The price of gold almost didn’t move at all at the beginning of this week’s trading, as the movement during yesterday's session ranged between $1775 an ounce and $1765. It settled around the $1772 level at the beginning of Tuesday’s trading, ahead of an important testimony of US Federal Reserve Governor Jerome Powell. The lack of an economic calendar of important announcements yesterday was a factor in this limited move. The US job numbers, which will be announced on Thursday instead of Friday, along with the daily numbers of new Covid-19 cases, will be the most exciting for markets. The yellow metal ignored the USD strength, as they usually moves in an inverse relation, and continues its gains that are closer to highest levels in eight years.

Markets are watching for the strength of the second Covid-19 wave, the most powerful factor affecting markets, and the main support for the recent gold gains. The US numbers are important, as the United States continues to lead the world in numbers of deaths and infections. For the fifth consecutive day, the American death toll has decreased, however, the infection continues to rise in 30 states. And with 40,691 new infections reported in the past 24 hours, the total number of infections in the United States has increased to 254,069, according to the latest Johns Hopkins University update on Monday. The number of new cases reached an all-time high of 44,726 on Friday.

An additional 250 deaths were reported in the past 24 hours, bringing the total death toll to 125,803 in the United States, and this was the lowest daily number of casualties in the United States in 94 days. New York, once an epicenter of coronavirus, registered the lowest level of mortality at 5 since March 15.

Below is the latest data on cases and deaths from the most affected states by the epidemic.

New York (31,397 deaths, 392539 infections), New Jersey (14975 deaths, 171182 infections), Michigan (6,157 deaths, 69946 infections), Massachusetts (8059 deaths, 108,667 infections), Louisiana (3199 deaths, 56,236 infections) , Illinois (6,888 deaths, 141723 infections), Pennsylvania (6,606 deaths, 89,863 infections), California (5932 deaths, 215,296 infections), Connecticut (4,316 deaths, 46,303 infections), Texas (2,402 deaths, 150,152 infections), Georgia (2778 deaths, 77210 infections), Virginia (1732 deaths, 61736 infections), Maryland (3168 deaths, 66777 infections), Florida (3419 deaths, 141723 infections), Indiana (2619 deaths, 44930 infections), Ohio (2,807 deaths, 50,309 infections), Colorado (1676 deaths, 32,290 infections), Minnesota (1,460 deaths, 35,549 infections), Arizona (1594 deaths, 73920 infections) and Washington (1,310 deaths, 31,752 infections).

With the figures being monitored, two senior public health experts said the increase in COVID-19 cases may appear to last for weeks. Therefore, Tom Frieden, former director of the Centers for Disease Control, stated on "Fox News Sunday": "The virus has the upper hand. This virus will not go away on its own. We have to stop it.” Scott Gottlieb, the former head of the US Food and Drug Administration, said the European Union's move to block entry of US citizens to the bloc would be followed by travel restrictions in the United States.

As cases rise in 30 states, Texas Governor Greg Abbott warned that the spread of the visrus has taken a "very quick and dangerous turn" in the state. He pointed out that "during the past few weeks, the daily number of cases increased from about 2000 cases to more than 5 thousand cases."

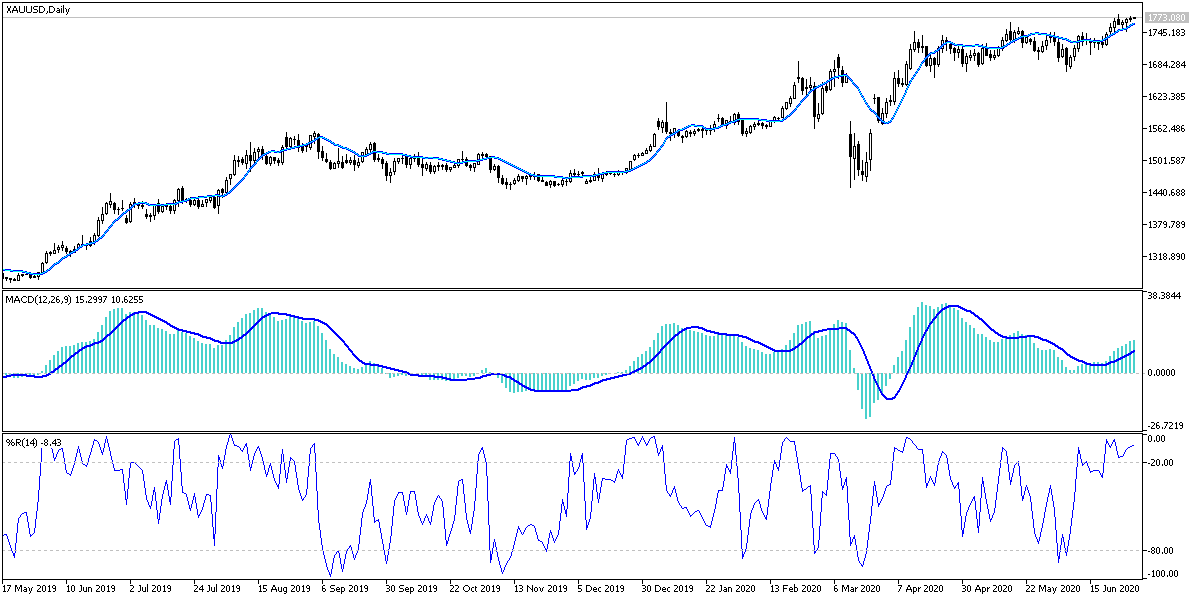

According to the technical analysis of gold: Stability of gold price above the $1775 resistance will remain supportive to the next stronger move towards $1,800 psychological resistance. At the same time, from now on, the technical indicators are still giving strong signals for strong overbought areas there can be sell-offs to collect profits at any time. Especially if investors’ risk appetite return, and the end of the second coronavirus outbreak wave was announced. The closest support levels for gold are now 1762, 1750 and 1738, respectively.

Gold price will react today with the testimony of Federal Reserve Governor Jerome Powell and the US Treasury Secretary before the US Parliament to clarify emergency stimulus plans to cope with the pandemic.