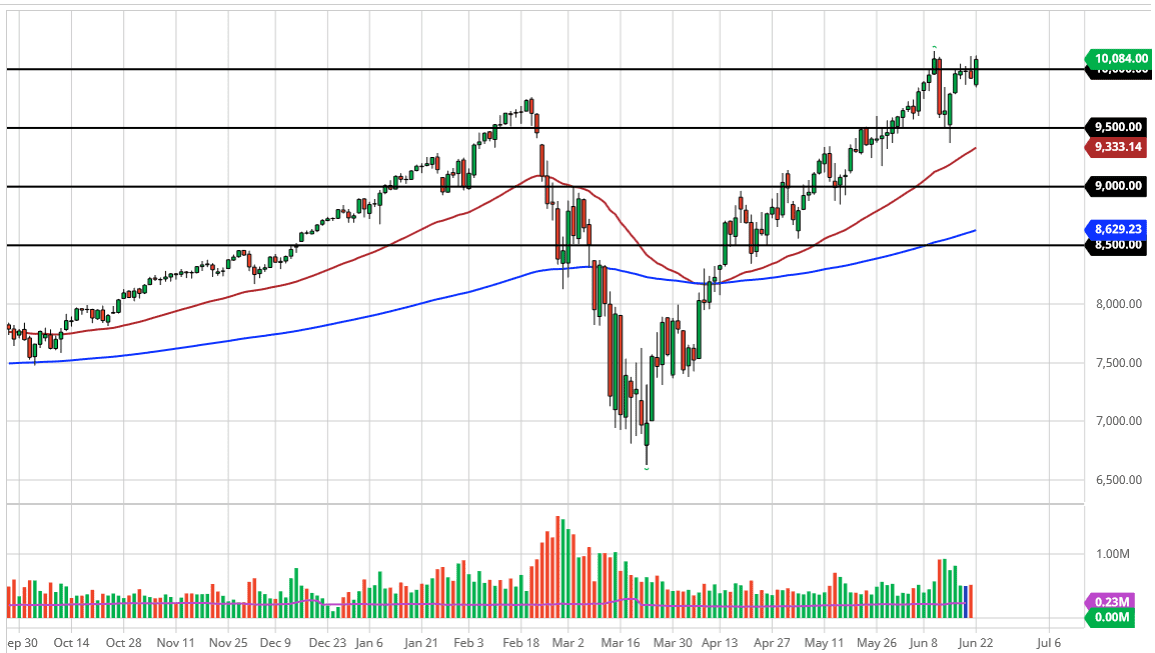

The NASDAQ 100 rallied a bit during the trading session on Monday, as we are broken back above the 10,000 level. At this point, the market looks like it refuses to accept any type of economic reality, because the NASDAQ 100 is comprised of all of the “go to” names on Wall Street. Netflix, Amazon, Alphabet, Microsoft, and Facebook. Those stocks right there are essentially 33% or so of the index. This is the same stock that everybody buys day in and day out, so that is why this index tends to rally rather significantly. It outperforms the S&P 500 and the Dow Jones Industrial Average for those reasons as well, because without the most heavily weighted stocks in the NASDAQ 100, the returns would be quite a bit different. The same thing can be said about the other indices as well, so at this point the NASDAQ 100 is an index that I simply do not short.

If you were to tell me that the stock markets were to fall apart tomorrow, then I would be looking for shorting opportunities in the S&P 500 to take advantage of, or perhaps even the Down Jones Industrial Average, although those indices are not equal weighted either.

With that in mind, if you do see this market breaking down then it is typically a signal to start selling the other indexes. If we break out to a fresh, new high, then you could be a buyer the NASDAQ 100 as it should send this market looking towards the 11,000 level, but you can also use it as a signal to start buying some of the other indices as they will eventually typically play “catch up.” Ultimately, this is a market that is desperately trying to break out to the upside, so I am not going to find it, and I will simply buy it if we break out. If we pull back towards the 9900 level, on a supportive type of bounce on short-term charts, might be willing to buy there as well. I think it is only a matter of time before market participants continue to push towards the same stocks that they always do. Having said that, if we were to break down below the 50 day EMA that would be an extremely negative sign, but I do not see that happening in the short term.