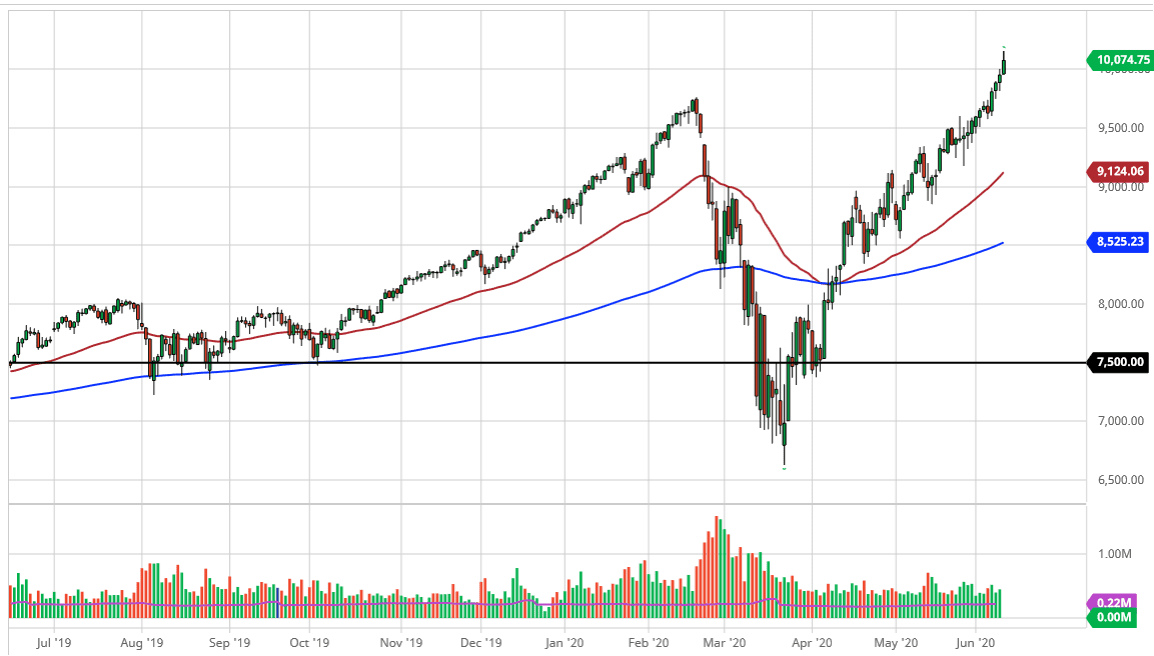

The NASDAQ 100 has rallied again during the trading session on Wednesday, as we have sliced through the 10,000 level. Ultimately, this was partially in reaction to the Federal Reserve meeting, and of course statement afterwards. It appears that the Federal Reserve is willing to continue stepping on the gas when it comes to the policy, meaning that they are more than willing to support the market. This has money flowing into the “big five” at the top of the food chain when it comes to the NASDAQ 100. If we are going to continue to see this, I believe that the NASDAQ 100 is going to outperform other indices such as the S&P 500.

The 10,000 level is of course psychologically important, so I would anticipate that it could offer a bit of support but at the very least I think this market needs to pull back a bit. The fact that we gave back some of the gains late in the session even though the Federal Reserve Chairman had suggested that he was willing to acquiesce to Wall Street tells you that perhaps things have gotten a little ahead of themselves. Economic reality and of course simple gravity eventually comes into play, and the further this market spikes to the upside, the more likely the pullback is going to be sudden and severe.

I believe there is a significant amount of support down at the 9500 level as well, and I am currently thinking of that as the “floor” in the market. If we were to break down below 9500 it will be an extraordinary sign of weakness, but I think that going through the 10,000 level is probably less of a challenge. The further we move to the upside from here, the more likely it is that a lot of traders get hurt. Markets do not behave like this forever, and the return is almost always vicious. The NASDAQ 100 is extraordinarily overbought at this point so I would be cautious about buying here. As far as buying after a short-term pullback, that is an entirely different conversation to be had. All things being equal though, I would need to see a shift from a fundamental standpoint in order to start selling this market. I do not have that yet, so at this point you have to be thinking more or less as a value trader than anything else. You are looking for cheaper pricing.