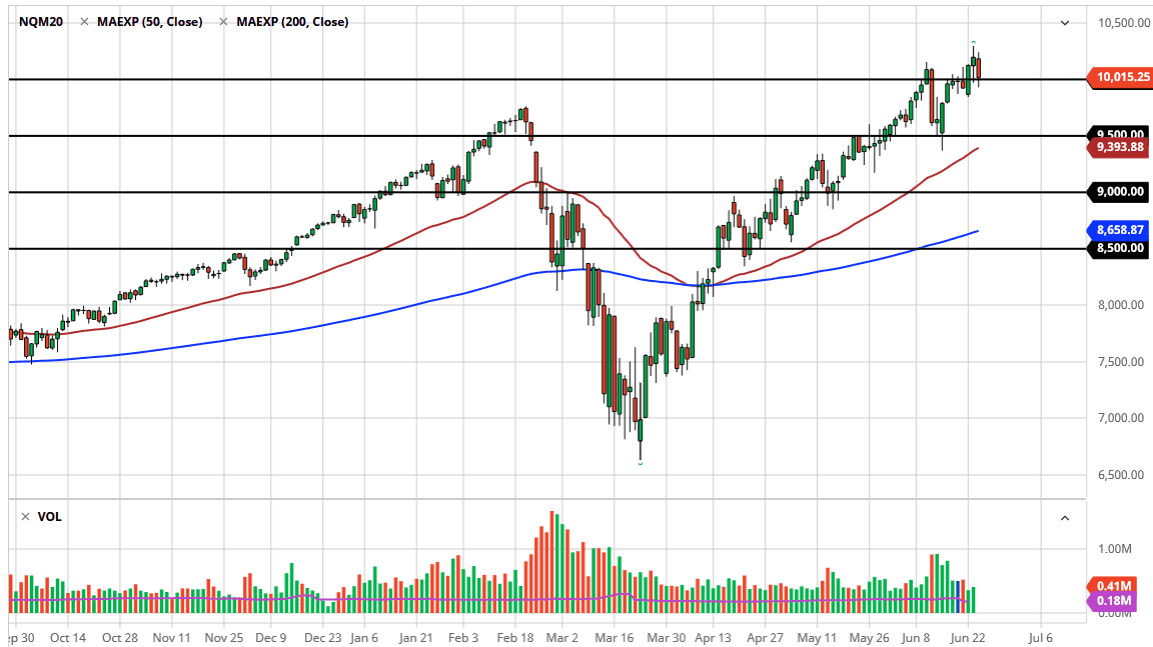

The NASDAQ 100 formed a negative candlestick during the day, piercing the 10,000 level but did break back above it. I think there are plenty of buyers in this area and as long as the major stocks that push the NASDAQ 100 higher, then we will continue to make all-time highs again. The major players are Amazon, Facebook, Microsoft, Tesla, Alphabet, Apple, and of course Netflix. At this point, expect those stocks to do fairly well, and if that does end up being the case, it is likely that we continue to see the NASDAQ 100 go looking towards the 10,500 level.

If you take a look at the chart, you can see that the market has been trading in a bit of a channel, and we are close to the top of it, so it makes sense that a little bit of a pullback. I do not think we break down below the 9500 level though, and that would be interested in buying the NASDAQ 100 near that level. Not only is 9500 important due to its previous support level, and of course the 50 day EMA reaching towards that area. At this point, I think that the market will reach towards the 10,000 level above.

All things being equal, I do not think that the market is going to suddenly fall apart, but I think a pullback might be something that people look forward to, because it gives the buyers an opportunity to pick up a little bit of value. After all, the NASDAQ 100 has led the way for some time, and I do not see that changing anytime soon. If we were to break down below the 50 day EMA, then we could go looking towards 9250 level, and then eventually the 9000 level. I do not expect to see that happen, but it would be a 10% pullback, something that a lot of the larger traders will use as an entry point a pullback in what has been an uptrend by just about any measure you use. Things are getting volatile, so keep your position size small and use micro contracts if you can via futures or use a small CFD position. Ultimately, this is a market that cannot be taken lightly but clearly there is more momentum to the upside than down over the longer term.