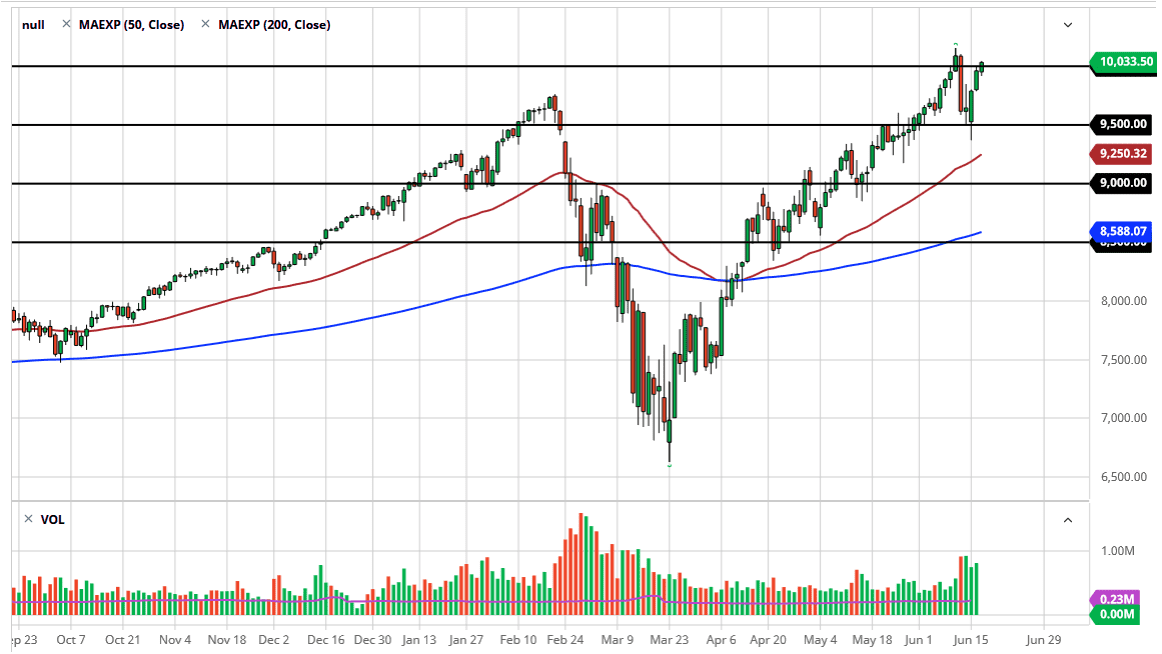

The NASDAQ 100 has rallied again during the trading session on Wednesday, breaking above the 10,000 level during the day. Ultimately, it looks as if we are ready to break out to a fresh, new high, and send the NASDAQ 100 much higher. This makes sense, because it is driven by just a handful of stocks that everybody knows and loves, including Facebook, Google, Apple, Tesla, and Amazon. That is the entire market over the last several months, so course the NASDAQ 100 is going to outperform almost everything else.

We have been in an uptrend for some time and the fact that we reached down towards the 50 day EMA suggests previously that we had found plenty of buyers. The 9500 level course was supportive and now we have shot straight up in the air from there. Ultimately, I think that we are starting to run out of a little bit of momentum, but pullbacks will be looked at as value as a lot of people have lost on the opportunity to get involved again. Ultimately, the NASDAQ 100 continues to see plenty of buyers jump in and so therefore it is difficult to imagine shorting it. In fact, stock indices are not built to be shorted, and are structured in a way that they almost always go higher over the longer term. With that type of attitude in mind, you are simply looking for value from time to time.

If we break above the all-time highs, then it is likely we go looking towards the 11,000 level, perhaps even higher than that. The downside sees the 9500 level as a hard floor, but even below there we have the 9250 level where the 50 day EMA is and plenty of buyers in that region I would anticipate. Remember, the Federal Reserve is looking to support Wall Street anyway it can, so it is difficult to imagine that this market falls anytime soon. The volatility has been extraordinarily strong around the markets, and of course the NASDAQ 100 will not be any different. That being said, I still think this is a “one-way trade”, as the buyers continue to overwhelm every opportunity that they get. I have no scenario in which a willing to sell this market right now, because it has divorced itself from economic reality anyway, so at this point everybody is on the same side.