Strong weakness of the US dollar and fears of a second wave of the Coronavirus outbreak was enough to push the price of an ounce of gold towards the $1774 resistance, its highest for nearly eight years, where it is stable at the time of writing. Adding to the yellow metal gains were low interest rates and tension between the United States and China, commenting on this, Jeff Wright, Executive Vice President of GoldMining Inc, said that conflicting statements about the state of the US-China trade deal from White House trade adviser Peter Navarro, in addition to the increasing tensions between the two countries, led to the purchase of more safe haven assets, represented in gold. Navarro, White House trade adviser, told Fox News in an interview on Monday that the trade agreement with China signed in January has been terminated. Then he came back and later said that his comments were “taken randomly” out of context, and that the Phase 1 agreement was still in effect. President Donald Trump also tweeted that the agreement was sound and confirmed its continuity.

In the same trend as gold, the silver ounce rose to $18.063 an ounce.

On the economic level. IHS Markit announced that the US services sector PMI rose to a 4-month high of 46.7 in June from 37.5 in the previous month. The Manufacturing PMI rose to a 4-month high of 49.6 from 39.8 in May. Despite the improvement, readings remain slightly below the 50 level, indicating deteriorating conditions.

Gold price rose despite US PMI readings, which showed "a strong recovery, which supports the idea that US monetary policy officials need to keep stimulus in place." The yellow metal gains came despite the recovery of global stocks amid a gradual resumption of business activity and the abandonment of some provisions of the closure policy to contain the Coronavirus epidemic, but investors expressed concern that the rebound of high-risk assets had come too quickly, as cautious investors viewed gold As a hedge against the return of the stocks upward.

In general, monetary stimulus from global central banks, including the Federal Reserve Bank, and extremely low or negative interest rates that are expected to be approved in the future, have helped to increase the attractiveness of gold.

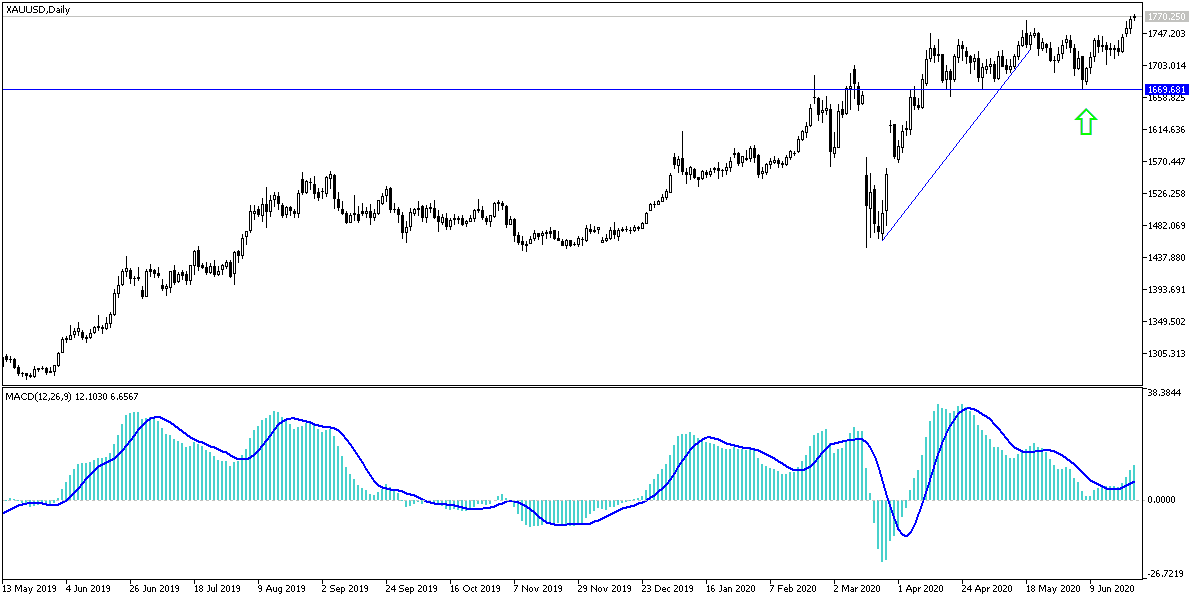

According to gold technical analysis today: the bullish trend in the price of gold has increased in strength, and technical indicators have reached very strong overbought areas and the market is waiting for profit-taking sell-offs at any time, therefore I still prefer to sell gold, and resistance levels at 1772, 1785 and 1810 may be best suited to harvest the correction gains. As I mentioned before, there will be no shift in the general trend downwards without moving below the $1700 level. This could happen with the announcement of a vaccine that would eliminate the Covid-19 epidemic and the global economy starting to emerge from the current historical recession swamp.

As for the economic calendar data today: After the announcement of the monetary policy of the New Zealand Central Bank, the markets are only expecting the announcement of the the IFO reading for the German business climate.