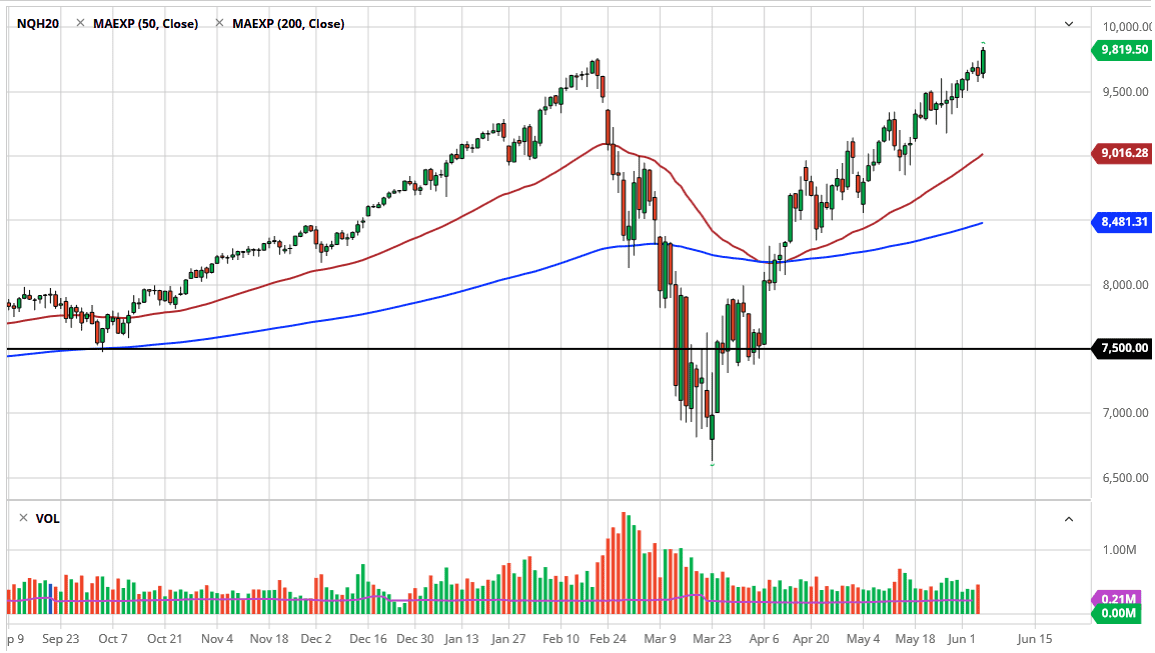

The NASDAQ 100 has rallied significantly during the training session on Friday after the job numbers came out much stronger than anticipated. By adding 2 million jobs instead of losing 7 million as anticipated, this shows that people are more likely going to find a risk appetite yet again. Ultimately, this is a market that I think continues to see an explosive move, and now that we have cleared the top of the market, it is likely that we continue to see buyers try to push this market towards the 10,000 level.

The 10,000 level, of course, has a certain amount of psychological resistance built into it, so it also could cause some issues. Regardless, this is a market that will look at that as a potential magnet as well.

Remember, the NASDAQ 100 is highly levered to just a handful of major technology companies, so that causes a major issue.

The fact is that the NASDAQ 100 can rally quite nicely without having much reality behind it other than the fact that people continue to chase markets. At this point, if we can break above the top of the candlestick, then it is likely that we continue to move towards the 10,000 level and break above.

Pullbacks at this point could send this market back down towards the 9500 level where I would anticipate seeing certain amount of buying based upon the psychology with that round figure in the fact that it had been resistance previously. Longer-term, the best way to look at this market is in an uptrend, which means that one should look at short-term pullbacks as potential buying opportunity.

I have no interest in trying to sell this market because, quite frankly, it has gone straight up in the air. The stock market is a bit of a bubble at this point, but the NASDAQ 100 is far too strong to start shorting anytime soon. Now that we have cleared to make an all-time high yet again, it is likely that traders are starting to come back in and push this even higher. Volume is not exactly that strong, but at this point, price continues to rise and that is really the only thing that you can pay attention to. This is a grind it to the upside so a certain amount of patience is needed.