Gold prices rose to offset the losses of the previous two sessions, as geopolitical tensions and Fed Chairman Jerome Powell's makes cautious statements about the economic recovery. The increased demand for the yellow metal was launched towards $1733 an ounce before settling around $1725 at the time of writing. Gold held onto gains despite strong equity markets and a steady dollar. The dollar index, DXY, rose to 97.25 before falling back to 96.98 later. July silver futures rose $0.250 or 1.5% to $17,652 an ounce, while copper futures for July fell slightly to $2.5645 a pound.

In a testimony before the Senate Banking Committee, Powell warned of "the great uncertainty about the timing and strength of the economic recovery." Powell pointed out that some recent indicators indicated stability and even a modest recovery in economic activity after the contraction caused by the coronavirus.

He specifically mentioned the latest jobs report issued by the Ministry of Labor, which showed that jobs unexpectedly jumped by 2.5 million jobs in May. The Fed Chairman attributed the sudden growth of US jobs to the reopening of some businesses amid easing restrictions on movement and trade. The extension of federal loans and grants, also helped due to stimulus checks and unemployment benefits that support household incomes and spending.

Powell, however, noted that production and employment levels are still much lower than pre-epidemic levels and cautioned against continued uncertainty about economic outlook.

"A lot of economic uncertainty comes from uncertainty about the course of the disease and the effects of its containment measures," Powell said. “Until the public trusts that the disease is contained, a full recovery is unlikely.” He added.

As for other economic data, the US Commerce Department reported that retail sales increased by 17.7% in May after falling - 14.7% in April. Economists had expected retail sales to rise 8% compared to a decrease - 16.4% announced in the previous month. With the exception of a major rebound in car sales, retail sales still rose 12.4% in May after falling - 15.2% in April. Previous car sales were expected to jump 5.5%.

According to a report from the Federal Reserve, industrial production jumped 1.4% in May, after falling - 12.5% in April. Economists had expected industrial production to rise by 2.9% compared to a decrease - 11.2% which was announced in the previous month.

The National Association of Home Builders released a report showing a continued rebound in confidence for American home builders in June. The report stated that the NAHB/Wells Fargo index of the housing market rose to a reading of 58 in June from 37 in May, and continued to rebound from the lowest level in nearly eight years reached on April 30. Economists had expected the index to rise to a reading of 45.

A report released by the US Commerce Department showed business inventories fell - 1.3% in April after a revised 0.3% decline in March. Business inventories were expected to decrease by 0.8% compared to the -0.2% decrease announced in the previous month.

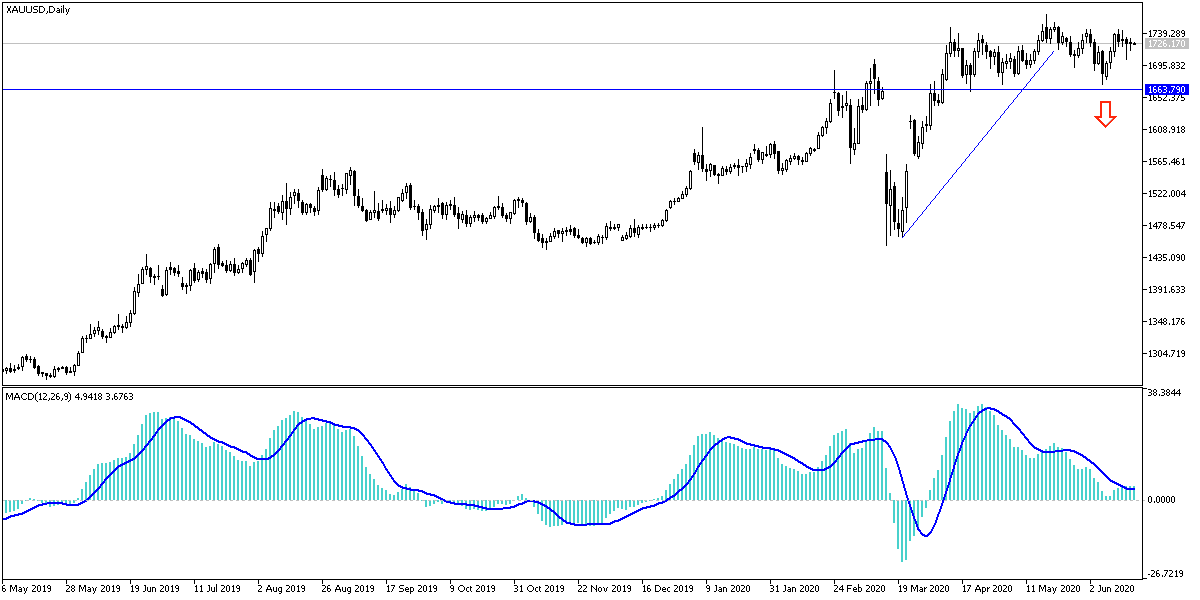

According to gold technical analysis: There is no change in my technical view of the gold price, as it is the closest to the continued rise as long as it is stable above the $1700 psychological resistance. Increased global trade and geopolitical tensions will motivate investors to buy gold as a safe haven. The closest purchase levels are now 1715, 1703 and 1685, respectively. Bulls will get the momentum needed to complete the upward trend towards 1742, 1755 and 1770 resistance levels, respectively.

Gold price will react today to the announcement of inflation figures in Britain, the Eurozone and Canada, and will the content of the second testimony of US Central Bank Governor Jerome Powell.