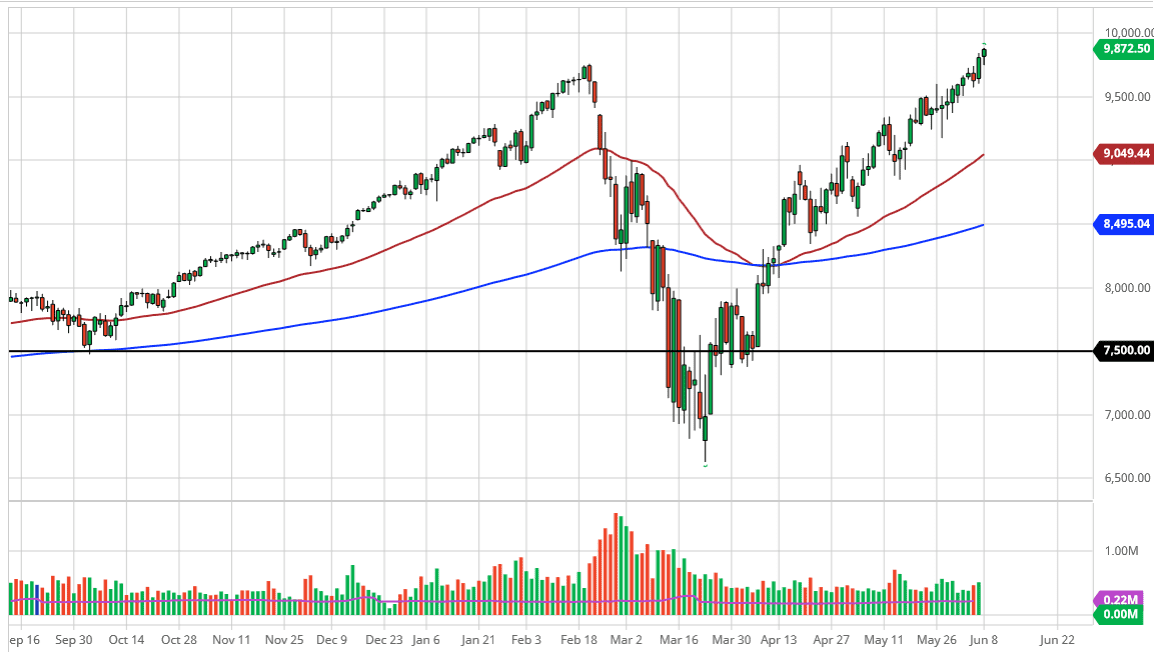

The NASDAQ 100 initially pulled back a bit during the trading session on Monday but then found buyers again as it looks like we are set on reaching towards the 10,000 level. That should not be a surprise, because the market has been parabolic for some time, and the 10,000 level is simply far too enticing for traders to ignore. As the market closed just below the 9900 level, it is important to keep in mind that there could be a little bit of a pullback, but I think there will be plenty of “FOMO traders” out there buying every dip that happens.

At this point, I believe that the short-term “floor” is closer to the 9500 level, and that is an area that should be paid attention to. Ultimately, I think this is a market that will continue to lift mainly due to the fact that there is only a handful of stocks that control almost 40% of this index. Those are all the stocks that everybody buys on a daily basis, including the Robin Hood traders. Retail money is plowing into all of the names that everybody knows, and this tends to end poorly. In the meantime, it is obvious that we are going to go higher, perhaps based upon cheap money from the Fed yet again.

If we were to break above the 10,000 level, it is likely that we go much higher, as it will be more of a “blow-off top.” I do think that we need a significant pullback. When you think about what is going on around the world, it is a bit absurd that we are here, yet here we are. Because of this, you have to “embrace the stupidity”, at least until the realization of the world in which we are in hits the market. You simply have to “hold your nose and buy.” That does not mean that you need to buy at the absolute highs though, as we will more than likely get short-term pullbacks. It will be interesting to see what happens at the 10,000 level, because I think a lot of profit-taking will be had there. That is typical for large, round, psychologically significant numbers, but clearly you cannot be selling in this market anytime soon. If the attitude of the market changes, it will be sudden, and it will be violent. Right now, there is no head of that.