, citing lower real interest rates and concerns about the currency's decline.

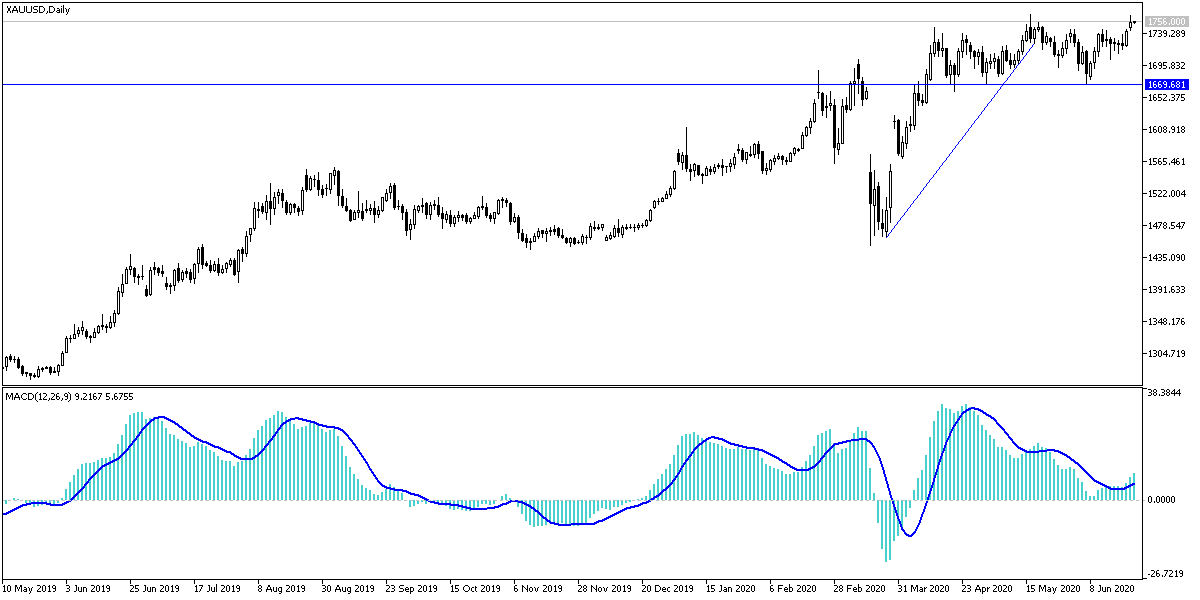

According to the technical analysis of gold: The general trend gold price is getting more upward momentum, which closest to testing its highest levels in more than seven years if it breaks above the mid-May top around the resistance at $1768 dollars an ounce. Penetrating that top may increase the momentum to move the price to the next psychological resistance at $1,800 an ounce. However, it should be beared in mind that the technical indicators have reached strong overbought areas, and calming market fears may push gold prices to correct by profit-taking sales, so the closest support levels then might be at 1748, 1735 and 1720, respectively.

In addition to the extent of investors’ risk appetite, gold prices will interact with the announcement of the services Industrial Purchasing Managers Index from the Eurozone, Britain and the United States of America.