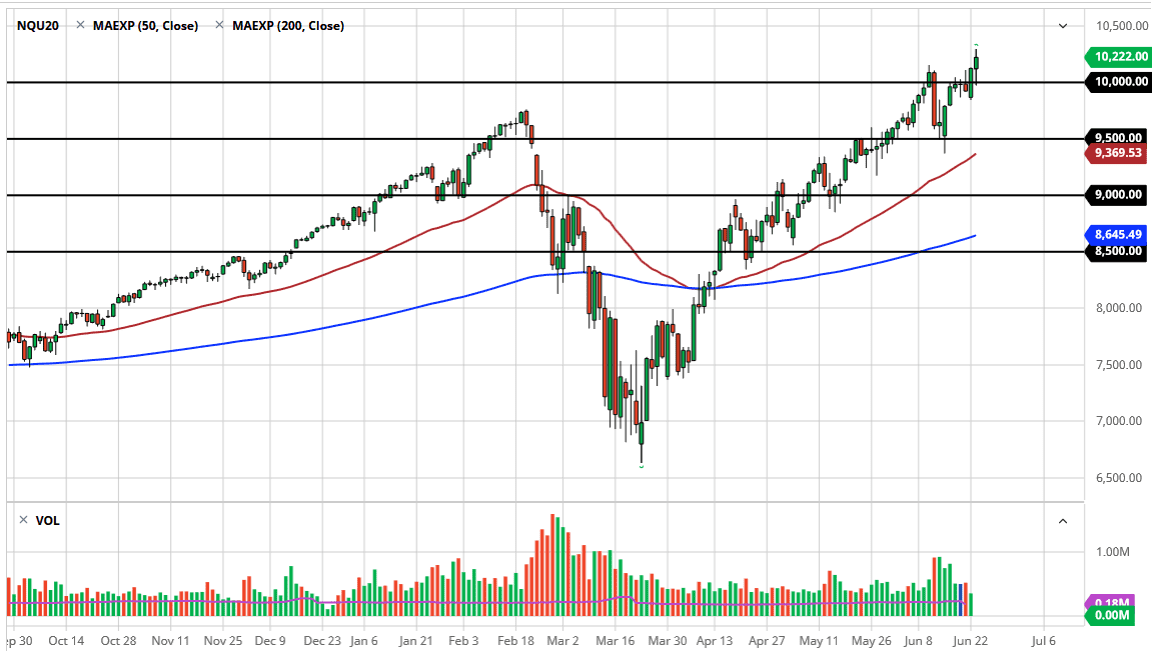

The NASDAQ 100 has had an interesting day, pulling back during the early hours to reach towards the 10,000 level before finding buyers yet again. At this point, the market is likely to continue to go much higher, as we have broken to a fresh, new high. The NASDAQ 100 is comprised of a handful of stocks that lead the way. All things being equal, there is only about five or six stocks that you need to pay attention to. These are all the usual technology companies like Netflix, Amazon, Alphabet, Facebook, and Microsoft. Those are the ones that make all of the difference, and nobody cares about the other companies. If those go up, so is this index. I think that short-term pullbacks are going to continue find buyers underneath near the 10,000 level.

The 10,000 level of course has had a psychological impact on the market, but at this point it is obvious that we should see a lot of noise back and forth in this general vicinity. If we were to break down below the 10,000 level, then it is likely that the 9500 level is essentially your “floor” in the market. I would be a bit surprised to see if we break down towards that level, but I would anticipate that the 50 day EMA would come into play as well. With that, I like the idea of picking up value when we get the opportunity, and therefore I think that short-term traders jump in on pullbacks as we grind our way towards the 10,500 level.

After that, we could go looking towards the 11,000 level, which of course is a large, round, psychologically significant figure but quite frankly with the Federal Reserve willing to jump in and protect Wall Street, it is difficult to imagine a scenario where we break down significantly. If we do get some type of meltdown, buyers will come right back to pick up value. The overall trajectory is a nice 45° angle, and that is the perfect uptrend. At this point, I think that it is only a matter of time before we get some reason to take out. Even if we do pull back, it is hard to imagine that people will be willing to jump into the market. The candlestick is positive but at the end of the day we did pull back slightly. That more than likely is going to be traders closing out for the session.