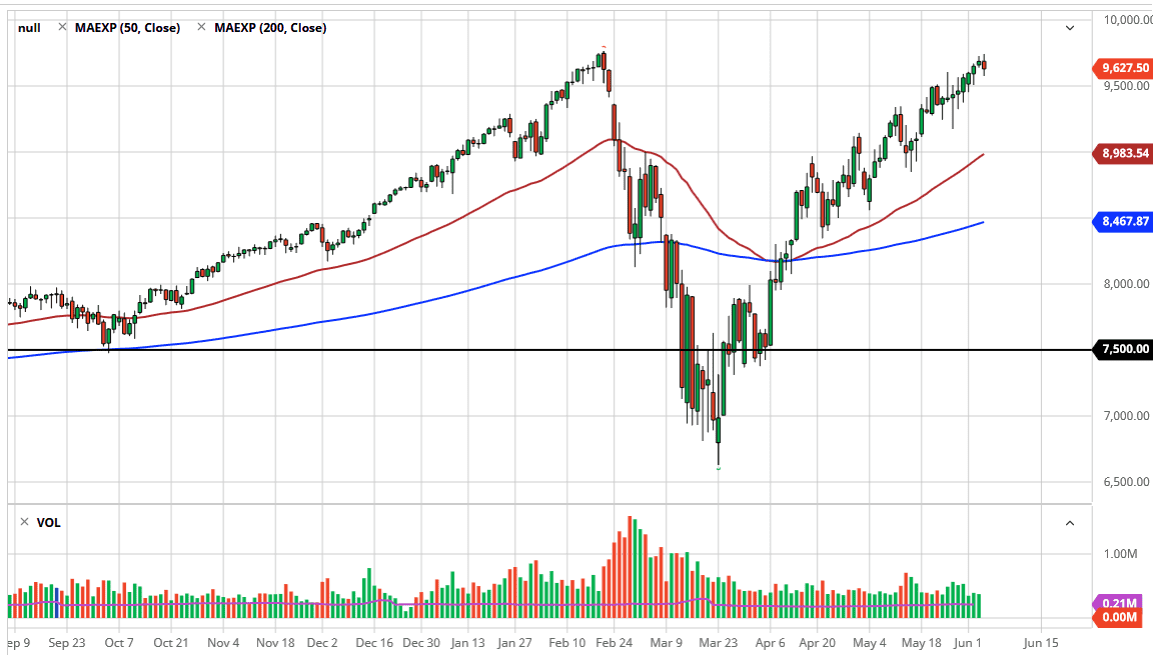

The NASDAQ 100 initially rally during the trading session on Thursday, as we have seen a lot of volatility and pushing to the upside. Keep in mind that the jobs number comes out during the day on Friday so that of course will have a major influence on how the market behaves but it is a “buy stocks at all cost” type of market right now, so I do think that the market is probably going to find buyers on pullbacks, and I do think that there might be a bit of a “knee-jerk reaction” to the jobs figure which is very likely to be horrific.

At this point in time, the market is likely to see an attempt to reach towards the 10,000 level, and the fact that we have chopped back and forth to the upside suggests that we are simply continuing to push and push and push until something changes. We are seeing a slow grind higher and there is likely to continue to be more of that going forward, although the jobs number will clearly throw a lot of volatility into the marketplace, we have seen the stock traders out there completely ignore bad economic numbers before, so it is hard to believe that they are suddenly going to change everything now. In fact, I would wager to say that it is likely that the market pulling back will be looked at as an opportunity to pick up the NASDAQ 100 “on the cheap.” After all, this is a market that is heavily influenced by five stocks that make up roughly 40% of the weighting.

To the downside, I think the 9500 level offers a lot of support, and then after that it is likely that we will go to the 9250 level. Below there, then we have the 9000 level which will be supported by the 50 day EMA. All things being equal, until the market starts to focus on the economic reality of the world, this is a market that will not be able to fall for a significant amount of time. The liquidity that the Federal Reserve is pushing out there is forcing markets higher, as they have done several times before. This does not mean we will not fall Monday, quite frankly we will probably break down rather significantly with some type of regularity. This is how the market has behaved over the last 20 years or so, and I think it is going to become the norm now.