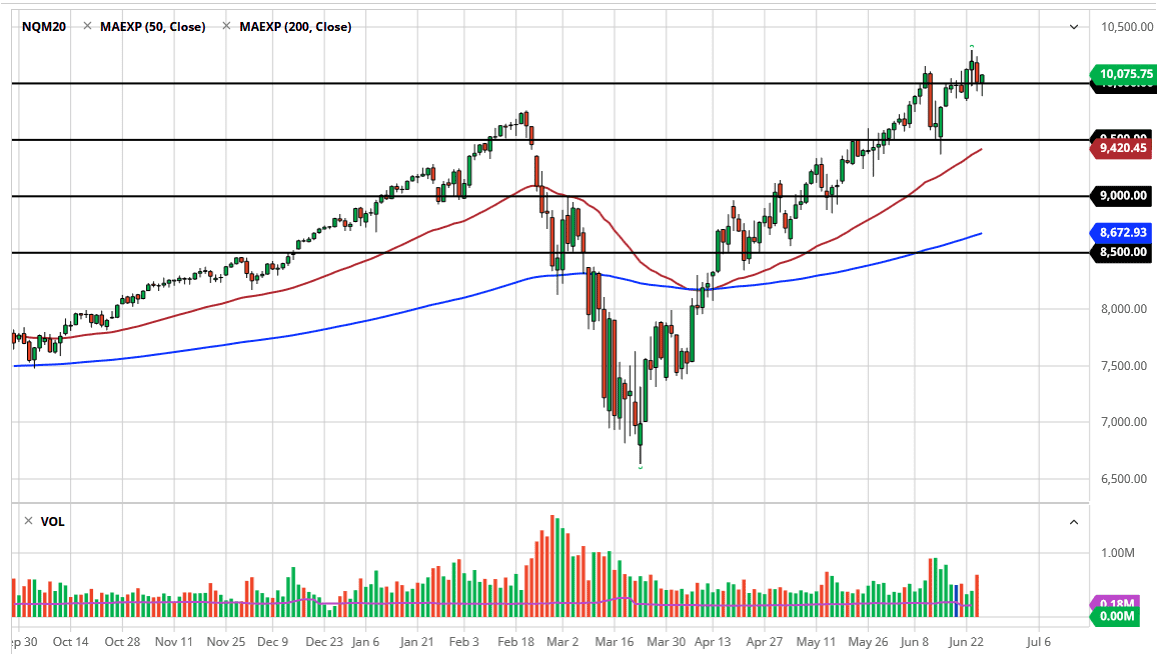

The NASDAQ 100 initially fell during the trading session on Thursday during the Globex session but found plenty of support near the 9900 level to turn around and rally. We ended up forming a hammer that sits around the 10,000 level, and therefore it is likely that we will continue to see buyers jump in. In fact, you can almost make the argument that traders have tested the 10,000 range for support and found it by the end of the day. Quite frankly, the stock market look rather rough at the end of the Wednesday session, so the fact that we are recovered quite nicely tells me that there is still a lot of demand for this index.

Looking at the index, you should keep in mind that it is highly overweight in factoring its value based upon Amazon, Alphabet, Microsoft, Facebook, and Netflix. After that you are talking about companies like Tesla and Intel. By the time you get down to those companies, you are already figuring roughly 45% of the index. In other words, those are all stocks that everybody on Wall Street loves, so the NASDAQ 100 does not tend to pullback for any significant amount of time.

If we were to break down below the bottom of the candlestick, that would be a bit negative, and it could open up a move down to the 9500 level. The 9500 level is a major support level that is now being approached by the 50 day EMA, so by the time we get down there, plenty of support and buyer should jump into this market and it will be a major buying opportunity. At this point, the market is likely to see a lot of volatility, but I think we are getting used to the idea of being above the 10,000 level, and therefore I think that the market goes looking towards the 10,250 level, and then eventually the 10,500 level. Longer-term, I think we go much higher due to the fact that the Federal Reserve cannot stop loosening monetary policy as Wall Street punishes it every time it tries to. At this point in time, buying the dip has worked for ages, and unless we have some type of major event, it is likely that the market will continue to show the same type of action.